Question: 6 . ( 1 2 points ) You are an investor in common stock and you currently hold a well - diversified portfolio that has

points

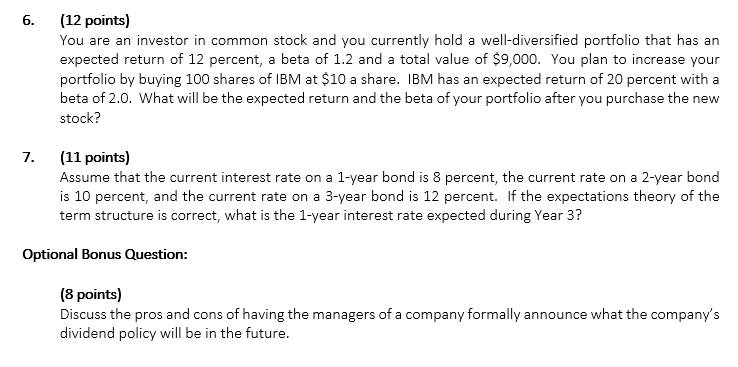

You are an investor in common stock and you currently hold a welldiversified portfolio that has an expected return of percent, a beta of and a total value of $ You plan to increase your portfolio by buying shares of IBM at $ a share. IBM has an expected return of percent with a beta of What will be the expected return and the beta of your portfolio after you purchase the new stock?

points

Assume that the current interest rate on a year bond is percent, the current rate on a year bond is percent, and the current rate on a year bond is percent. If the expectations theory of the term structure is correct, what is the year interest rate expected during Year

Optional Bonus Question:

points

Discuss the pros and cons of having the managers of a company formally announce what the company's dividend policy will be in the future.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock