Question: 52%. 10:56 PM Chapter 22, Problem 2P Bookmark Show all steps ON Problem Joel Franklin is a portfolio manager responsible for derivatives. Franklin observes an

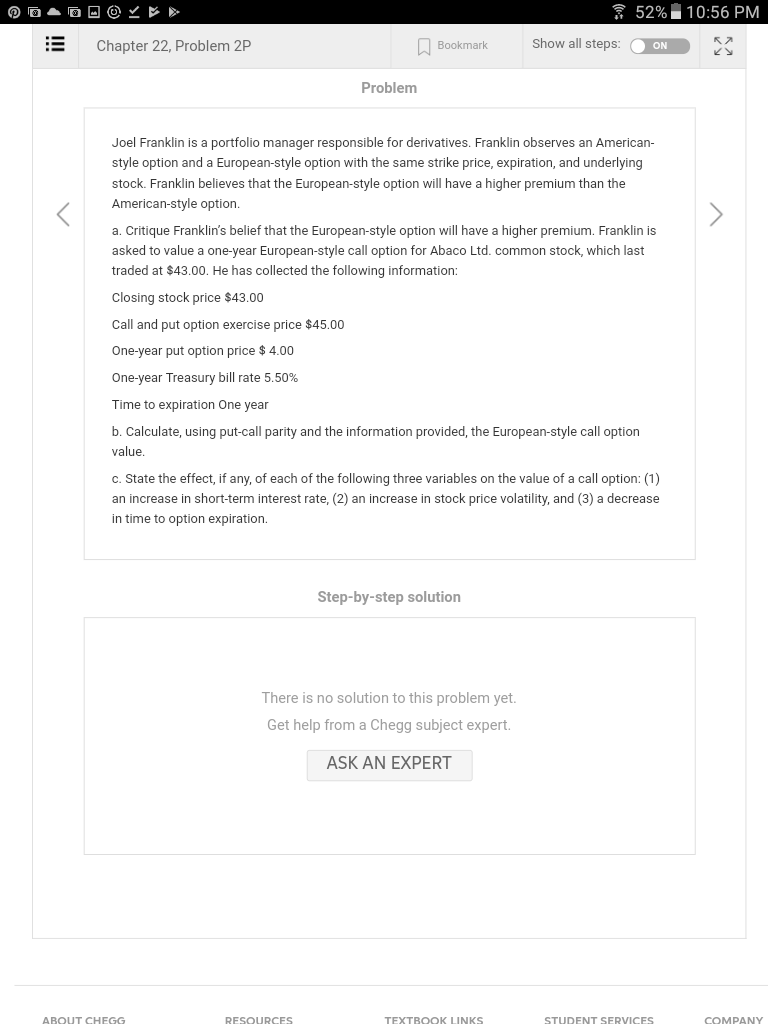

52%. 10:56 PM Chapter 22, Problem 2P Bookmark Show all steps ON Problem Joel Franklin is a portfolio manager responsible for derivatives. Franklin observes an American- style option and a European-style option with the same strike price, expiration, and underlying stock. Franklin believes that the European-style option will have a higher premium than the American-style option a. Critique Franklin's belief that the European-style option will have a higher premium. Franklin is asked to value a one-year European-style call option for Abaco Ltd. common stock, which last traded at $43.00. He has collected the following information: Closing stock price $43.00 all and put option exercise price $45.00 One-year put option price $ 4.00 One-year Treasury bill rate 5.50% Time to expiration One year b. Calculate, using put-call parity and the information provided, the European-style call option value c. State the effect, if any, of each of the following three variables on the value of a call option: (1) an increase in short-term interest rate, (2) an increase in stock price volatility, and (3) a decrease in time to option expiration. Step-by-step solution There is no solution to this problem yet. Get help from a Chegg subject expert. ASK AN EXPERT ABOUT CHEGG RESOURCES TEXTBOOK LINKS STUDENT SERVICES COMPANY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts