Question: Same context as previous question: Suppose on March 1, the spot exchange rate between British Pound and US dollars is 1 Pound = 1.3 USD,

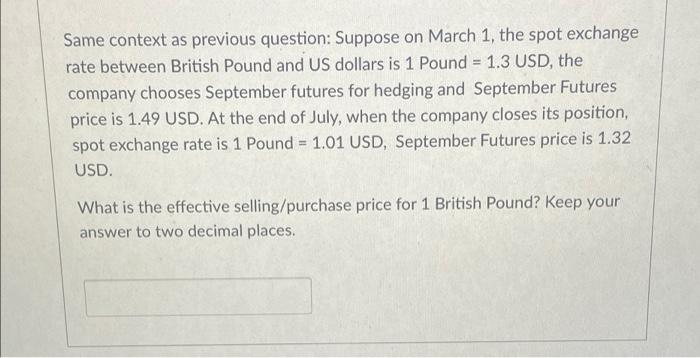

Same context as previous question: Suppose on March 1, the spot exchange rate between British Pound and US dollars is 1 Pound = 1.3 USD, the company chooses September futures for hedging and September Futures price is 1.49 USD. At the end of July, when the company closes its position, spot exchange rate is 1 Pound = 1.01 USD, September Futures price is 1.32 USD. What is the effective selling/purchase price for 1 British Pound? Keep your answer to two decimal places. Same context as previous question: Suppose on March 1, the spot exchange rate between British Pound and US dollars is 1 Pound = 1.3 USD, the company chooses September futures for hedging and September Futures price is 1.49 USD. At the end of July, when the company closes its position, spot exchange rate is 1 Pound = 1.01 USD, September Futures price is 1.32 USD. What is the effective selling/purchase price for 1 British Pound? Keep your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts