Question: 6. Chapter b Multiple Choice 07-84, Section b Multiple Choice 07-84, Problem b Multiple Choice 07-84 Sawchuck Consulting has been profitable for the last 5

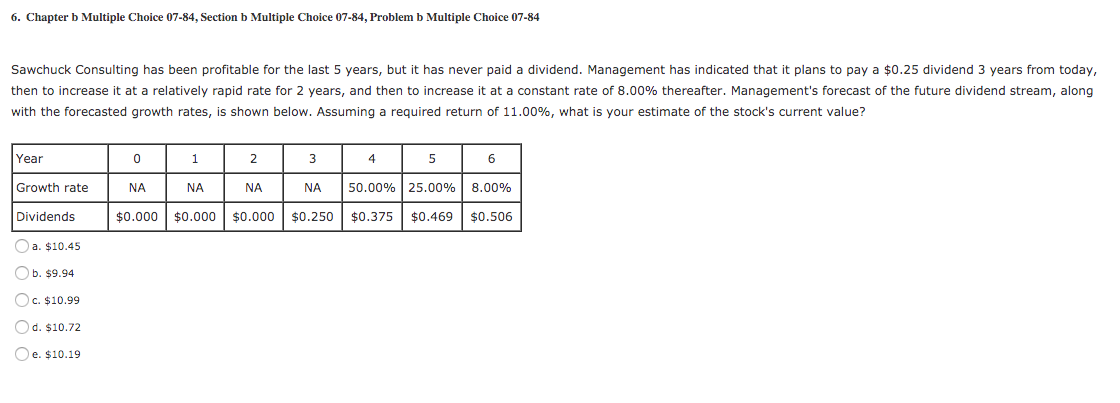

6. Chapter b Multiple Choice 07-84, Section b Multiple Choice 07-84, Problem b Multiple Choice 07-84 Sawchuck Consulting has been profitable for the last 5 years, but it has never paid a dividend. Management has indicated that it plans to pay a $0.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value? Year Growth rate 0 1 2 | NA NA NA $0.000 $0.000 $0.000 3 NA $0.250 4 5 6 50.00% 25.00% 8.00% $0.375 $0.469 | $0.506 Dividends O a. $10.45 O b. $9.94 O c. $10.99 Od. $10.72 Oe. $10.19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts