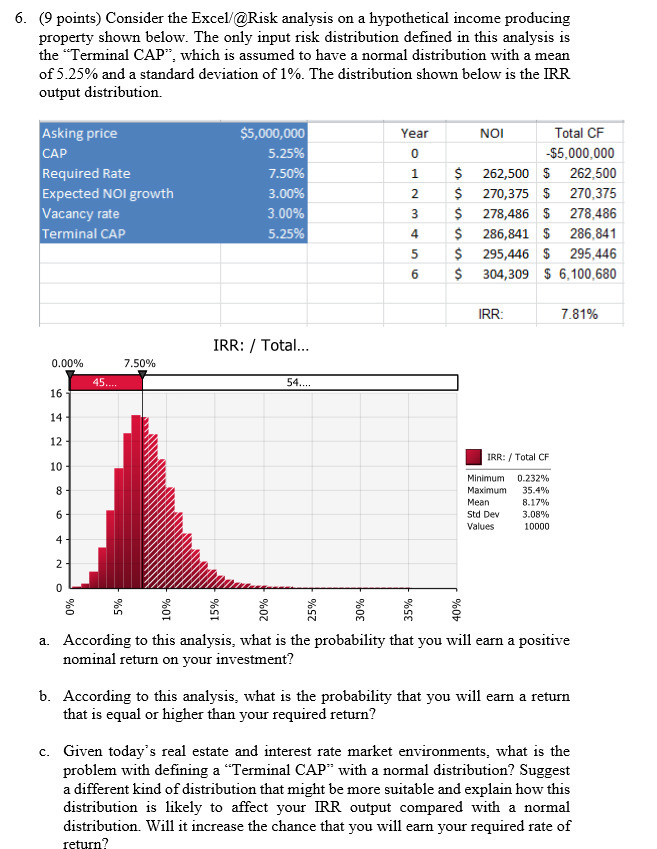

Question: 6. {9 points) Consider the ExceH@Risk analysis on a hypothetical income producing property shown below. The only input risk distribution defmed in this analysis is

6. {9 points) Consider the ExceH@Risk analysis on a hypothetical income producing property shown below. The only input risk distribution defmed in this analysis is the 'Terminal CAP", which is assumed to have a normal distribution with a mean of 5-25% and a standard deviation of 1%. The distribution shown below is the [RR output distribution. Asking once ' ' l 'rear I NEH iTutal CF [LA Fl lI] ~$E1 Illlll Require-:1 Fists 1 5 llm $ 262,5 2 5 ZTDJTS $- 27"0133'5 s 5 House 5 213.435 TEr'rTI I "I .3 | 4 5 235,341 5 235.341 5 5 195,445 5 295.445 6 S 304*309 5 E.'1D. IRE: 131% IRR: 1" Total... I Ins: Jr'rml EF Hlnllnurn U.232% Minimum 35.4% Mean E.1?% Std DH 3.433% \"like: lUUU \":3 at"; i Fl sass: H F'l D"!- a. According to this analysis: what is the probability that you will earn a positive nominal return on your irwastment? 15% b. According to this analysis, what is the probability that you will earn a return that is equal or higher than your required return? c. Given today's real estate and interest rate market environments, what is the problem with dening a \"Terminal CAP" with a normal distribution? Suggest a di'erent lcind of distribution that might be more suitable and explain how this distribution is likely to a'ect your [RR output comparod with a normal distribution. Will it increase the chance that you will earn your required rate of return?I

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts