Question: How do I use the Monte Carlo simulation to estimate the probability that the final withdraw will be less than half of what you would

How do I use the Monte Carlo simulation to estimate the probability that the final withdraw will be less than half of what you would like to withdraw using different withdraw limits?

How do I use the Monte Carlo simulation to estimate the probability that the final withdraw will be less than half of what you would like to withdraw using different withdraw limits?

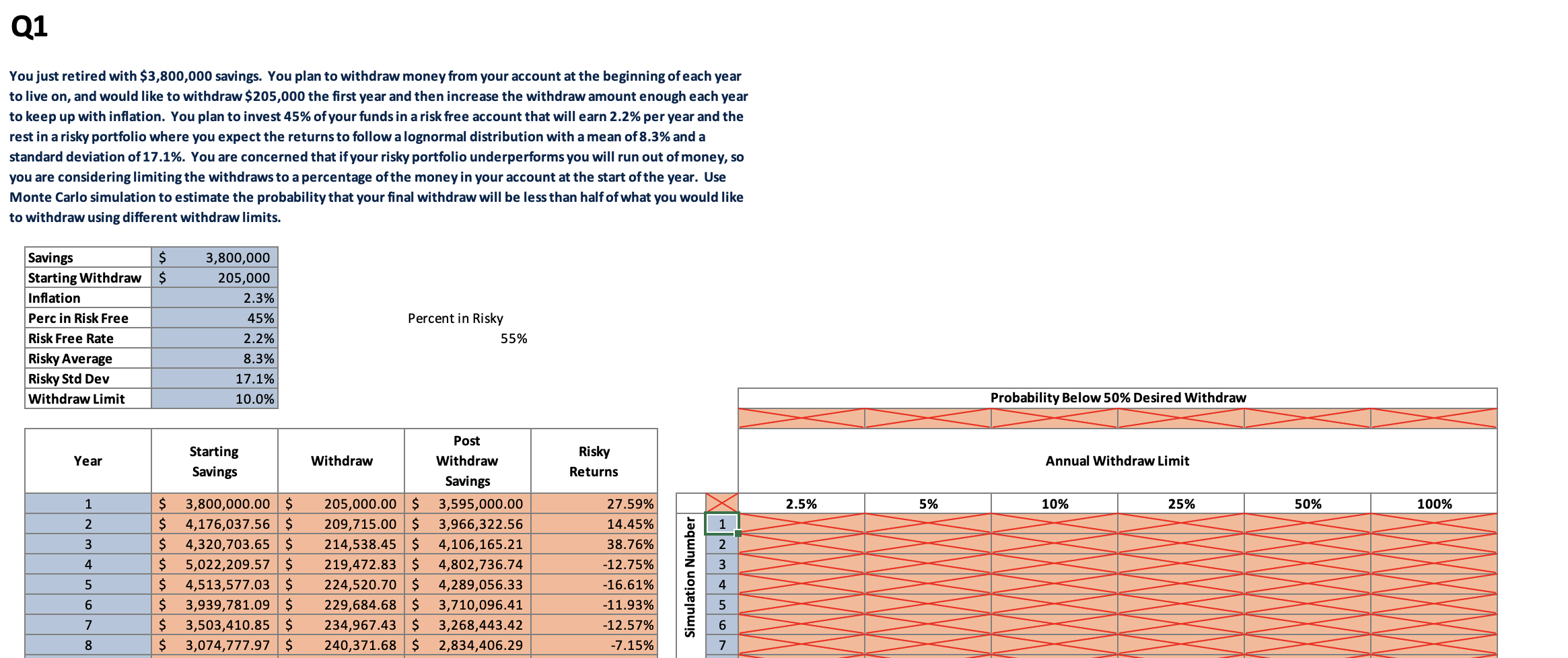

Q1 You just retired with $3,800,000 savings. You plan to withdraw money from your account at the beginning of each year to live on, and would like to withdraw $ 205,000 the first year and then increase the withdraw amount enough each year to keep up with inflation. You plan to invest 45% of your funds in a risk free account that will earn 2.2% per year and the rest in a risky portfolio where you expect the returns to follow a lognormal distribution with a mean of 8.3% and a standard deviation of 17.1%. You are concerned that if your risky portfolio underperforms you will run out of money, so you are considering limiting the withdraws to a percentage of the money in your account at the start of the year. Use Monte Carlo simulation to estimate the probability that your final withdraw will be less than half of what you would like to withdraw using different withdraw limits. Savings $ 3,800,000 205,000 Starting Withdraw $ Inflation 2.3% Perc in Risk Free 45% Percent in Risky Risk Free Rate 2.2% 55% Risky Average 8.3% Risky Std Dev 17.1% Withdraw Limit 10.0% Year Starting Savings Withdraw 2.5% $ 3,800,000.00 $ 205,000.00 $ $ 4,176,037.56 $ $ 4,320,703.65 $ $ 5,022,209.57 $ $ 4,513,577.03 $ Post Withdraw Savings 3,595,000.00 209,715.00 $ 3,966,322.56 214,538.45 $ 4,106,165.21 219,472.83 $ 4,802,736.74 224,520.70 $ 4,289,056.33 229,684.68 $ 3,710,096.41 234,967.43 $ 3,268,443.42 240,371.68 $ $ 3,939,781.09 $ 3,503,410.85 $ $ $ 3,074,777.97 $ 2,834,406.29 IN3 + 1 2 4 5 6 7 8 Risky Returns 27.59% 14.45% 38.76% -12.75% -16.61% -11.93% -12.57% -7.15% Simulation Number 1 ~35067 2 4 7 5% Probability Below 50% Desired Withdraw Annual Withdraw Limit 10% 25% 50% 100% Q1 You just retired with $3,800,000 savings. You plan to withdraw money from your account at the beginning of each year to live on, and would like to withdraw $ 205,000 the first year and then increase the withdraw amount enough each year to keep up with inflation. You plan to invest 45% of your funds in a risk free account that will earn 2.2% per year and the rest in a risky portfolio where you expect the returns to follow a lognormal distribution with a mean of 8.3% and a standard deviation of 17.1%. You are concerned that if your risky portfolio underperforms you will run out of money, so you are considering limiting the withdraws to a percentage of the money in your account at the start of the year. Use Monte Carlo simulation to estimate the probability that your final withdraw will be less than half of what you would like to withdraw using different withdraw limits. Savings $ 3,800,000 205,000 Starting Withdraw $ Inflation 2.3% Perc in Risk Free 45% Percent in Risky Risk Free Rate 2.2% 55% Risky Average 8.3% Risky Std Dev 17.1% Withdraw Limit 10.0% Year Starting Savings Withdraw 2.5% $ 3,800,000.00 $ 205,000.00 $ $ 4,176,037.56 $ $ 4,320,703.65 $ $ 5,022,209.57 $ $ 4,513,577.03 $ Post Withdraw Savings 3,595,000.00 209,715.00 $ 3,966,322.56 214,538.45 $ 4,106,165.21 219,472.83 $ 4,802,736.74 224,520.70 $ 4,289,056.33 229,684.68 $ 3,710,096.41 234,967.43 $ 3,268,443.42 240,371.68 $ $ 3,939,781.09 $ 3,503,410.85 $ $ $ 3,074,777.97 $ 2,834,406.29 IN3 + 1 2 4 5 6 7 8 Risky Returns 27.59% 14.45% 38.76% -12.75% -16.61% -11.93% -12.57% -7.15% Simulation Number 1 ~35067 2 4 7 5% Probability Below 50% Desired Withdraw Annual Withdraw Limit 10% 25% 50% 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts