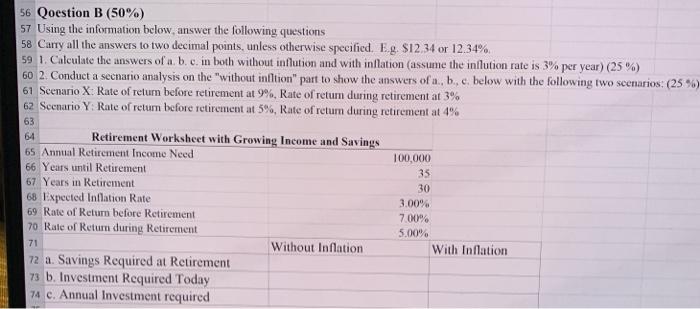

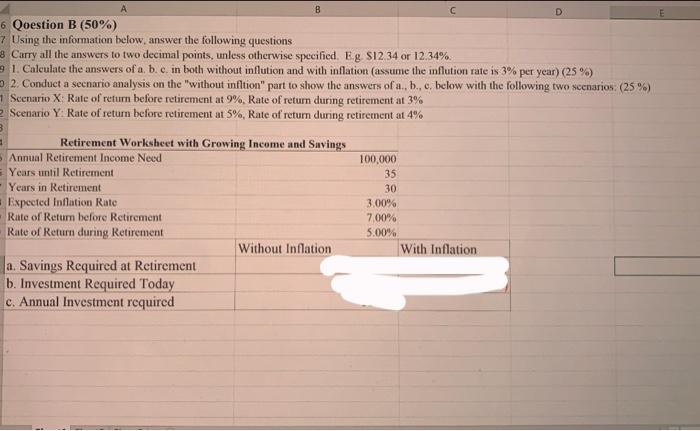

Question: 56 Qoestion B (50%) 57 Using the information below, answer the following questions 58 Carry all the answers to two decimal points, unless otherwise specified.

56 Qoestion B (50%) 57 Using the information below, answer the following questions 58 Carry all the answers to two decimal points, unless otherwise specified. Eg. $12.34 or 12.34% 59 1. Calculate the answers of a b. c. in both without inflation and with inflation (assume the inflution rate is 3% per year) (25 %) 60 2. Conduct a secnario analysis on the "Without inition" part to show the answers of a, b, c, below with the following two scenarios: (25%) 61 Scenario X: Rate of return before retirement at 9%, Rate of return during retirement at 3% 62 Scenario Y Rate of return before retirement at 5%, Rate of return during retirement at 4% 63 64 Retirement Worksheet with Growing Income and Savings 65 Annual Retirement Income Need 100,000 66 Years until Retirement 35 67 Years in Retirement 30 68 Expected Inflation Rate 3.00% 69 Rate of Return before Retirement 7.00% 70 Rate of Return during Retirement 5.00% Without Inflation With Inflation 72 a. Savings Required at Retirement 73 b. Investment Required Today 74 c. Annual Investment required 71 D 6 Qoestion B (50%) 7 Using the information below, answer the following questions 3 Carry all the answers to two decimal points, unless otherwise specified. Eg S12 34 or 12.34%. 1. Calculate the answers of a b. c. in both without inflution and with inflation (assume the inflution rate is 3% per year) (25%) 2. Conduct a secnario analysis on the "without infltion" part to show the answers of a., b., o below with the following two scenarios: (25%) Scenario X Rate of return before retirement at 9%, Rate of return during retirement at 3% Scenario Y Rate of return before retirement at 5%, Rate of return during retirement at % Retirement Worksheet with Growing Income and Savings Annual Retirement Income Need Years until Retirement Years in Retirement Expected Inflation Rate Rute of Return before Retirement Rate of Return during Retirement Without Inflation a. Savings Required at Retirement b. Investment Required Today c. Annual Investment required 100,000 35 30 3.00% 7.00% 5.00% With Inflation 56 Qoestion B (50%) 57 Using the information below, answer the following questions 58 Carry all the answers to two decimal points, unless otherwise specified. Eg. $12.34 or 12.34% 59 1. Calculate the answers of a b. c. in both without inflation and with inflation (assume the inflution rate is 3% per year) (25 %) 60 2. Conduct a secnario analysis on the "Without inition" part to show the answers of a, b, c, below with the following two scenarios: (25%) 61 Scenario X: Rate of return before retirement at 9%, Rate of return during retirement at 3% 62 Scenario Y Rate of return before retirement at 5%, Rate of return during retirement at 4% 63 64 Retirement Worksheet with Growing Income and Savings 65 Annual Retirement Income Need 100,000 66 Years until Retirement 35 67 Years in Retirement 30 68 Expected Inflation Rate 3.00% 69 Rate of Return before Retirement 7.00% 70 Rate of Return during Retirement 5.00% Without Inflation With Inflation 72 a. Savings Required at Retirement 73 b. Investment Required Today 74 c. Annual Investment required 71 D 6 Qoestion B (50%) 7 Using the information below, answer the following questions 3 Carry all the answers to two decimal points, unless otherwise specified. Eg S12 34 or 12.34%. 1. Calculate the answers of a b. c. in both without inflution and with inflation (assume the inflution rate is 3% per year) (25%) 2. Conduct a secnario analysis on the "without infltion" part to show the answers of a., b., o below with the following two scenarios: (25%) Scenario X Rate of return before retirement at 9%, Rate of return during retirement at 3% Scenario Y Rate of return before retirement at 5%, Rate of return during retirement at % Retirement Worksheet with Growing Income and Savings Annual Retirement Income Need Years until Retirement Years in Retirement Expected Inflation Rate Rute of Return before Retirement Rate of Return during Retirement Without Inflation a. Savings Required at Retirement b. Investment Required Today c. Annual Investment required 100,000 35 30 3.00% 7.00% 5.00% With Inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts