Question: 6 & 7 please . 6. Suppose you short 2 futures contracts of SwF 125,000 at a price of $1.0850/SwF. Three months later you close

6 & 7 please .

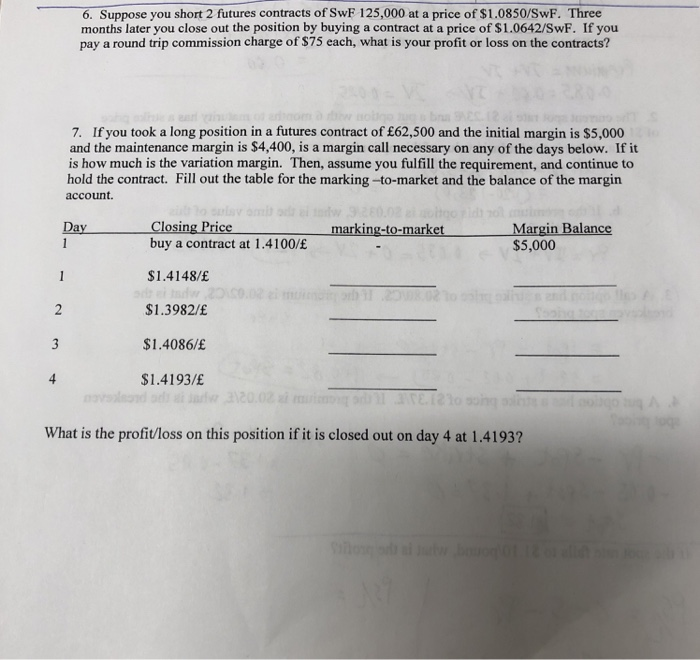

6 & 7 please . 6. Suppose you short 2 futures contracts of SwF 125,000 at a price of $1.0850/SwF. Three months later you close out the position by buying a contract at a price of $1.0642/SwF. If you pay a round trip commission charge of $75 each, what is your profit or loss on the contracts? 7. If you took a long position in a futures contract of 62,500 and the initial margin is $5,000 and the maintenance margin is $4,400, is a margin call necessary on any of the days below. If it is how much is the variation margin. Then, assume you fulfill the requirement, and continue to hold the contract. Fill out the table for the marking -to-market and the balance of the margin account. Margin Balance $5,000 marking-to-market buy a contract at 1.4100/ $1.4148/t $1.3982/f $1.4086/ $1.4193/E What is the profit/loss on this position if it is closed out on day 4 at 1.41932

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts