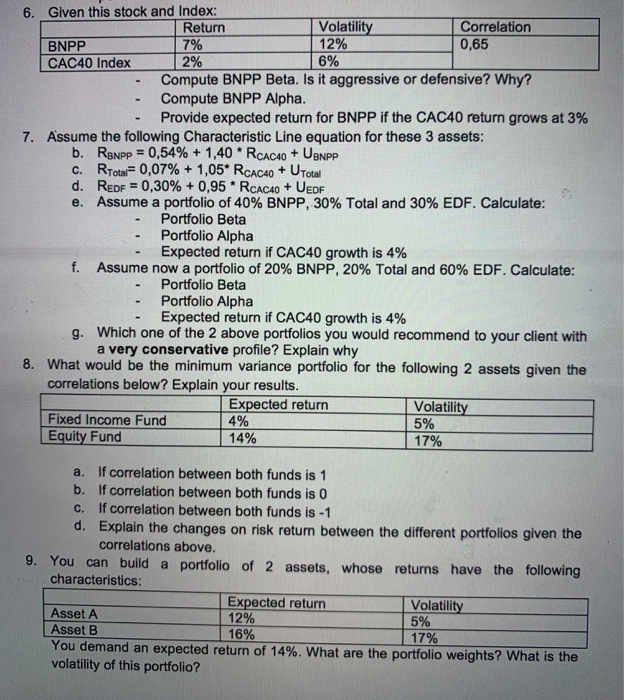

Question: _ 6% 6. Given this stock and Index: Return Volatility Correlation BNPP 7% 12% 0,65 CAC40 Index 2% Compute BNPP Beta. Is it aggressive or

_ 6% 6. Given this stock and Index: Return Volatility Correlation BNPP 7% 12% 0,65 CAC40 Index 2% Compute BNPP Beta. Is it aggressive or defensive? Why? Compute BNPP Alpha. - Provide expected return for BNPP if the CAC40 return grows at 3% 7. Assume the following Characteristic Line equation for these 3 assets: b. RgNpp = 0,54% + 1,40 * RCAC40 + UBNPP C. RTotal= 0,07% + 1,05* RCAC40 + UTotal d. REDF = 0,30% + 0,95 * RCAC40 + UEDF e. Assume a portfolio of 40% BNPP, 30% Total and 30% EDF. Calculate: Portfolio Beta Portfolio Alpha Expected return if CAC40 growth is 4% f. Assume now a portfolio of 20% BNPP, 20% Total and 60% EDF. Calculate: Portfolio Beta - Portfolio Alpha - Expected return if CAC40 growth is 4% g. Which one of the 2 above portfolios you would recommend to your client with a very conservative profile? Explain why 8. What would be the minimum variance portfolio for the following 2 assets given the correlations below? Explain your results. Expected return Volatility Fixed Income Fund 4% 5% Equity Fund 1 4% 17% - a. If correlation between both funds is 1 b. If correlation between both funds is 0 c. If correlation between both funds is -1 d. Explain the changes on risk return between the different portfolios given the correlations above. 9. You can build a portfolio of 2 assets, whose returns have the following characteristics: Expected return Volatility Asset A 12% 5% Asset B 16% 17% You demand an expected return of 14%. What are the portfolio weights? What is the volatility of this portfolio? _ 6% 6. Given this stock and Index: Return Volatility Correlation BNPP 7% 12% 0,65 CAC40 Index 2% Compute BNPP Beta. Is it aggressive or defensive? Why? Compute BNPP Alpha. - Provide expected return for BNPP if the CAC40 return grows at 3% 7. Assume the following Characteristic Line equation for these 3 assets: b. RgNpp = 0,54% + 1,40 * RCAC40 + UBNPP C. RTotal= 0,07% + 1,05* RCAC40 + UTotal d. REDF = 0,30% + 0,95 * RCAC40 + UEDF e. Assume a portfolio of 40% BNPP, 30% Total and 30% EDF. Calculate: Portfolio Beta Portfolio Alpha Expected return if CAC40 growth is 4% f. Assume now a portfolio of 20% BNPP, 20% Total and 60% EDF. Calculate: Portfolio Beta - Portfolio Alpha - Expected return if CAC40 growth is 4% g. Which one of the 2 above portfolios you would recommend to your client with a very conservative profile? Explain why 8. What would be the minimum variance portfolio for the following 2 assets given the correlations below? Explain your results. Expected return Volatility Fixed Income Fund 4% 5% Equity Fund 1 4% 17% - a. If correlation between both funds is 1 b. If correlation between both funds is 0 c. If correlation between both funds is -1 d. Explain the changes on risk return between the different portfolios given the correlations above. 9. You can build a portfolio of 2 assets, whose returns have the following characteristics: Expected return Volatility Asset A 12% 5% Asset B 16% 17% You demand an expected return of 14%. What are the portfolio weights? What is the volatility of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts