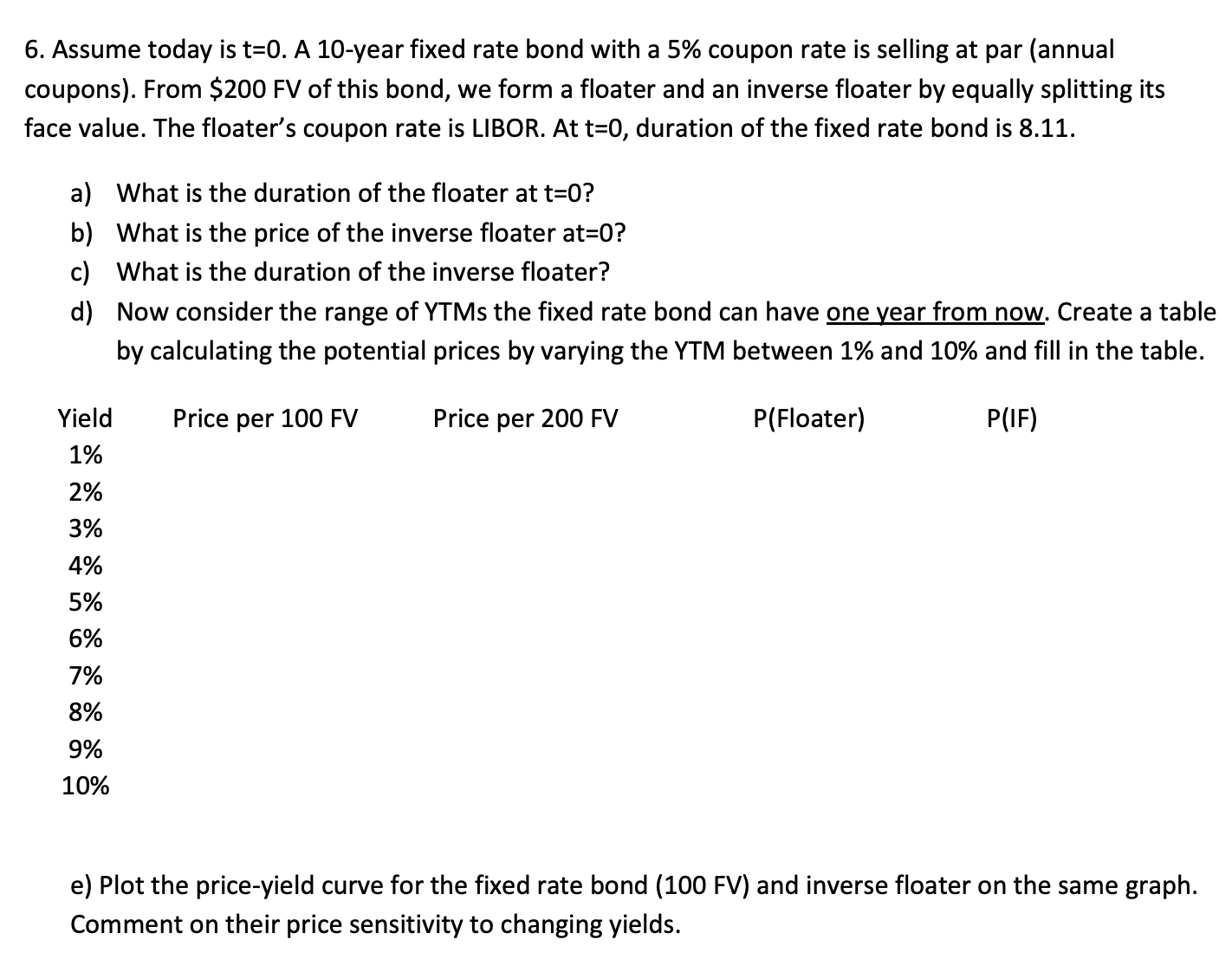

Question: 6 . Assume today is t = 0 . A 1 0 - year fixed rate bond with a 5 % coupon rate is selling

Assume today is t A year fixed rate bond with a coupon rate is selling at par annual coupons From $ FV of this bond, we form a floater and an inverse floater by equally splitting its Assume today is A year fixed rate bond with a coupon rate is selling at par annual

coupons From $ of this bond, we form a floater and an inverse floater by equally splitting its

face value. The floater's coupon rate is LIBOR. At duration of the fixed rate bond is

a What is the duration of the floater at

b What is the price of the inverse floater at

c What is the duration of the inverse floater?

d Now consider the range of YTMs the fixed rate bond can have one year from now. Create a table

by calculating the potential prices by varying the YTM between and and fill in the table.

e Plot the priceyield curve for the fixed rate bond FV and inverse floater on the same graph.

Comment on their price sensitivity to changing yields.face value. The floaters coupon rate is LIBOR. At t duration of the fixed rate bond is

a What is the duration of the floater at t

b What is the price of the inverse floater at

c What is the duration of the inverse floater?

d Now consider the range of YTMs the fixed rate bond can have one year from now. Create a table by calculating the potential prices by varying the YTM between and and fill in the table.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock