Question: 6 1 1 1 1. In class, we learned to evaluate whether a consumer with well-behaved preferences is better off from a lump sum tax

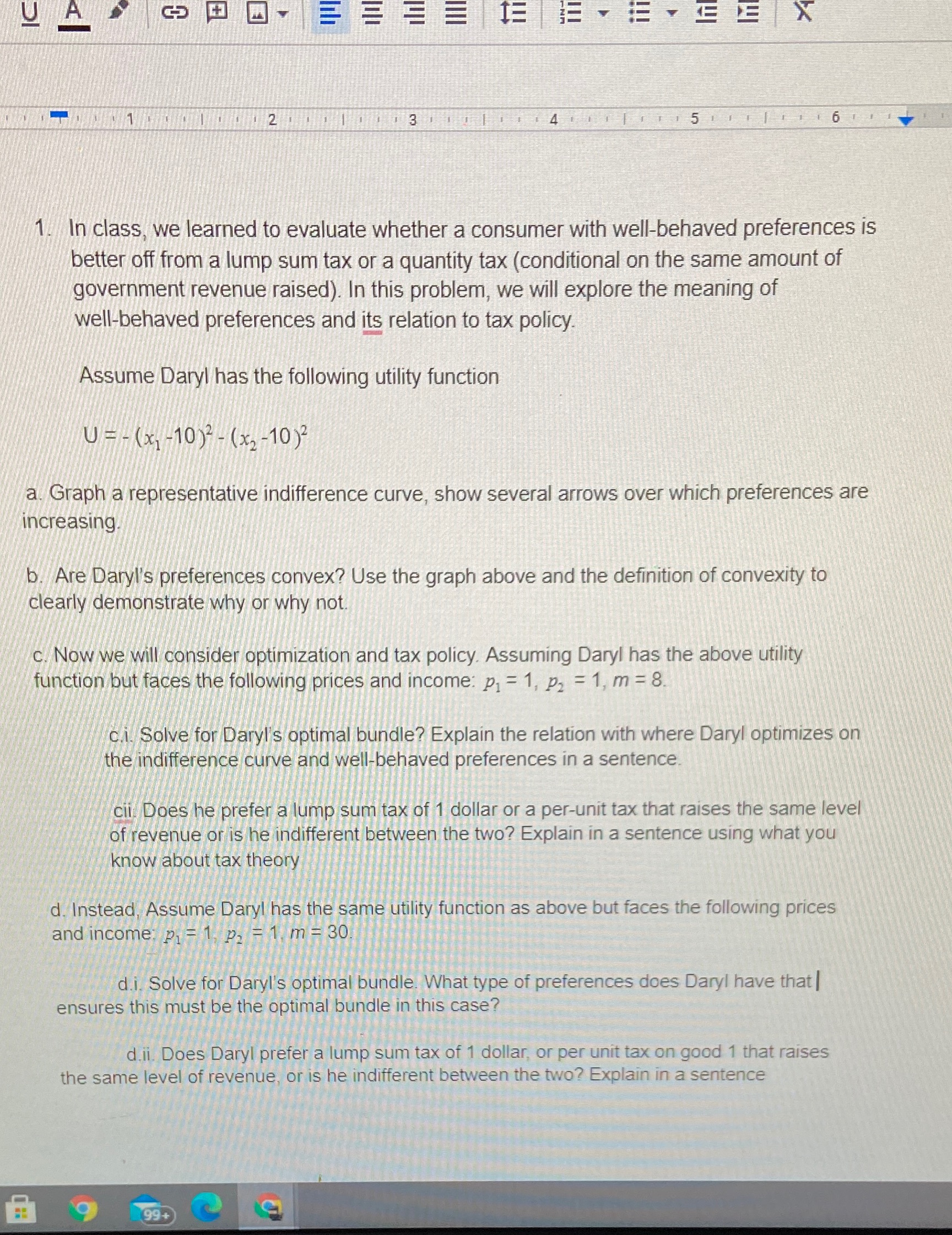

6 1 1 1 1. In class, we learned to evaluate whether a consumer with well-behaved preferences is better off from a lump sum tax or a quantity tax (conditional on the same amount of government revenue raised). In this problem, we will explore the meaning of well-behaved preferences and its relation to tax policy. Assume Daryl has the following utility function U = - (x, - 10)2 - (x2-10) a. Graph a representative indifference curve, show several arrows over which preferences are increasing b. Are Daryl's preferences convex? Use the graph above and the definition of convexity to clearly demonstrate why or why not. c. Now we will consider optimization and tax policy. Assuming Daryl has the above utility function but faces the following prices and income: p, = 1, p2 = 1, m = 8. c.i. Solve for Daryl's optimal bundle? Explain the relation with where Daryl optimizes on the indifference curve and well-behaved preferences in a sentence. cii Does he prefer a lump sum tax of 1 dollar or a per-unit tax that raises the same level of revenue or is he indifferent between the two? Explain in a sentence using what you know about tax theory d. Instead, Assume Daryl has the same utility function as above but faces the following prices and income: p1 = 1, p, = 1, m = 30. d.i. Solve for Daryl's optimal bundle. What type of preferences does Daryl have that | ensures this must be the optimal bundle in this case? d.ii. Does Daryl prefer a lump sum tax of 1 dollar, or per unit tax on good 1 that raises the same level of revenue, or is he indifferent between the two? Explain in a sentence 99+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts