Question: he following table shows the expected return (E(ri)), the standard deviation (si), the cor- relation with the market portfolio (ri,M), the market beta (bi), and

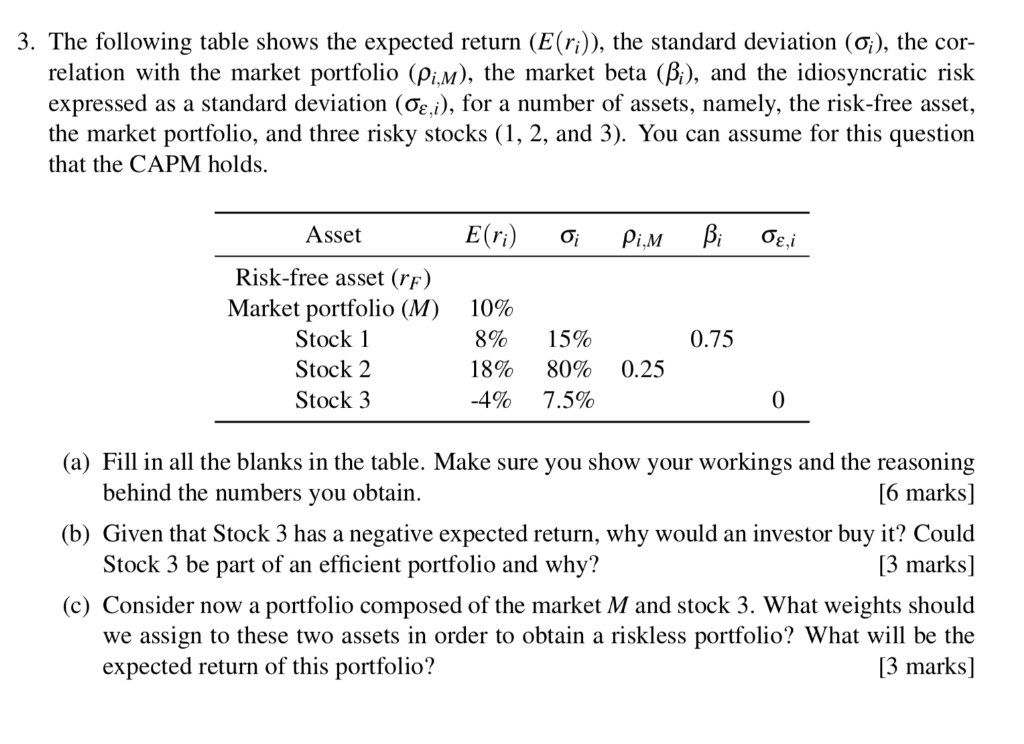

he following table shows the expected return (E(ri)), the standard deviation (si), the cor- relation with the market portfolio (ri,M), the market beta (bi), and the idiosyncratic risk expressed as a standard deviation (se,i), for a number of assets, namely, the risk-free asset, the market portfolio, and three risky stocks (1, 2, and 3). You can assume for this question that the CAPM holds.

| Asset | expected return | standard deviation | cor- relation with the market portfolio | market beta | idiosyncratic risk expressed as a standard deviation |

| Risk-free asset (rF ) | |||||

| Market portfolio (M) | 10% | ||||

| Stock 1 | 8% | 15% |

| 0.75 | |

| Stock 2 | 18% | 80% | 0.25 | ||

| Stock3 | -4% | 7.5% | 0 |

(a) Fill in all the blanks in the table. Make sure you show your workings and the reasoning behind the numbers you obtain. [6 marks]

(b) Given that Stock 3 has a negative expected return, why would an investor buy it? Could Stock 3 be part of an efficient portfolio and why? [3 marks]

(c) Consider now a portfolio composed of the market M and stock 3. What weights should we assign to these two assets in order to obtain a riskless portfolio? What will be the expected return of this portfolio? [3 marks]

3. The following table shows the expected return (E(ri)), the standard deviation (0;), the cor- relation with the market portfolio (Pi,m), the market beta (Pi), and the idiosyncratic risk expressed as a standard deviation (O,i), for a number of assets, namely, the risk-free asset, the market portfolio, and three risky stocks (1, 2, and 3). You can assume for this question that the CAPM holds. Asset E(ri) O; Pim Bi , Risk-free asset (rf) Market portfolio (M) Stock 1 Stock 2 Stock 3 0.75 10% 8% 18% -4% 15% 80% 7.5% 0.25 0 (a) Fill in all the blanks in the table. Make sure you show your workings and the reasoning behind the numbers you obtain. [6 marks] (b) Given that Stock 3 has a negative expected return, why would an investor buy it? Could Stock 3 be part of an efficient portfolio and why? [3 marks] (c) Consider now a portfolio composed of the market M and stock 3. What weights should we assign to these two assets in order to obtain a riskless portfolio? What will be the expected return of this portfolio? [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts