Question: 6 and 7 D Question 6 5 pts Same context as previous question: Suppose on March 1, the spot exchange rate between British Pound and

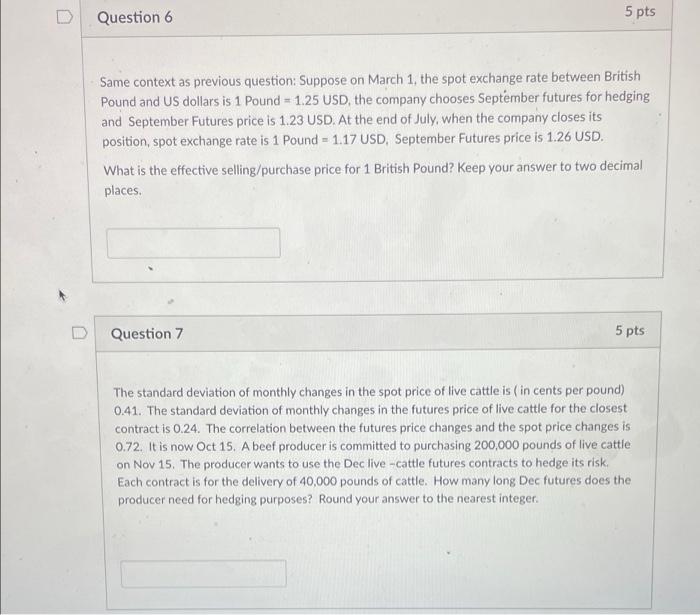

D Question 6 5 pts Same context as previous question: Suppose on March 1, the spot exchange rate between British Pound and US dollars is 1 Pound = 1.25 USD, the company chooses September futures for hedging and September Futures price is 1.23 USD. At the end of July, when the company closes its position, spot exchange rate is 1 Pound - 1.17 USD, September Futures price is 1.26 USD. What is the effective selling/purchase price for 1 British Pound? Keep your answer to two decimal places. Question 7 5 pts The standard deviation of monthly changes in the spot price of live cattle is (in cents per pound) 0.41. The standard deviation of monthly changes in the futures price of live cattle for the closest contract is 0.24. The correlation between the futures price changes and the spot price changes is 0.72. It is now Oct 15. A beef producer is committed to purchasing 200,000 pounds of live cattle on Nov 15. The producer wants to use the Dec live-cattle futures contracts to hedge its risk. Each contract is for the delivery of 40,000 pounds of cattle. How many long Dec futures does the producer need for hedging purposes? Round your answer to the nearest integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts