Question: 6 1. You are facing a choice between borrowing money under two loan structures. Structure 1 is a fixed rate, fully 7 amortizing, constant payment

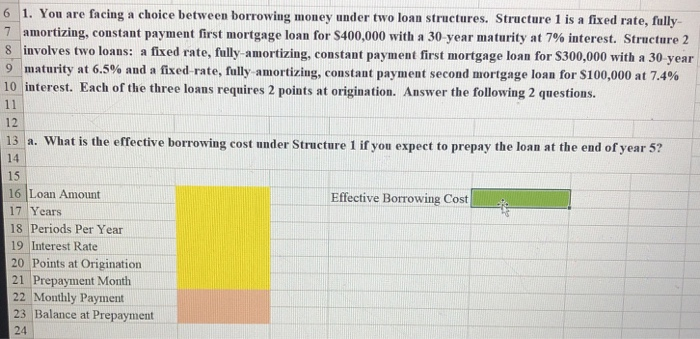

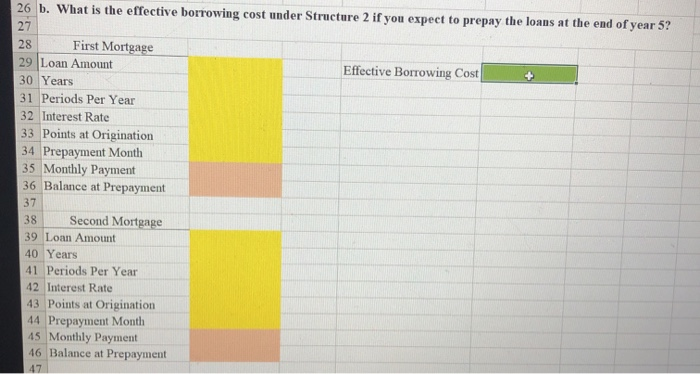

6 1. You are facing a choice between borrowing money under two loan structures. Structure 1 is a fixed rate, fully 7 amortizing, constant payment first mortgage loan for $400,000 with a 30-year maturity at 7% interest. Structure 2 8 involves two loans: a fixed rate, fully-amortizing, constant payment first mortgage loan for $300,000 with a 30 year 9 maturity at 6.5 % and a fixed-rate, fully-amortizing, constant payment second mortgage loan for $100,000 at 7.4 % 10 interest. Each of the three loans requires 2 points at origination. Answer the following 2 questions. 11 12 13 a. What is the effective borrowing cost under Structure 1 if you expect to prepay the loan at the end of year 5? 14 15 16 Loan Amount 17 Years Effective Borrowing Cost 18 Periods Per Year 19 Interest Rate 20 Points at Origination 21 Prepayment Month 22 Monthly Payment 23 Balance at Prepayment 24 26 b. What is the effective borrowing cost under Structure 2 if you expect to prepay the loans at the end of year 5? 27 First Mortgage 28 29 Loan Amount 30 Years 31 Periods Per Year 32 Interest Rate 33 Points at Origination 34 Prepayment Month 35 Monthly Payment 36 Balance at Prepayment Effective Borrowing Cost 37 Second Mortgage 38 39 Loan Amount 40 Years 41 Periods Per Year 42 Interest Rate 43 Points at Origination 44 Prepayment Month 45 Monthly Payment 46 Balance at Prepayment 47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts