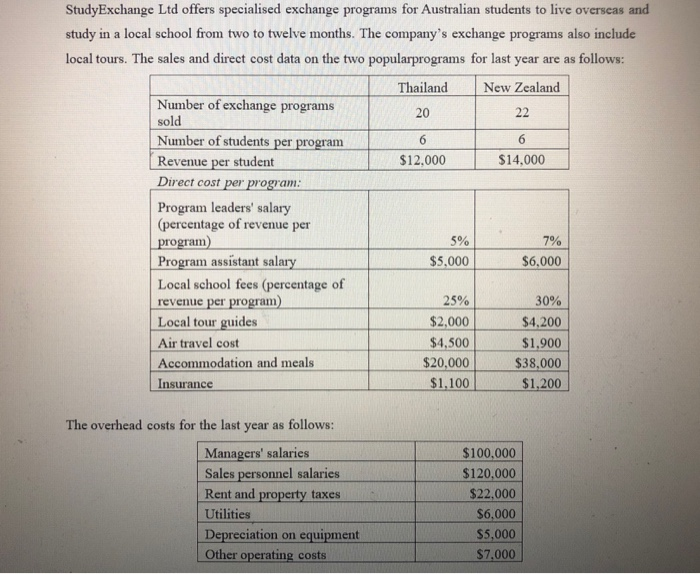

Question: 6 6 StudyExchange Ltd offers specialised exchange programs for Australian students to live overseas and study in a local school from two to twelve months.

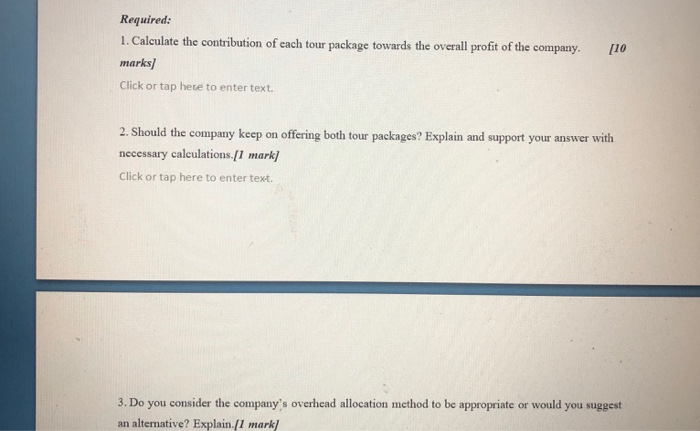

6 6 StudyExchange Ltd offers specialised exchange programs for Australian students to live overseas and study in a local school from two to twelve months. The company's exchange programs also include local tours. The sales and direct cost data on the two popularprograms for last year are as follows: Thailand New Zealand Number of exchange programs 20 22 sold Number of students per program Revenue per student $12.000 $14,000 Direct cost per program: Program leaders' salary (percentage of revenue per program) 5% 7% Program assistant salary $5,000 $6,000 Local school fees (percentage of revenue per program) 25% 30% Local tour guides $2,000 $4,200 Air travel cost $4,500 $1,900 Accommodation and meals $20,000 $38,000 Insurance $1,100 $1,200 The overhead costs for the last year as follows: Managers' salaries Sales personnel salaries Rent and property taxes Utilities Depreciation on equipment Other operating costs $100.000 $120,000 $22.000 $6.000 $5,000 $7,000 Required: 1. Calculate the contribution of each tour package towards the overall profit of the company. marks] Click or tap here to enter text. [10 2. Should the company keep on offering both tour packages? Explain and support your answer with necessary calculations. [1 mark] Click or tap here to enter text. 3. Do you consider the company's overhead allocation method to be appropriate or would you suggest an alternative? Explain.[1 mark/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts