Question: 6. Darrow Company uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. Last year, the company worked 10,000 direct

6. Darrow Company uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. Last year, the company worked 10,000 direct labor-hours and incurred $80,000 of actual manufacturing overhead cost. If overhead was underapplied by $2,000, the predetermined overhead rate for the company for the year must have been:

$7.80 $8.00 $8.20 $8.40

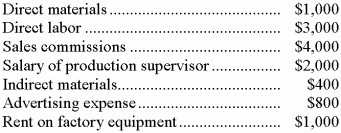

7. Reamer Company uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. The company has provided the following estimated costs for next year:

Reamer estimates that 500 direct labor-hours and 1,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be:

$6.80 $6.00 $3.00 $3.40

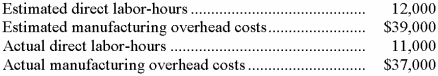

8. Washtenaw Corporation uses a job-order costing system. The following data are for last year:

Washtenaw applies overhead using a predetermined rate based on direct labor-hours. What amount of overhead was applied to jobs last year?

$39,050 $42,600 $35,750 $36,960

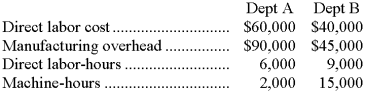

9. The Silver Company uses a predetermined overhead rate to apply manufacturing overhead to jobs. The predetermined overhead rate is based on labor cost in Dept. A and on machine-hours in Dept. B. At the beginning of the year, the company made the following estimates:

What predetermined overhead rates would be used in Dept A and Dept B, respectively?

67% and $3.00 150% and $5.00 150% and $3.00 67% and $5.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts