Question: 52. Under the completed-contract method 3. Tevenue, cost, and gross profit are recognized in the production cycle. b. revenue and cost are recognized during the

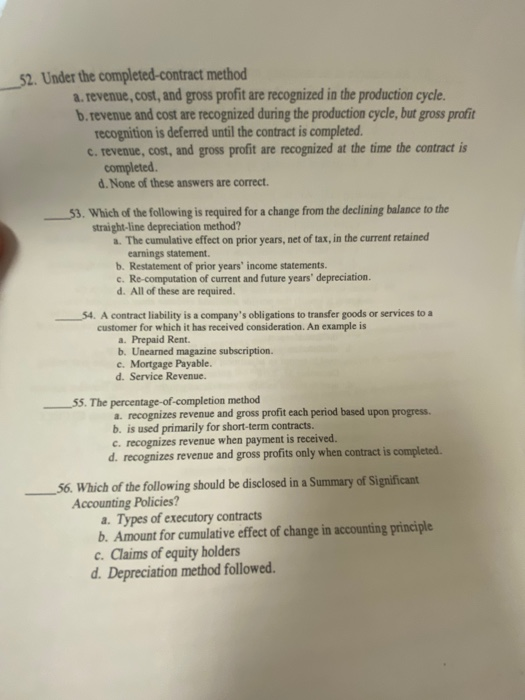

52. Under the completed-contract method 3. Tevenue, cost, and gross profit are recognized in the production cycle. b. revenue and cost are recognized during the production cycle, but gross profit Tecognition is deferred until the contract is completed. c. revenue, cost, and gross profit are recognized at the time the contract is completed. d. None of these answers are correct. 53. Which of the following is required for a change from the declining balance to the straight-line depreciation method? . The cumulative effect on prior years, net of tax, in the current retained earnings statement. b. Restatement of prior years' income statements. c. Re-computation of current and future years' depreciation. d. All of these are required. 54. A contract liability is a company's obligations to transfer goods or services to a customer for which it has received consideration. An example is a. Prepaid Rent. b. Unearned magazine subscription. c. Mortgage Payable. d. Service Revenue. 55. The percentage-of-completion method a. recognizes revenue and gross profit each period based upon progress b. is used primarily for short-term contracts. C. recognizes revenue when payment is received. d. recognizes revenue and gross profits only when contract is completed. 56. Which of the following should be disclosed in a Summary of Significant Accounting Policies? a. Types of executory contracts b. Amount for cumulative effect of change in accounting principle c. Claims of equity holders d. Depreciation method followed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts