Question: 54:04 Question 7 > As explained in the Help section for the Workforce Compensation, Training, and Product Assembly decision screen, if (1) a company pays

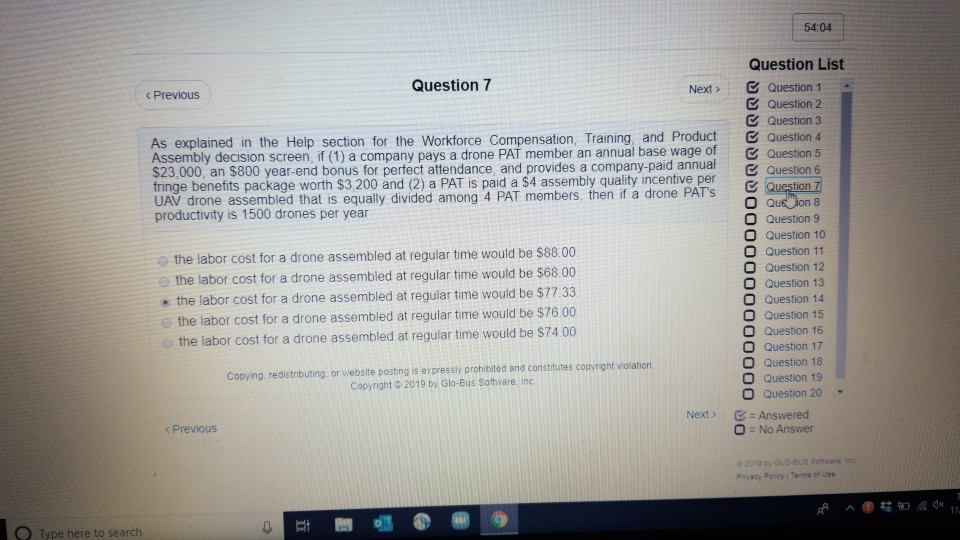

54:04 Question 7 > As explained in the Help section for the Workforce Compensation, Training, and Product Assembly decision screen, if (1) a company pays a drone PAT member an annual base wage of $23,000, an $800 year-end bonus for perfect attendance and provides a company-paid annual fringe benefits package worth $3,200 and (2) a PAT is paid a $4 assembly quality incentive per UAV drone assembled that is equally divided among 4 PAT members, then if a drone PAT'S productivity is 1500 drones per year the labor cost for a drone assembled at regular time would be $88.00 the labor cost for a drone assembled at regular time would be $68.00 the labor cost for a drone assembled at regular time would be $7733 the labor cost for a drone assembled at regular time would be $76.00 the labor cost for a drone assembled at regular time would be $74.00 Question List C Question 1 Question 2 Question 3 e Question 4 Question 5 Question 6 Question 7 O QUEion 8 O Question 9 O Question 10 O Question 11 Question 12 0 Question 13 O Question 14 O Question 15 0 Question 16 O Question 17 O Question 18 O Question 19 O Question 20 E = Answered O No Answer UUU80000000000000 Copying, redistributing or website posting is expressly prohibited and constitutes copyright violation Copyright 2019 by Glo-Bus Software Inc Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts