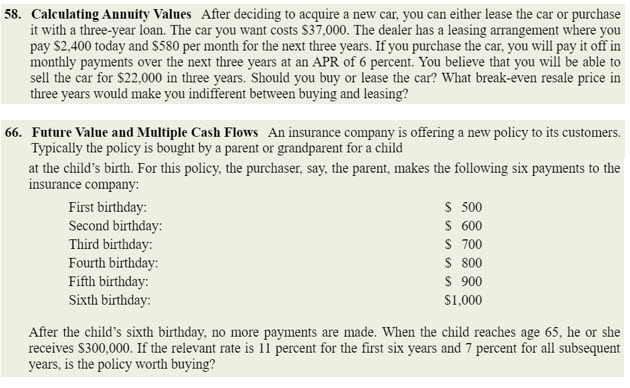

Question: 58. Calculating Annuity Values After deciding to acquire a new car, you can either lease the car or purchase it with a three-year loan. The

58. Calculating Annuity Values After deciding to acquire a new car, you can either lease the car or purchase it with a three-year loan. The car you want costs $37,000. The dealer has a leasing arrangement where you pay $2,400 today and S580 per month for the next three years. If you purchase the car, you will pay it off in monthly payments over the next three years at an APR of 6 percent. You believe that you will be able to sell the car for $22,000 in three years. Should you buy or lease the car? What break-even resale price in three years would make you indifferent between buying and leasing? 66. Future Value and Multiple Cash Flows An insurance company is offering a new policy to its customers. Typically the policy is bought by a parent or grandparent for a child at the child's birth. For this policy, the purchaser, say, the parent, makes the following six payments to the insurance company: First birthday: S 500 Second birthday: S 600 Third birthday: S 700 Fourth birthday: $ 800 Fifth birthday: S 900 Sixth birthday: $1,000 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $300,000. If the relevant rate is 11 percent for the first six years and 7 percent for all subsequent years, is the policy worth buying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts