Question: 5-39 with written work/ how to input into calculator if possible rsary yuw,UUU qui iegar expenses. ner doctor testified that she has been unable to

5-39 with written work/ how to input into calculator if possible

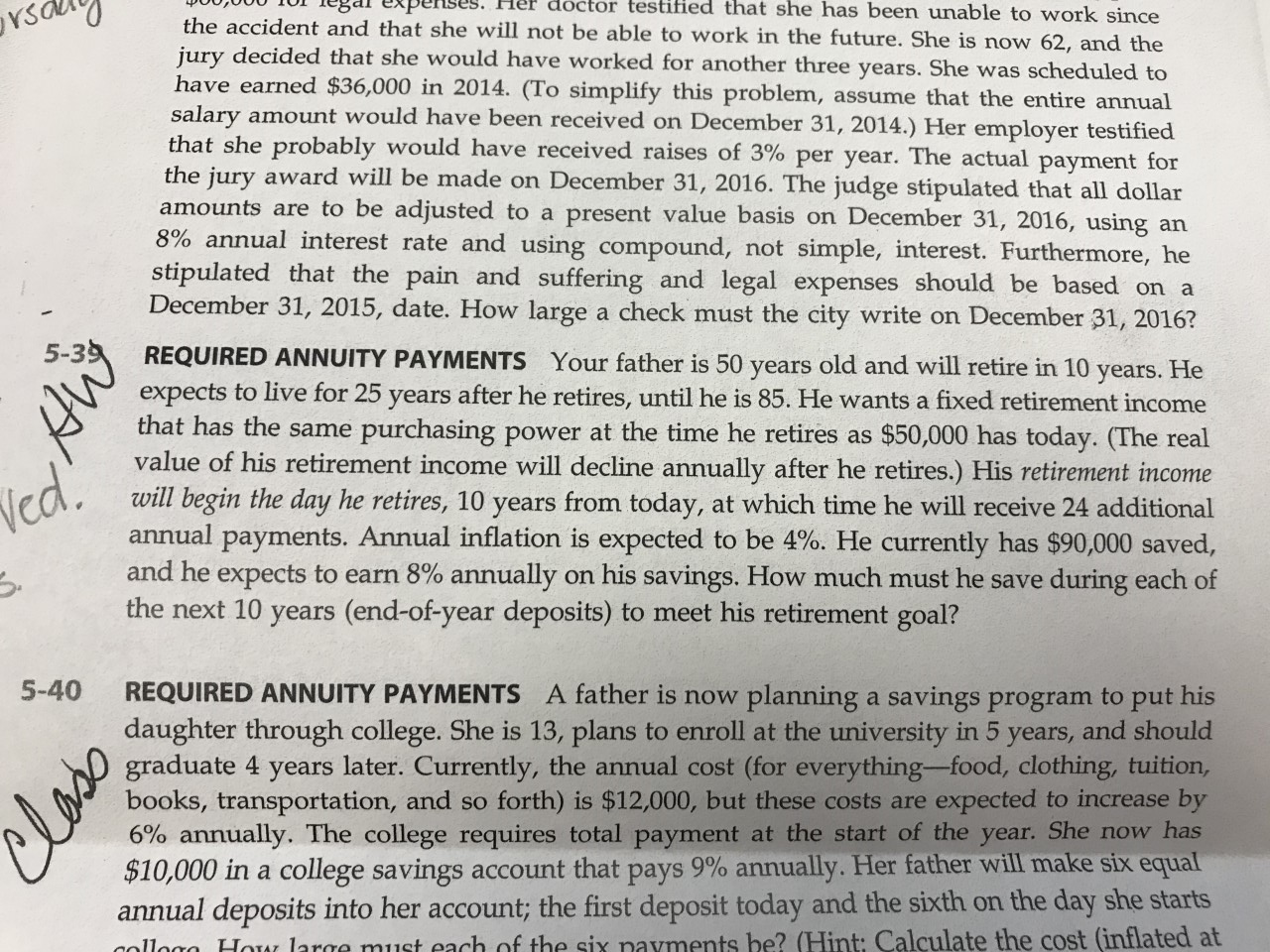

rsary yuw,UUU qui iegar expenses. ner doctor testified that she has been unable to work since the accident and that she will not be able to work in the future. She is now 62, and the jury decided that she would have worked for another three years. She was scheduled to have earned $36,000 in 2014. (To simplify this problem, assume that the entire annual salary amount would have been received on December 31, 2014.) Her employer testified that she probably would have received raises of 3% per year. The actual payment for the jury award will be made on December 31, 2016. The judge stipulated that all dollar amounts are to be adjusted to a present value basis on December 31, 2016, using an 8% annual interest rate and using compound, not simple, interest. Furthermore, he stipulated that the pain and suffering and legal expenses should be based on a December 31, 2015, date. How large a check must the city write on December 31, 2016? REQUIRED ANNUITY PAYMENTS Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $50,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 4%. He currently has $90,000 saved, and he expects to earn 8% annually on his savings. How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goal? 5-39 5-40 REQUIRED ANNUITY PAYMENTS A father is now planning a savings program to put his daughter through college. She is 13, plans to enroll at the university in 5 years, and should graduate 4 years later. Currently, the annual cost (for everything-food, clothing, tuition, books, transportation, and so forth) is $12,000, but these costs are expected to increase by 6% annually. The college requires total payment at the start of the year. She now has $10,000 in a college savings account that pays 9% annually. Her father will make six equal annual deposits into her account; the first deposit today and the sixth on the day she starts Toulonna muct each of the six payments be? (Hint: Calculate the cost (inflated at 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts