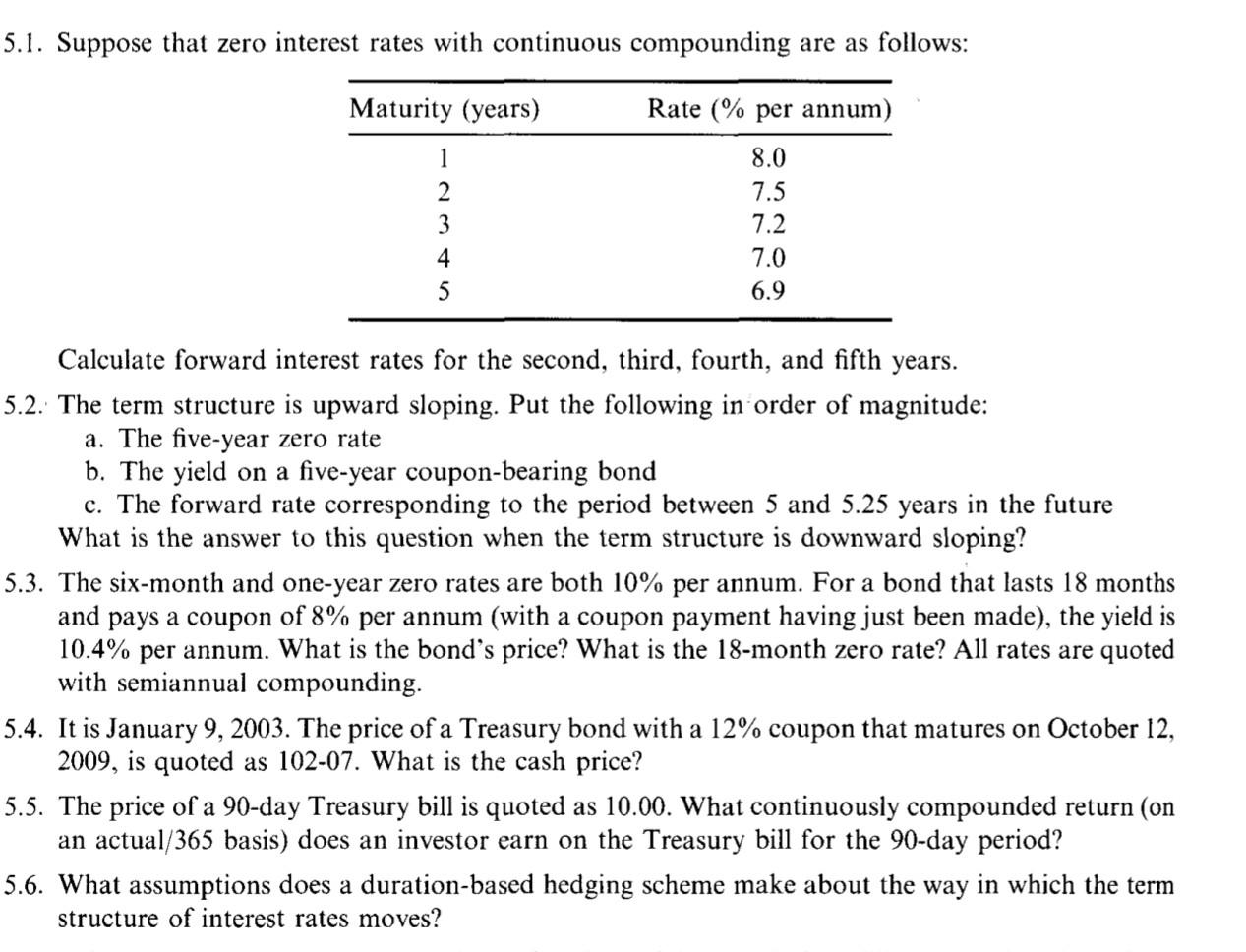

Question: 5.1. Suppose that zero interest rates with continuous compounding are as follows: Maturity (years) Rate (% per annum) 1 2 3 4 5 8.0 7.5

5.1. Suppose that zero interest rates with continuous compounding are as follows: Maturity (years) Rate (% per annum) 1 2 3 4 5 8.0 7.5 7.2 7.0 6.9 Calculate forward interest rates for the second, third, fourth, and fifth years. 5.2. The term structure is upward sloping. Put the following in order of magnitude: a. The five-year zero rate b. The yield on a five-year coupon-bearing bond c. The forward rate corresponding to the period between 5 and 5.25 years in the future What is the answer to this question when the term structure is downward sloping? 5.3. The six-month and one-year zero rates are both 10% per annum. For a bond that lasts 18 months and pays a coupon of 8% per annum (with a coupon payment having just been made), the yield is 10.4% per annum. What is the bond's price? What is the 18-month zero rate? All rates are quoted with semiannual compounding. 5.4. It is January 9, 2003. The price of a Treasury bond with a 12% coupon that matures on October 12, 2009, is quoted as 102-07. What is the cash price? 5.5. The price of a 90-day Treasury bill is quoted as 10.00. What continuously compounded return (on an actual/365 basis) does an investor earn on the Treasury bill for the 90-day period? 5.6. What assumptions does a duration-based hedging scheme make about the way in which the term structure of interest rates moves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts