Question: 6. Computing and interpreting the degree of operating leverage (DOL) Aa Aa E It is December 31. Last year, Aberdeen Petroleum Refiners Corp. had sales

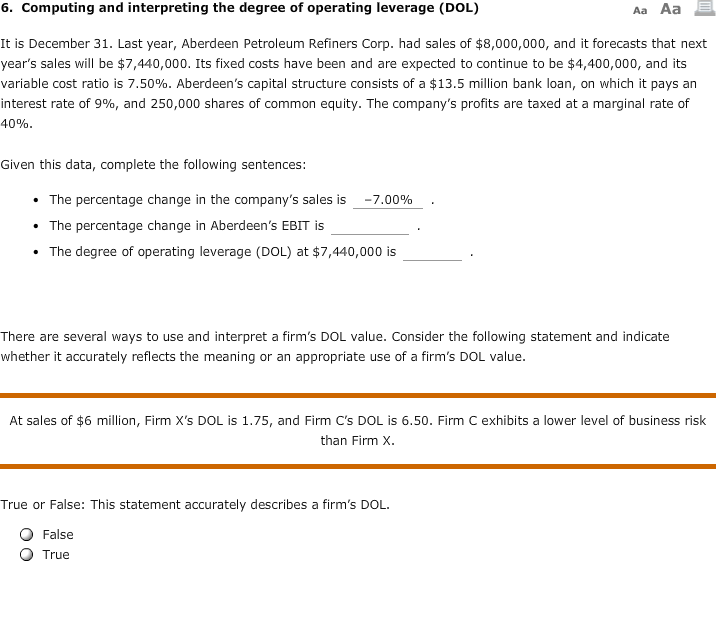

6. Computing and interpreting the degree of operating leverage (DOL) Aa Aa E It is December 31. Last year, Aberdeen Petroleum Refiners Corp. had sales of $8,000,000, and it forecasts that next year's sales will be $7,440,000. Its fixed costs have been and are expected to continue to be $4,400,000, and its variable cost ratio is 7.50%. Aberdeen's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 9%, and 250,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences . The percentage change in the company's sales is -7.00% The percentage change in Aberdeen's EBIT is The degree of operating leverage (DOL) at $7,440,000 is There are several ways to use and interpret a firm's DOL value. Consider the following statement and indicate whether it accurately reflects the meaning or an appropriate use of a firm's DOL value. At sales of $6 million, Firm X's DOL is 1.75, and Firm C's DOL is 6.50. Firm C exhibits a lower level of business risk than Firm X True or False: This statement accurately describes a firm's DOL O False True 6. Computing and interpreting the degree of operating leverage (DOL) Aa Aa E It is December 31. Last year, Aberdeen Petroleum Refiners Corp. had sales of $8,000,000, and it forecasts that next year's sales will be $7,440,000. Its fixed costs have been and are expected to continue to be $4,400,000, and its variable cost ratio is 7.50%. Aberdeen's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 9%, and 250,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences . The percentage change in the company's sales is -7.00% The percentage change in Aberdeen's EBIT is The degree of operating leverage (DOL) at $7,440,000 is There are several ways to use and interpret a firm's DOL value. Consider the following statement and indicate whether it accurately reflects the meaning or an appropriate use of a firm's DOL value. At sales of $6 million, Firm X's DOL is 1.75, and Firm C's DOL is 6.50. Firm C exhibits a lower level of business risk than Firm X True or False: This statement accurately describes a firm's DOL O False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts