Question: 6 Chapter 10 Homework Question 2 of4 3.1 / 6.2 E View Policies Show Attempt History Current Attempt in Progress MarigoldFurniture Company started construction of

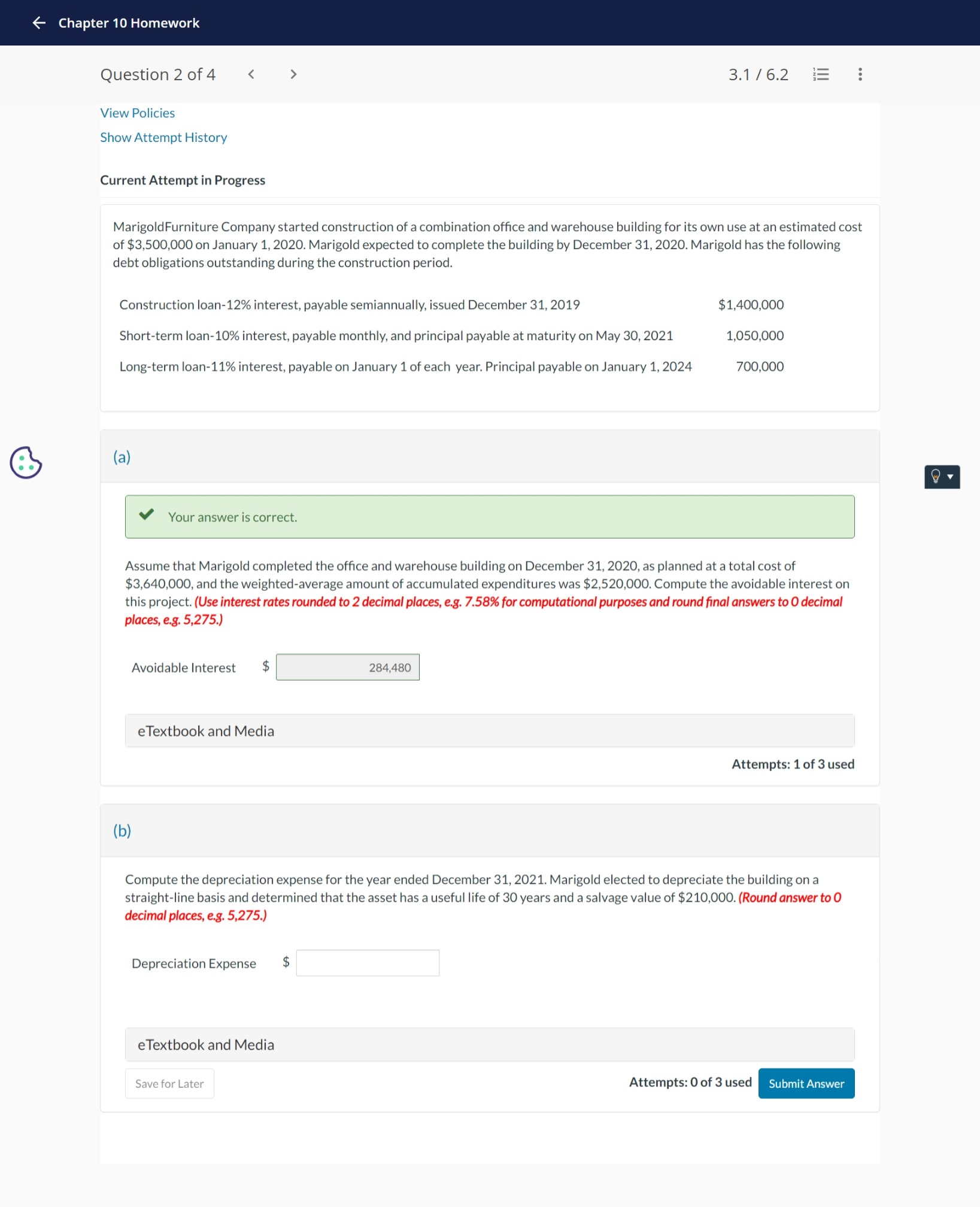

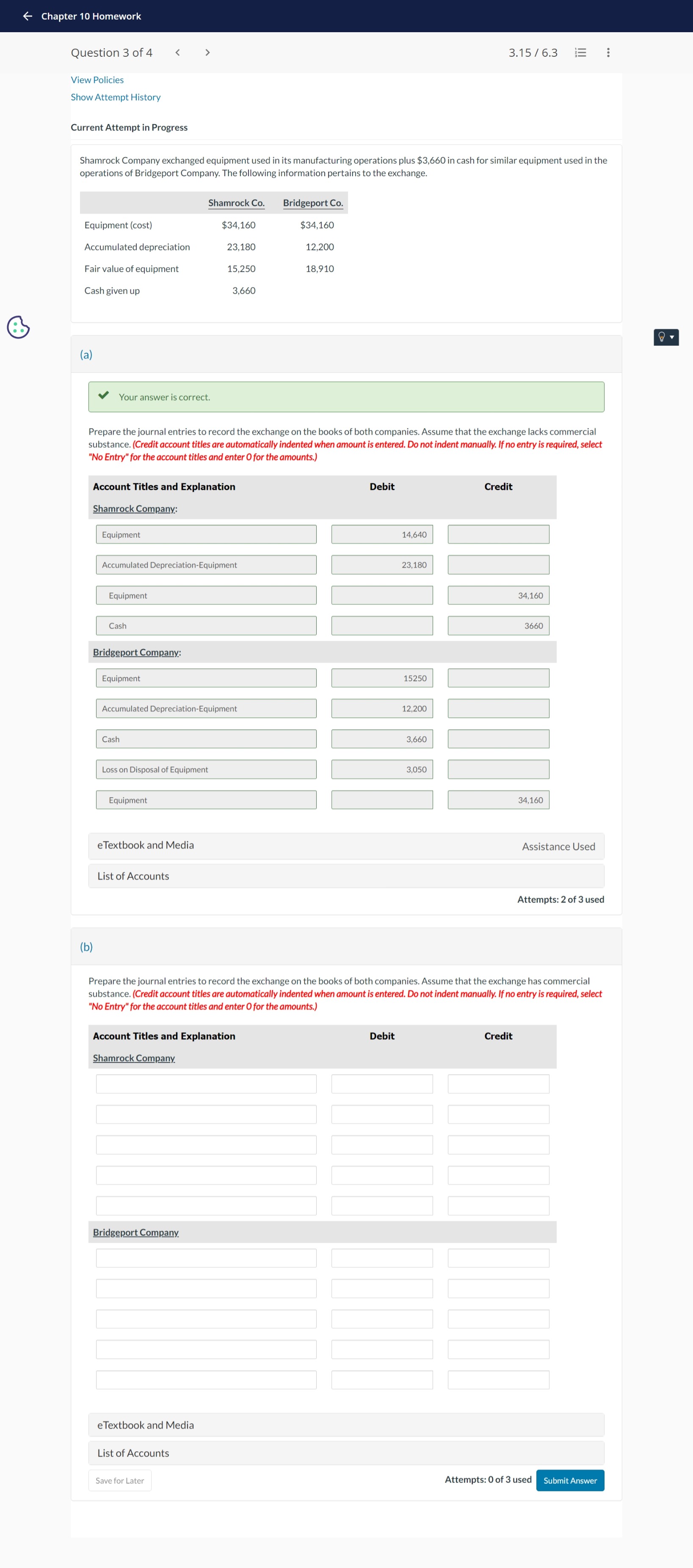

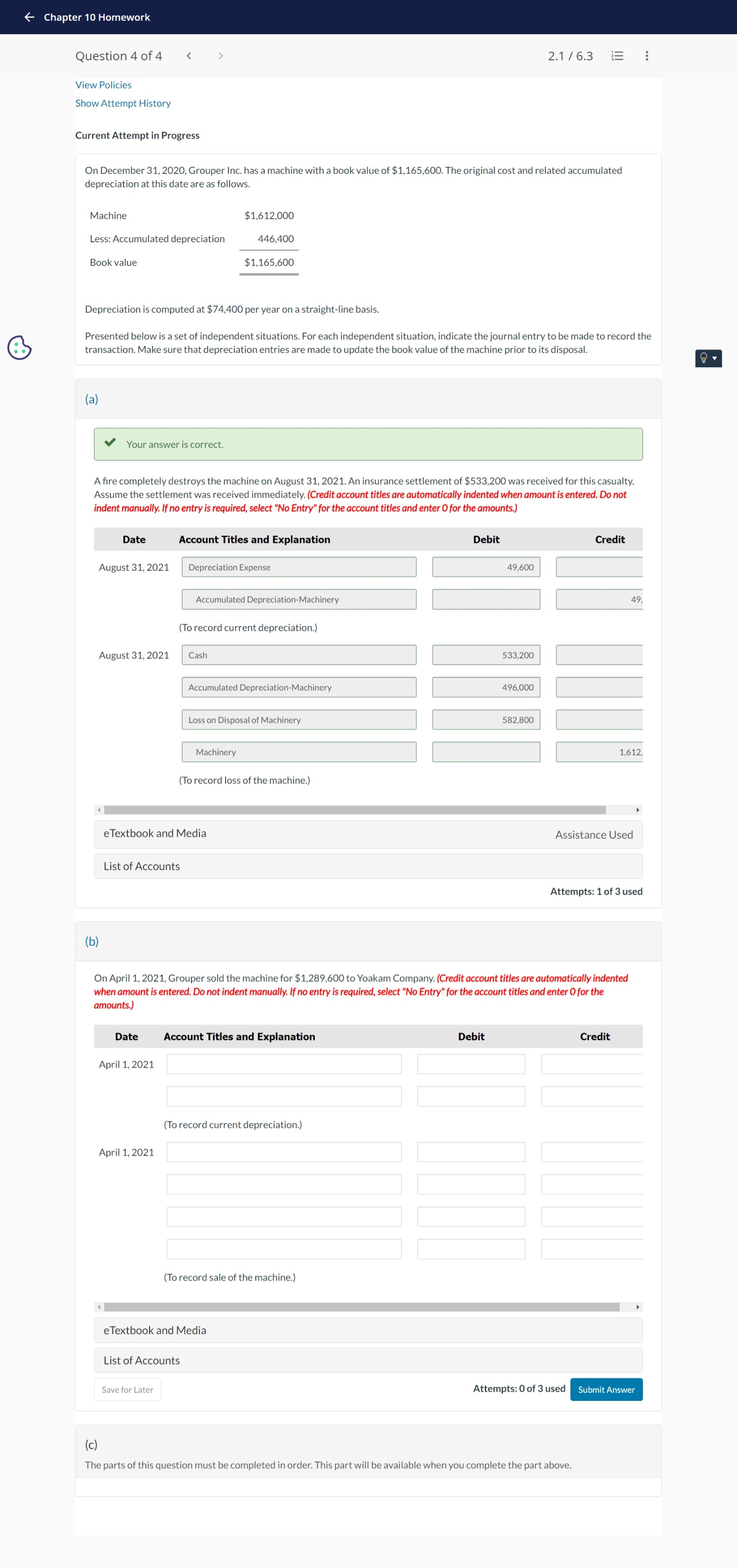

6 Chapter 10 Homework Question 2 of4 3.1 / 6.2 E View Policies Show Attempt History Current Attempt in Progress MarigoldFurniture Company started construction of a combination ofce and warehouse building for its own use at an estimated cost of $3.500.000 on January 1, 2020. Marigold expected to complete the building by December 31, 2020. Marigold has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31. 2019 331400000 Short-term loan-10% interest, payable monthly. and principal payable at maturity on May 30. 2021 1.050000 Long-term loan-11% interest, payable on January 1 of each yeah Principal payable on January 1. 2024 700.000 0 (a) .:. i V Your answer is correct. ' I: J Assume that Marigold completed the ofce and warehouse building on December 31. 2020. as planned at a total cost of $3,640.000, and the weighted-average amount of accumulated expenditures was $2,520.000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e3. 7.58% for computational purposes and round final answers to 0 decimal places. e.g. 5.275.) Avoidable Interest 35 284.480 eTextbook and Media Attempts: 1 of 3 used (b) Compute the depreciation expense for the year ended December 31. 2021. Marigold elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $210000. (Roundanswer toO decimal places. 9.3. 5.275.) Depreciation Expense $ eTextbook and Media H, y. , Attempts:00f3used Chapter 10 Homework Question 3 of 4 3.15 / 6.3 View Policies Show Attempt History Current Attempt in Progress Shamrock Company exchanged equipment used in its manufacturing operations plus $3,660 in cash for similar equipment used in the operations of Bridgeport Company. The following information pertains to the exchange. Shamrock Co. Bridgeport Co. Equipment (cost) $34,160 $34,160 Accumulated depreciation 23,180 12,200 Fair value of equipment 15,250 18,910 Cash given up 3,660 (a) Your answer is correct. Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange lacks commercial substance. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Shamrock Company: Equipment 14,640 Accumulated Depreciation-Equipment 23,180 Equipment 34,160 Cash 3660 Bridgeport Company: Equipment 15250 Accumulated Depreciation-Equipment 12,200 Cash 3,660 Loss on Disposal of Equipment 3,050 Equipment 34,160 e Textbook and Media Assistance Used List of Accounts Attempts: 2 of 3 used (b) Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange has commercial substance. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select 'No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Shamrock Company. Bridgeport Company. e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts