Question: please answer all 3 questions asap, will upvote Ingram Electric Products is considering a project that has the following cash flow and cost of capital

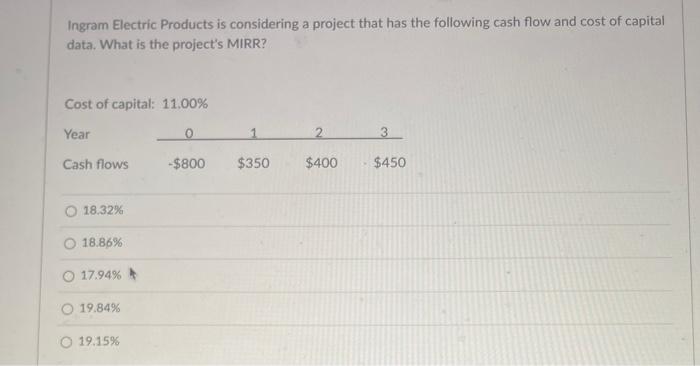

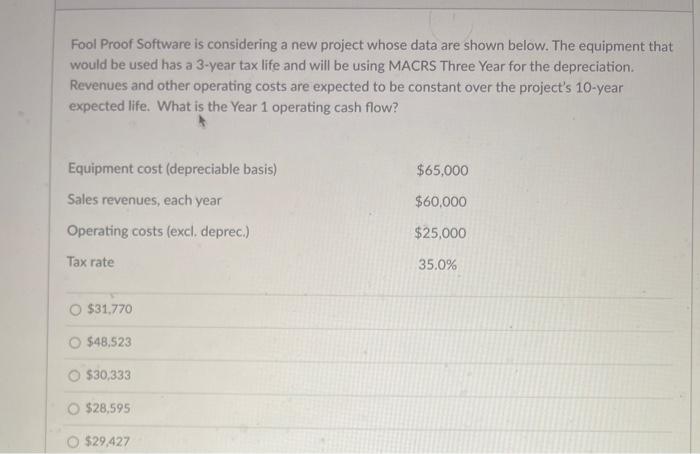

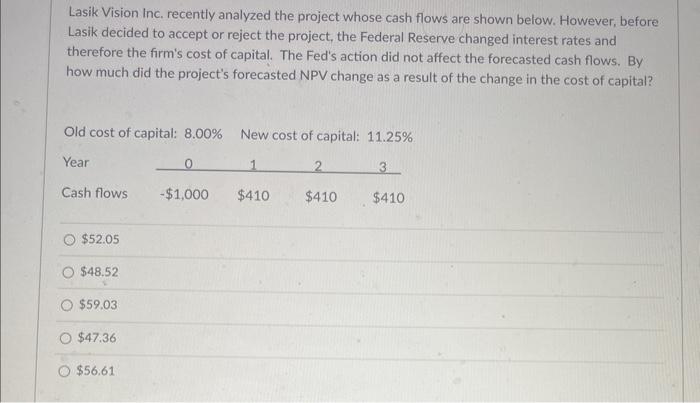

Ingram Electric Products is considering a project that has the following cash flow and cost of capital data. What is the project's MIRR? Cost of capital: 11.00% 18.32% 18.86% 17.94% 19.84% 19.15% Fool Proof Software is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life and will be using MACRS Three Year for the depreciation. Revenues and other operating costs are expected to be constant over the project's 10-year expected life. What is the Year 1 operating cash flow? $31,770 $48,523 $30,333 $28,595 $29,427 Lasik Vision Inc, recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve changed interest rates and therefore the firm's cost of capital. The Fed's action did not affect the forecasted cash flows. By how much did the project's forecasted NPV change as a result of the change in the cost of capital? Old cost of capital: 8.00% New cost of capital: 11.25% $52.05 $48.52 $59.03 $47.36 $56.61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts