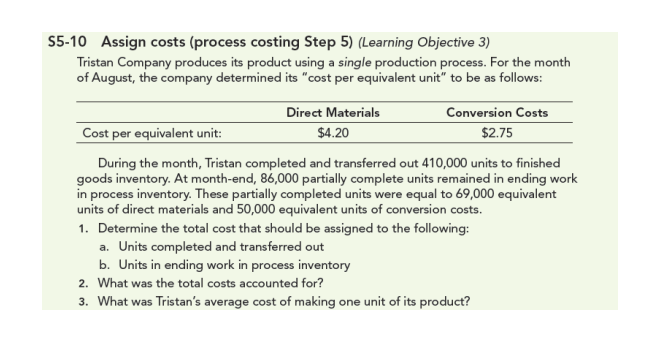

Question: 55-10 Assign costs (process costing Step 5) (Learning Objective 3) Tristan Company produces its product using a single production process. For the month of August,

55-10 Assign costs (process costing Step 5) (Learning Objective 3) Tristan Company produces its product using a single production process. For the month of August, the company determined its "cost per equivalent unit" to be as follows: Direct Materials Conversion Costs Cost per equivalent unit: $4.20 $2.75 During the month, Tristan completed and transferred out 410,000 units to finished goods inventory. At month-end, 86,000 partially complete units remained in ending work in process inventory. These partially completed units were equal to 69,000 equivalent units of direct materials and 50,000 equivalent units of conversion costs. 1. Determine the total cost that should be assigned to the following: a. Units completed and transferred out b. Units in ending work in process inventory 2. What was the total costs accounted for? 3. What was Tristan's average cost of making one unit of its product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts