Question: 5-You perform a Monte Carlo simulation to estimate the VAR for a $10 million portfolio. You choose to perform this simulation using a normal distribution

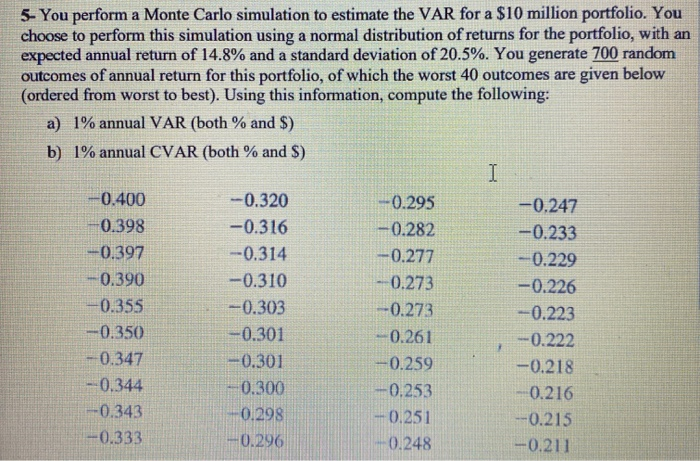

5-You perform a Monte Carlo simulation to estimate the VAR for a $10 million portfolio. You choose to perform this simulation using a normal distribution of returns for the portfolio, with an expected annual return of 14.8% and a standard deviation of 20.5%. You generate 700 random outcomes of annual return for this portfolio, of which the worst 40 outcomes are given below (ordered from worst to best). Using this information, compute the following: a) 1% annual VAR (both % and $) b) 1% annual CVAR (both % and S) I 0.400 0.398 -0.397 0.390 -0.355 -0.350 0.347 -0.344 -0.343 --0.333 -0.320 -0.316 --0.314 -0.310 -0.303 -0.301 -0.301 0.300 0.298 -0.296 0.295 -0.282 -0.277 0.273 ---0.273 0.261 -0.259 -0.253 +0.251 0.248 -0.247 -0.233 -0.229 -0.226 -0.223 -0.222 -0.218 0.216 --0.215 -0.211

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts