Question: Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 Which of the following is true? O A short

Question 1

Question 2

Question 2

Question 3

Question 3

Question 4

Question 4

Question 5

Question 5

Question 6

Question 6

Question 7

Question 8

Question 8

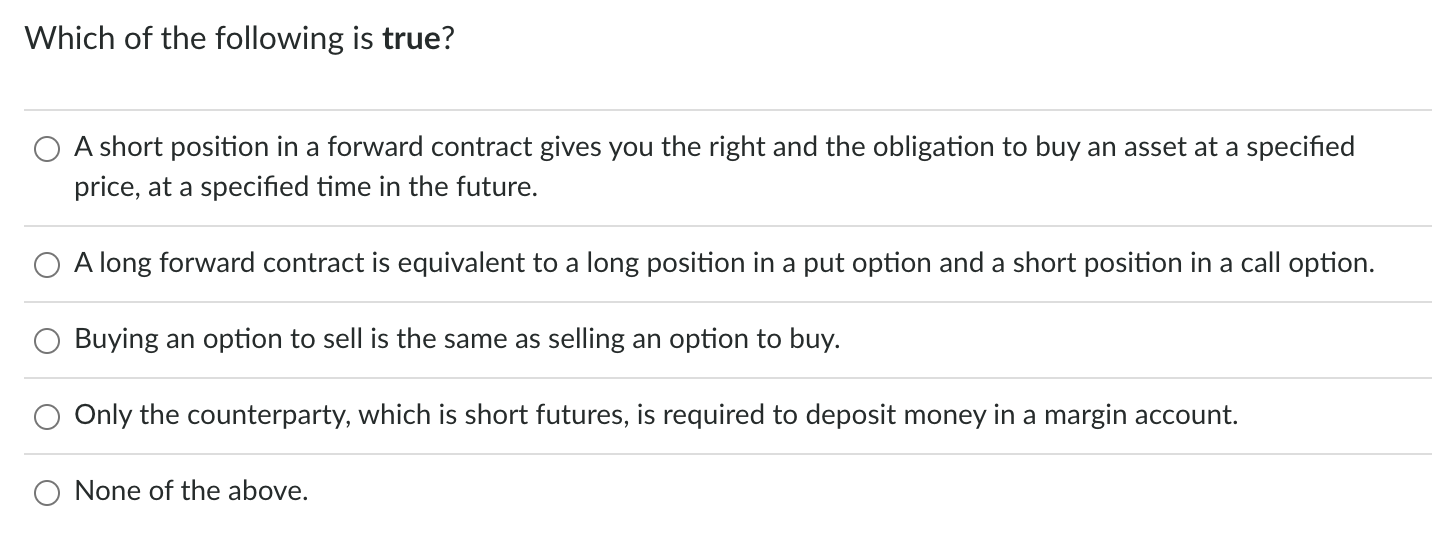

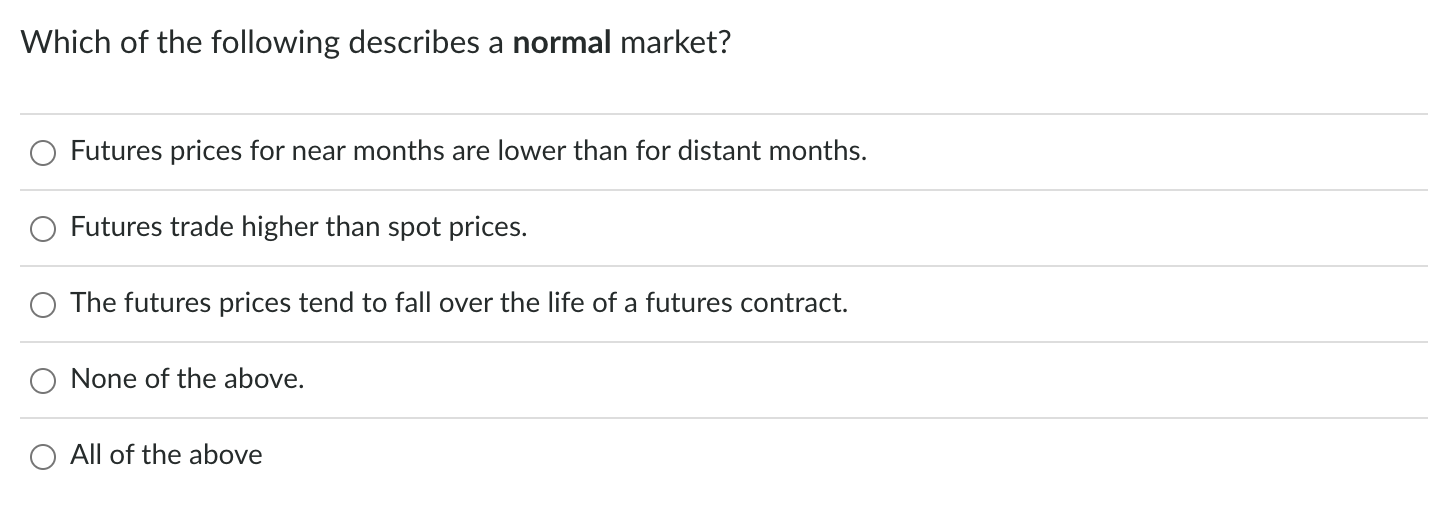

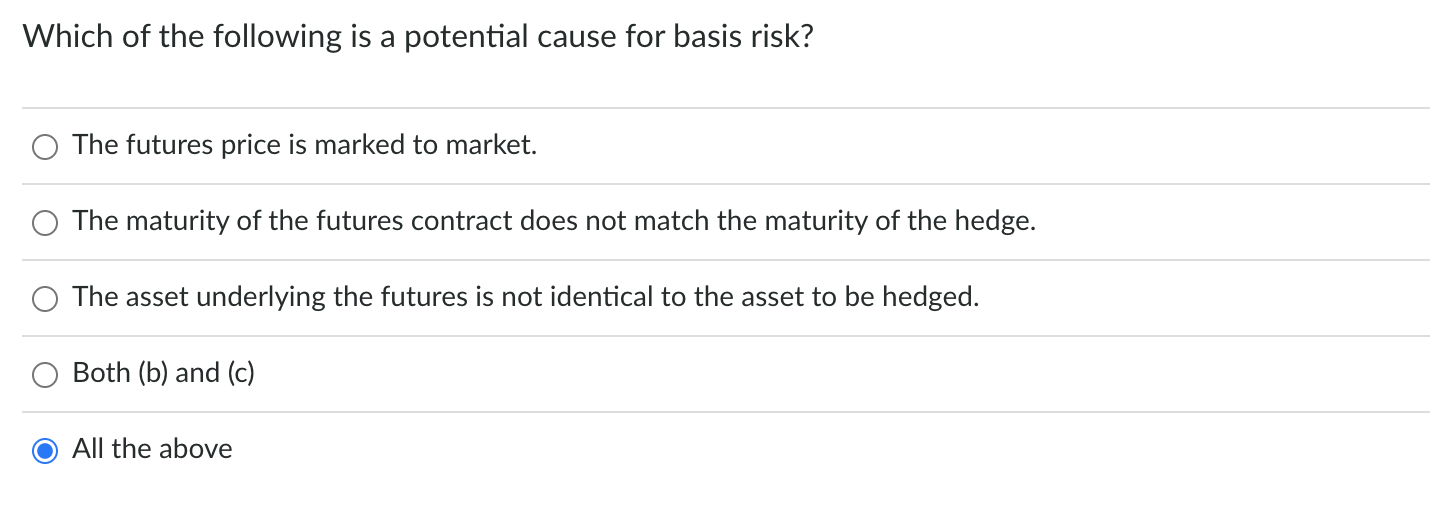

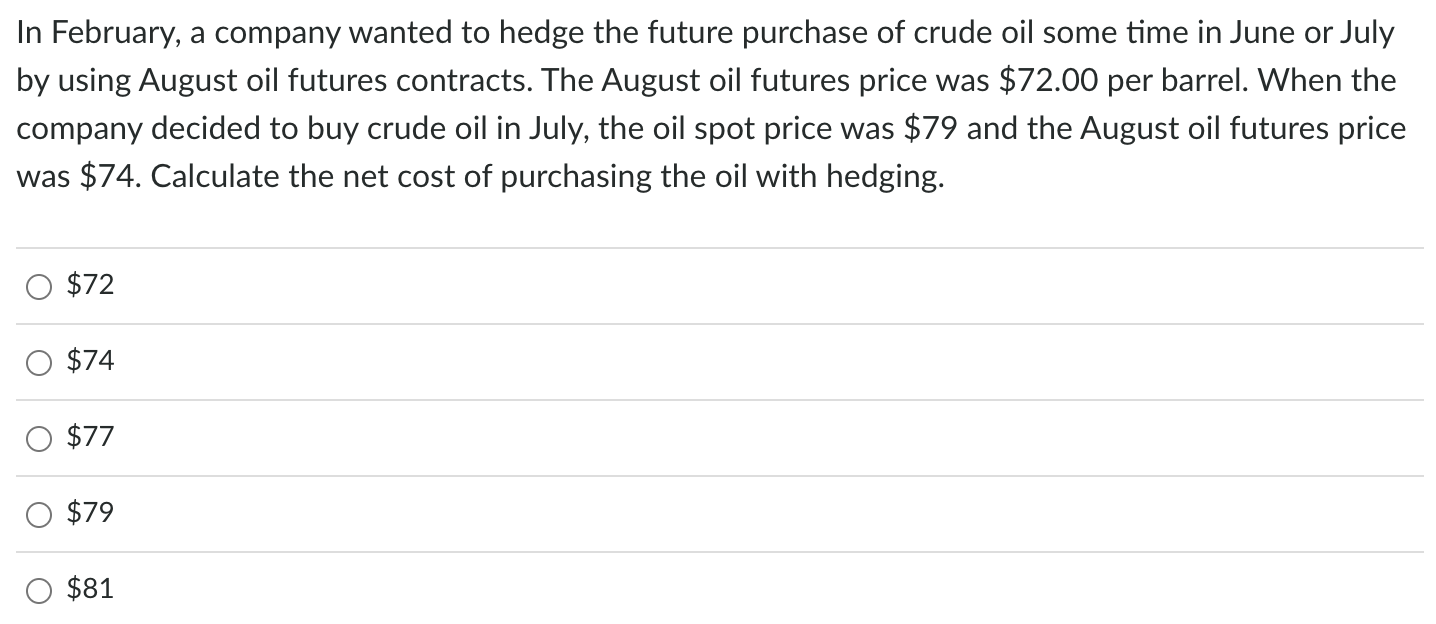

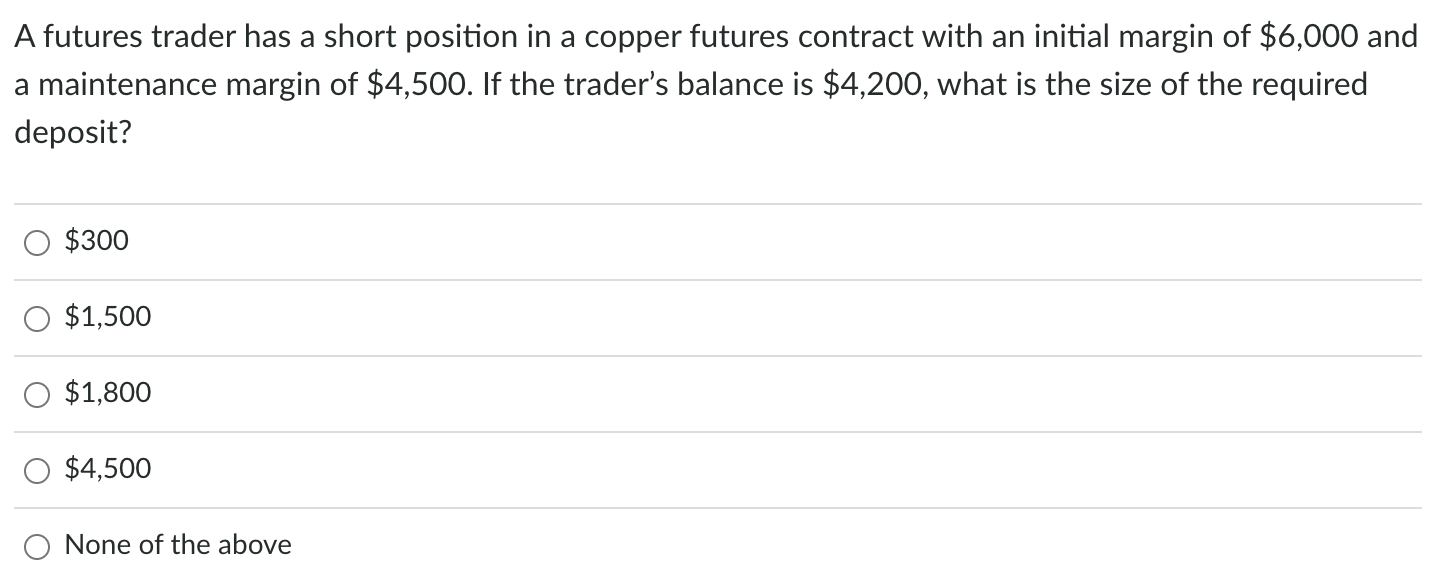

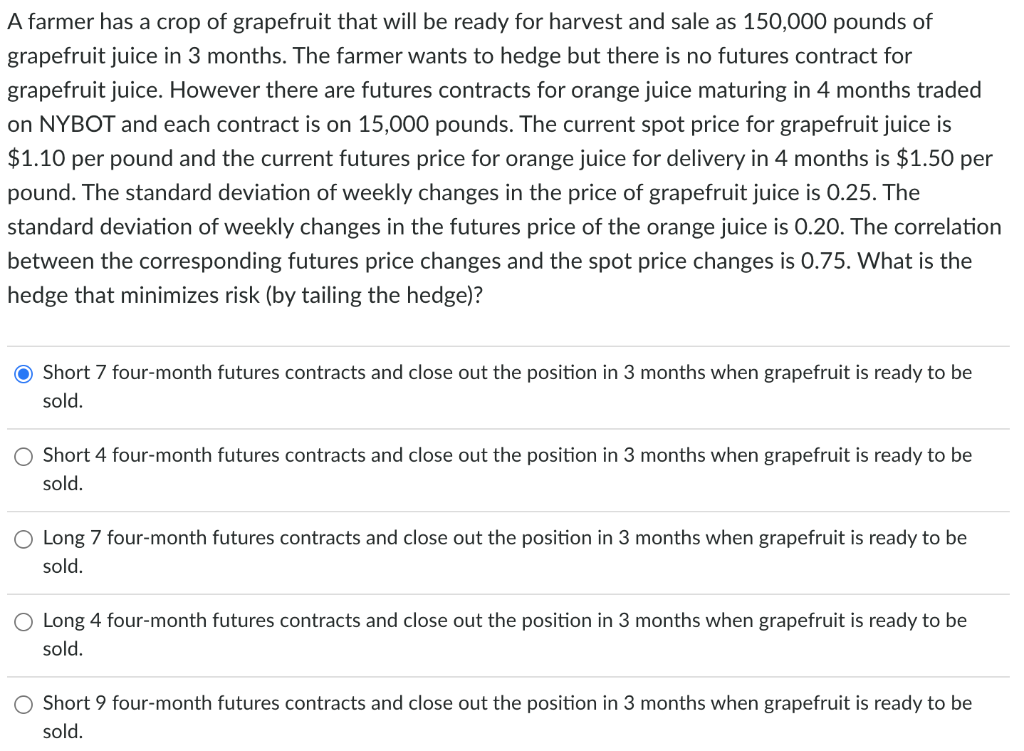

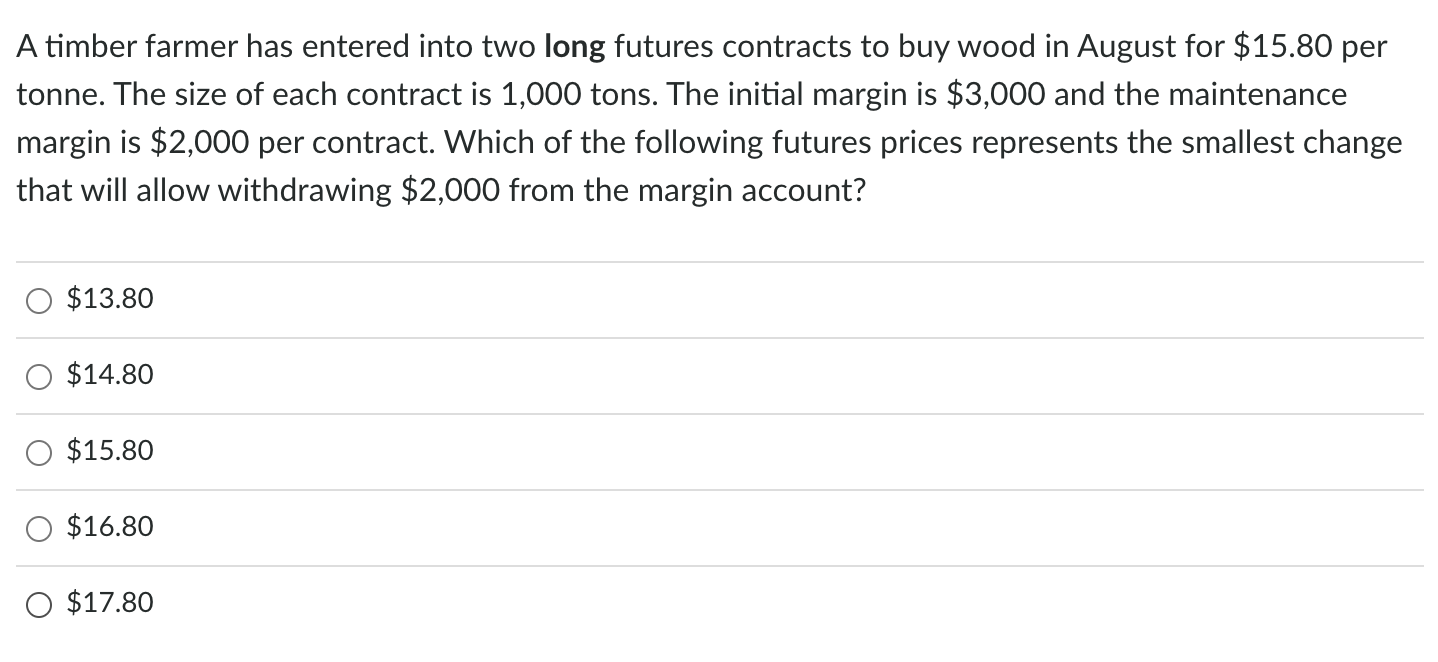

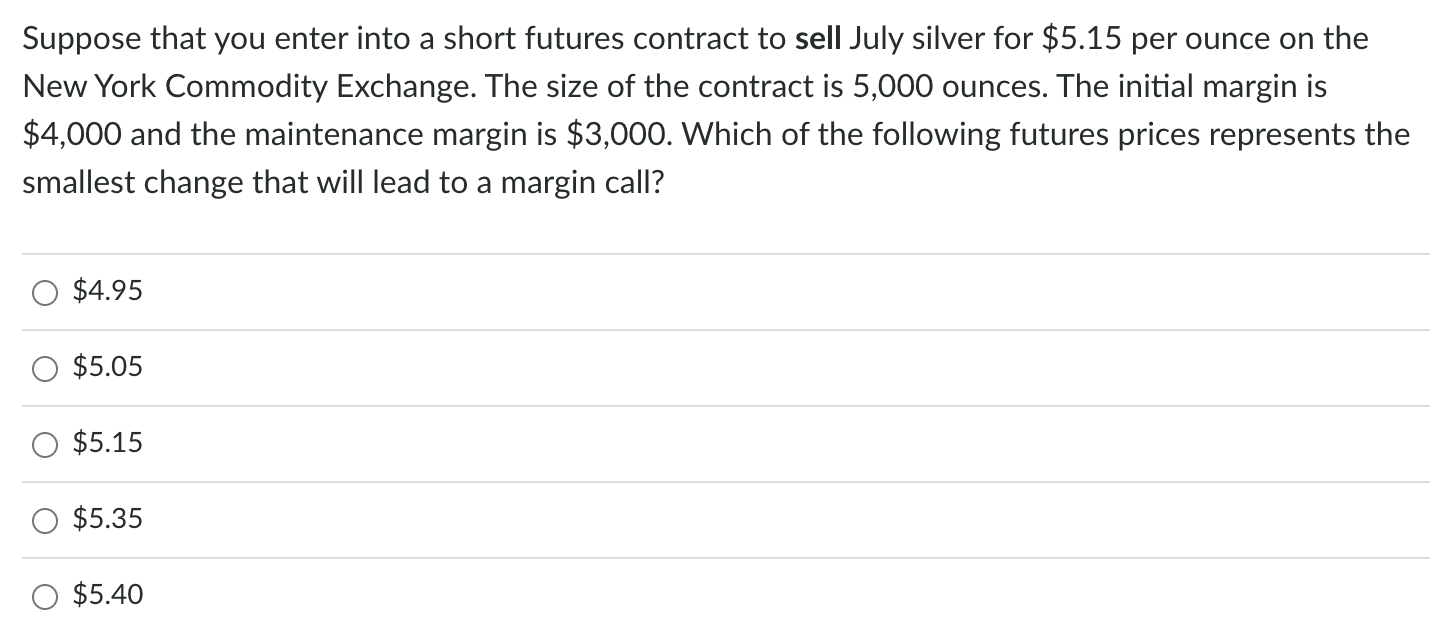

Which of the following is true? O A short position in a forward contract gives you the right and the obligation to buy an asset at a specified price, at a specified time in the future. A long forward contract is equivalent to a long position in a put option and a short position in a call option. O Buying an option to sell is the same as selling an option to buy. Only the counterparty, which is short futures, is required to deposit money in a margin account. None of the above. Which of the following describes a normal market? Futures prices for near months are lower than for distant months. O Futures trade higher than spot prices. The futures prices tend to fall over the life of a futures contract. None of the above. All of the above Which of the following is a potential cause for basis risk? O The futures price is marked to market. The maturity of the futures contract does not match the maturity of the hedge. The asset underlying the futures is not identical to the asset to be hedged. O Both (b) and (c) All the above In February, a company wanted to hedge the future purchase of crude oil some time in June or July by using August oil futures contracts. The August oil futures price was $72.00 per barrel. When the company decided to buy crude oil in July, the oil spot price was $79 and the August oil futures price was $74. Calculate the net cost of purchasing the oil with hedging. $72 $74 O $77 $79 $81 A futures trader has a short position in a copper futures contract with an initial margin of $6,000 and a maintenance margin of $4,500. If the trader's balance is $4,200, what is the size of the required deposit? $300 $1,500 O $1,800 $4,500 O None of the above A farmer has a crop of grapefruit that will be ready for harvest and sale as 150,000 pounds of grapefruit juice in 3 months. The farmer wants to hedge but there is no futures contract for grapefruit juice. However there are futures contracts for orange juice maturing in 4 months traded on NYBOT and each contract is on 15,000 pounds. The current spot price for grapefruit juice is $1.10 per pound and the current futures price for orange juice for delivery in 4 months is $1.50 per pound. The standard deviation of weekly changes in the price of grapefruit juice is 0.25. The standard deviation of weekly changes in the futures price of the orange juice is 0.20. The correlation between the corresponding futures price changes and the spot price changes is 0.75. What is the hedge that minimizes risk (by tailing the hedge)? Short 7 four-month futures contracts and close out the position in 3 months when grapefruit is ready to be sold. Short 4 four- month futures contracts and close out the position in 3 months when grapefruit is ready to be sold. O Long 7 four-month futures contracts and close out the position in 3 months when grapefruit is ready to be sold. Long 4 four-month futures contracts and close out the position in 3 months when grapefruit is ready to be sold. O Short 9 four-month futures contracts and close out the position in 3 months when grapefruit is ready to be sold. A timber farmer has entered into two long futures contracts to buy wood in August for $15.80 per tonne. The size of each contract is 1,000 tons. The initial margin is $3,000 and the maintenance margin is $2,000 per contract. Which of the following futures prices represents the smallest change that will allow withdrawing $2,000 from the margin account? $13.80 $14.80 $15.80 $16.80 $17.80 Suppose that you enter into a short futures contract to sell July silver for $5.15 per ounce on the New York Commodity Exchange. The size of the contract is 5,000 ounces. The initial margin is $4,000 and the maintenance margin is $3,000. Which of the following futures prices represents the smallest change that will lead to a margin call? O $4.95 $5.05 $5.15 $5.35 O $5.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts