Question: 6. (20 marks) (Stochastic Volatility Model) The Heston stochastic volatility model (Heston(1993)] for pricing options is given by ds S Erdt + Vodz(1) dv =

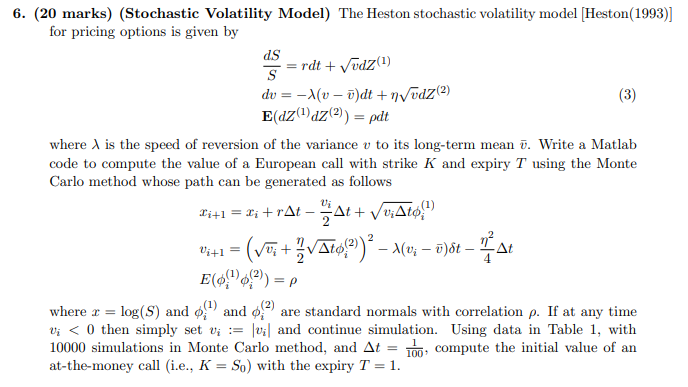

6. (20 marks) (Stochastic Volatility Model) The Heston stochastic volatility model (Heston(1993)] for pricing options is given by ds S Erdt + Vodz(1) dv = -1(v - )dt + Vodz(2) (3) Edz(1) az(2)) = pdt where X is the speed of reversion of the variance v to its long-term mean . Write a Matlab code to compute the value of a European call with strike K and expiry T using the Monte Carlo method whose path can be generated as follows l'i+1 = litrat At+ Vv;Ator (voi+vAtos?) ? 160x 5)8t - "LA E(69))) =P where x = log(S) and 6") and 6:42) are standard normals with correlation p. If at any time Vi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts