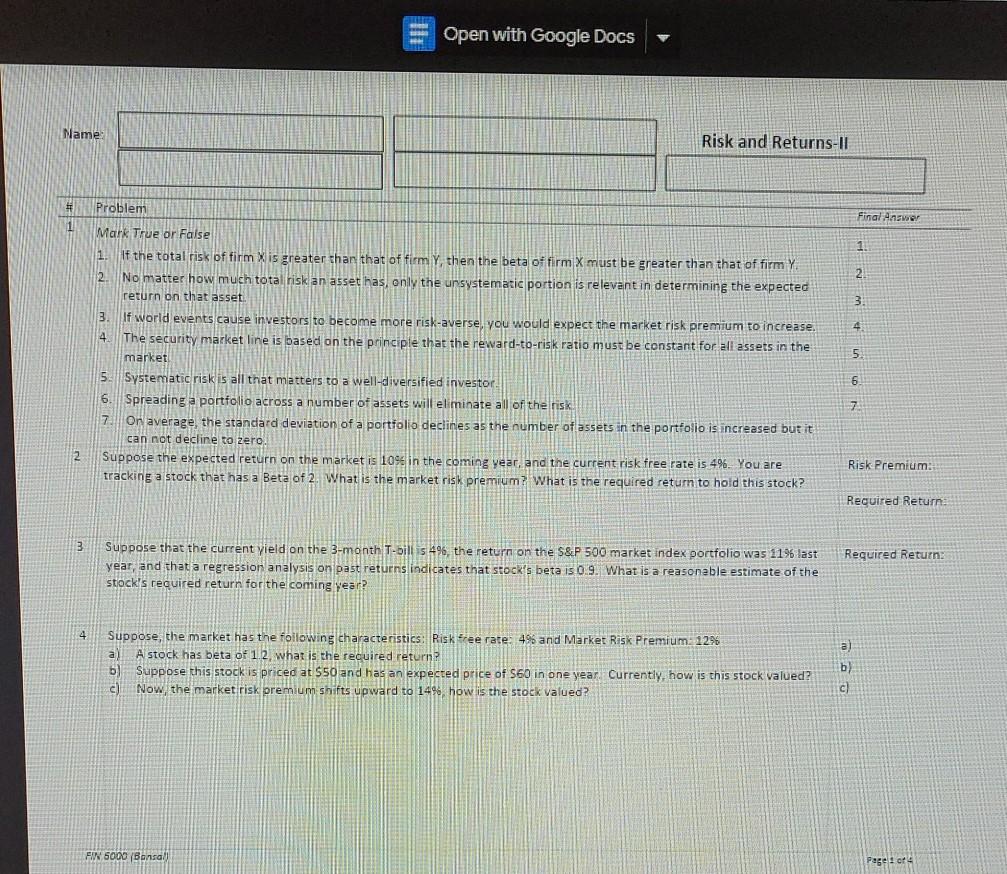

Question: TE Open with Google Docs Name Risk and Returns-Il Final Answer 1 1 2 3. 4 Problem Mark True or False 1. If the total

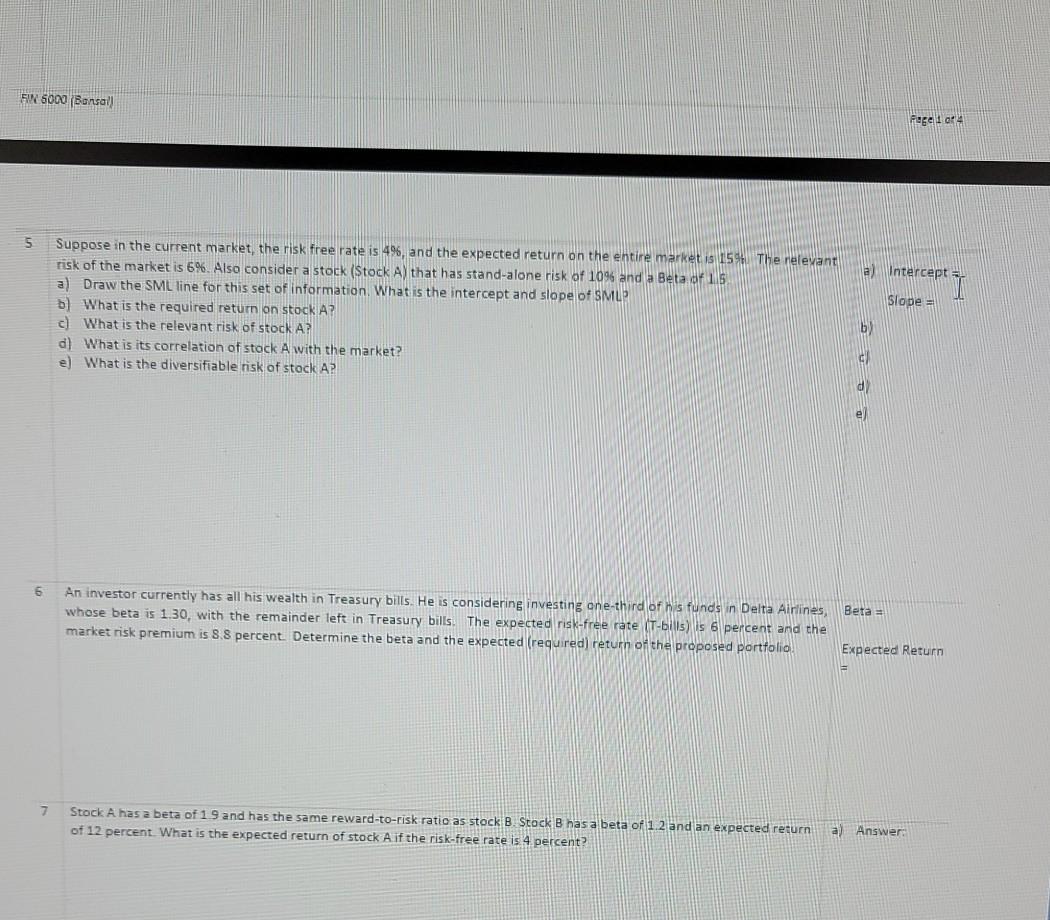

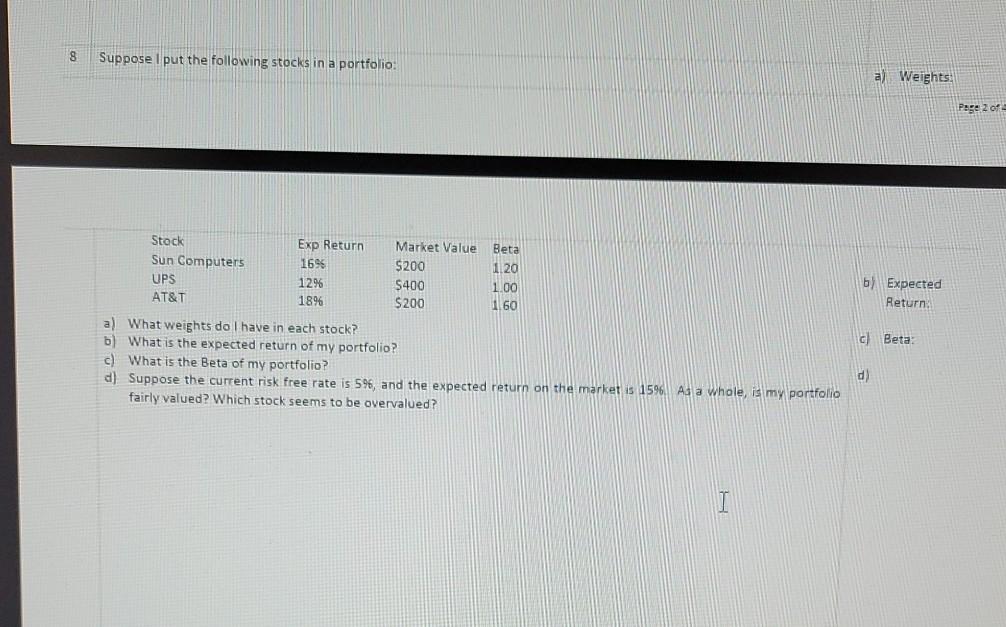

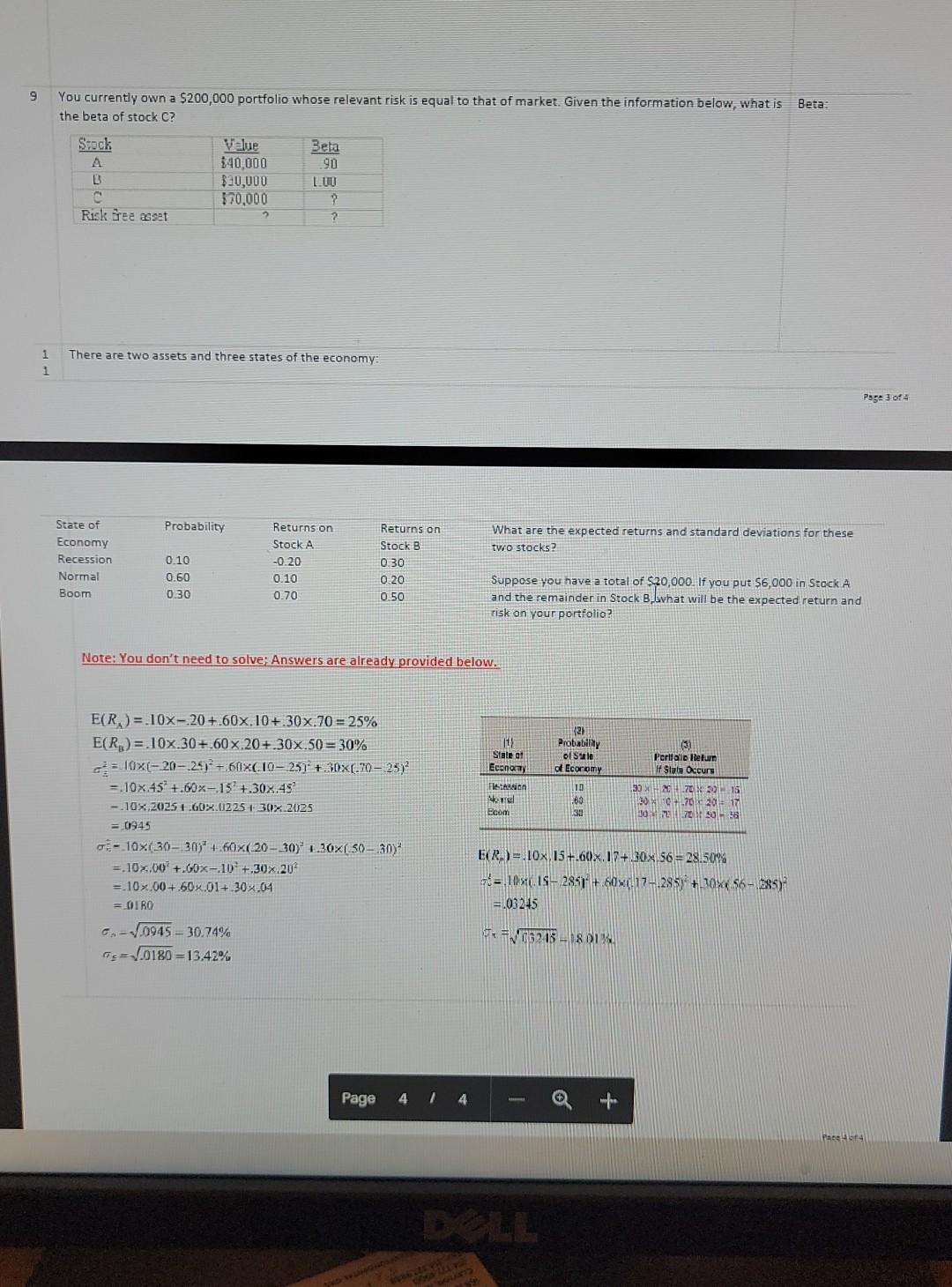

TE Open with Google Docs Name Risk and Returns-Il Final Answer 1 1 2 3. 4 Problem Mark True or False 1. If the total risk of firm X is greater than that of firm Y, then the beta of firm X must be greater than that of firmy 2 No matter how much total risk an asset has only the unsystematic portion is relevant in determining the expected return on that asset. 3. If world events cause investors to become more risk-averse, you would expect the market risk premium to increase. 4 The security market line is based on the principle that the reward-to-risk ratio must be constant for all assets in the market 5. Systematic risk is all that matters to a well-diversified investor 6. Spreading a portfolio across a number of assets will eliminate all of the risk 7. On average, the standard deviation of a portfolio declines as the number of assets in the portfolio is increased but it can not decline to zero. Suppose the expected return on the market is 1096 in the coming year, and current risk free rate is 4%. You are tracking a stock that has a Beta of 2. What is the market risk premium? What is the required return to hold this stock? 5 6 7 Risk Premium: Required Return: 3 Required Return Suppose that the current yield on the 3-month T-bill is 496, the return on the S&P 500 market index portfolio was 11% last year, and that a regression analysis on past returns indicates that stock's beta is 0.9. What is a reasonable estimate of the stock's required return for the coming year? 4 Suppose, the market has the following characteristics: Risk free rate: 496 and Market Risk Premium 1296 al A stock has beta of 1.2, what is the required return? b) Suppose this stock is priced at $50 and has an expected price of $60 in one year. Currently, how is this stock valued? c) Now, the market risk premium shifts upward to 14%, how is the stock valued? a) b) c) FI 5000 (Bonsal) Page 1 of 4 SIN 5000 (Bansal) Page 14 5 a) Intercept Suppose in the current market, the risk free rate is 49, and the expected return on the entire market is 15%. The relevant risk of the market is 6%. Also consider a stock (Stock A) that has stand-alone risk of 10% and a Beta of 15 a) Draw the SML line for this set of information. What is the intercept and slope of SMLP b) What is the required return on stock A? c) What is the relevant risk of stock A? d) What is its correlation of stock A with the market? e) What is the diversifiable risk of stack A? Slope = b) 6 An investor currently has all his wealth in Treasury bills. He is considering investing one-third of his funds in Delta Airlines Beta = whose beta is 1.30, with the remainder left in Treasury bills. The expected risk-free rate (T-bills) s 6 percent and the market risk premium is 8.8 percent. Determine the beta and the expected (required) return of the proposed portfolio Expected Return 7 Stock A has a beta of 1.9 and has the same reward-to-risk ratio as stock B. Stock Bhas a beta of 1.2 and an expected return of 12 percent What is the expected return of stock A if the risk-free rate is 4 percent? a) Answer: 8 Suppose I put the following stocks in a portfolio a) Weights. Page 2 of Stock Sun Computers UPS AT&T Exp Return 1695 12% 1896 Market Value Beta $200 1.20 $400 1.00 $200 1.60 b) Expected Return; c) Beta a) What weights do I have in each stock? b) What is the expected return of my portfolio? c) What is the Beta of my portfolio? d) Suppose the current risk free rate is 596, and the expected return on the market is 1596 As a whole, is my portfolio fairly valued? Which stock seems to be overvalued? d) 9 You currently own a $200,000 portfolio whose relevant risk is equal to that of market. Given the information below, what is Beta: the beta of stock C? Stock A B C Risk free asset Value 140,000 $20,000 $70.000 Beta 90 L.UU 2 2 2 There are two assets and three states of the economy: 1 1 Page 3012 Probability Returns on What are the expected returns and standard deviations for these two stocks? State of Economy Recession Normal Boom 0.10 0.60 0.30 Returns on Stock A -0.20 0.10 0.70 Stock B 0.30 0.20 0.50 Suppose you have a total of $20,000. If you put $6,000 in Stock A and the remainder in Stock B, lavhat will be the expected return and risk on your portfolio? Note: You don't need to solve: Answers are already provided below. 11) State of Economy 2) Probably o Sul of Economy 10 Flession Neni Ecom Peritalo lelum If State Occurs 50 x H 1 | TEN : 13 190 + 70 - 10:17 3078 E(R) = .10X-20+ 60x.10+.30x.70 = 25% E(R) = 10x 30+.60 x 20+.30x.50 = 30% = 10X(-20-299 + 61XC19251 + 30%(.70 25)? = 10x.45 +.60%-15 +.30X.45 - 10x.2025 1.60X.12251 30% 2025 = 0945 - 10x(30-309 60x120-301.36% [ 50- 304 =.10.00+.60%-.10+.30% 20% = 10x.00+ 60x.01+ 30.04 0 RO CA-V.0945 30.74% = 1.0180 = 13.42% ER)= 10x, 15+.60X.17+.30X.56= 28.50% = 10 IS-2851 +60X017-295) + Box 56-285) =.03245 75225 80 Page 4 14 1 Page 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts