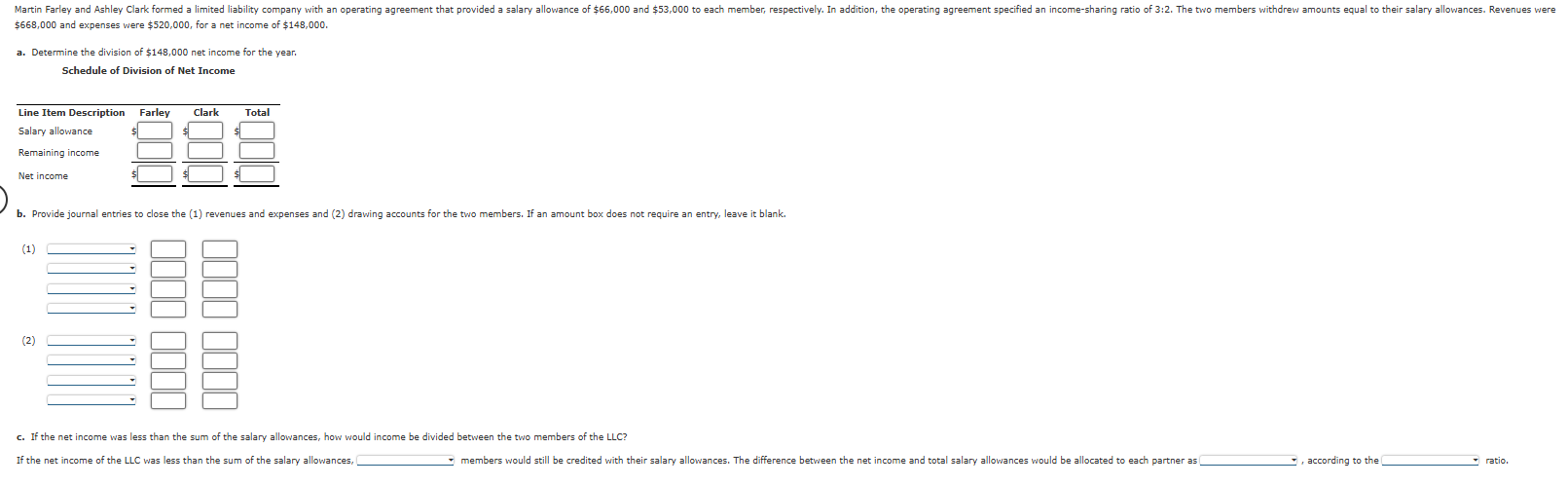

Question: ( $ 6 6 8 , 0 0 0 ) and expenses were ( $ 5 2 0 , 0

$ and expenses were $ for a net income of $

a Determine the division of $ net income for the year.

Schedule of Division of Net Income

b Provide journal entries to close the revenues and expenses and drawing accounts for the two members. If an amount box does not require an entry, leave it blank.

c If the net income was less than the sum of the salary allowances, how would income be divided between the two members of the LLC

If the net income of the LLC was less than the sum of the salary allowances,

members would still be credited with their salary allowances. The difference between the net income and total salary allowances would be allocated to each partner as

according to the

ratio.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock