Question: 6. Consider the CAPM framework. Suppose that you currently have 40% of your wealth in Treasury Bills, risk-free, and 60% in the four assets below

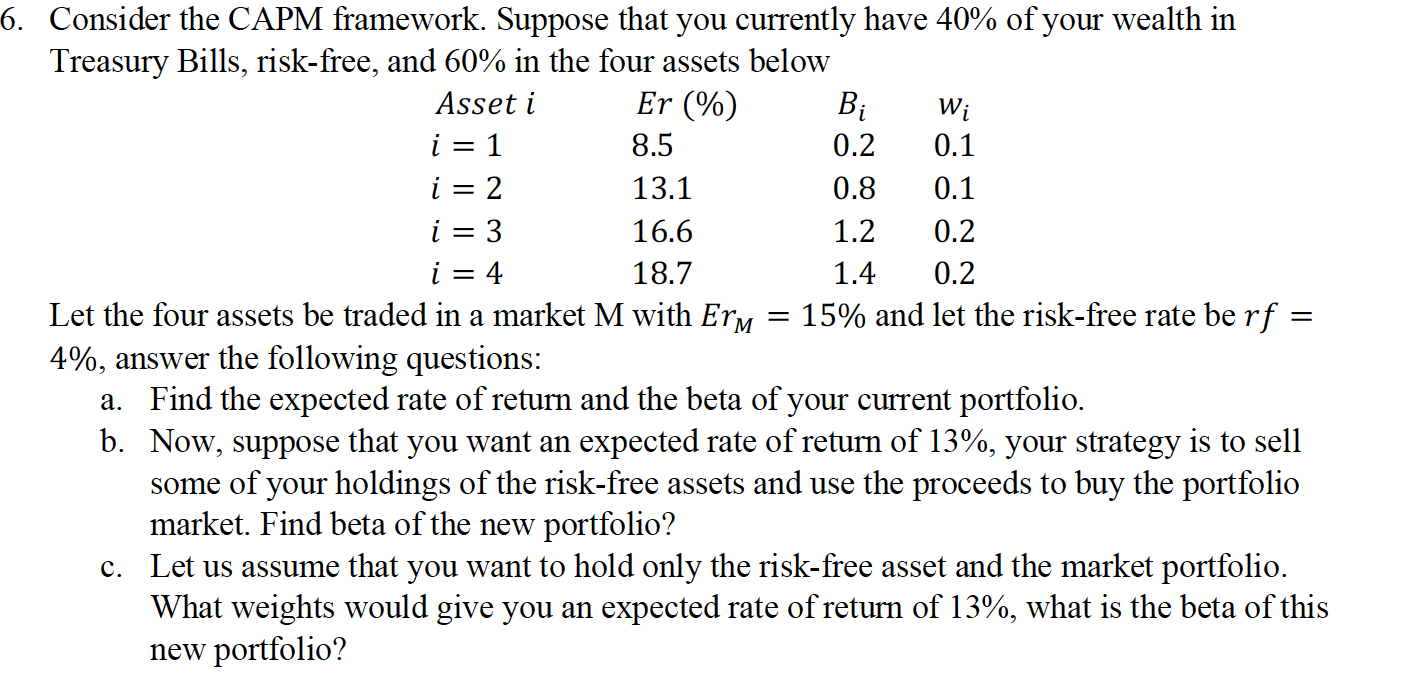

6. Consider the CAPM framework. Suppose that you currently have 40% of your wealth in Treasury Bills, risk-free, and 60% in the four assets below Asset i Er (%) i = 1 8.5 i = 2 13.1 i = 3 16.6 i = 4 18.7 Bi 0.2 0.8 1.2 1.4 Wi 0.1 0.1 0.2 0.2 Let the four assets be traded in a market M with Ery = 15% and let the risk-free rate be rf= 4%, answer the following

Consider the CAPM framework. Suppose that you currently have 40% of your wealth in Treasury Bills, risk-free, and 60% in the four assets below Let the four assets be traded in a market M with ErM=15% and let the risk-free rate be rf= 4%, answer the following questions: a. Find the expected rate of return and the beta of your current portfolio. b. Now, suppose that you want an expected rate of return of 13%, your strategy is to sell some of your holdings of the risk-free assets and use the proceeds to buy the portfolio market. Find beta of the new portfolio? c. Let us assume that you want to hold only the risk-free asset and the market portfolio. What weights would give you an expected rate of return of 13%, what is the beta of this new portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts