Question: 6. Exchange rate pass-through may be defined as a. the bid/ask spread on currency exchange rate transactions. b. the degree to which the prices of

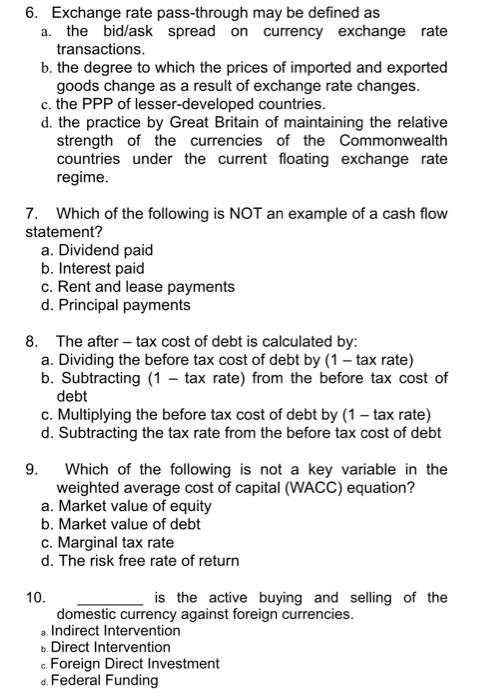

6. Exchange rate pass-through may be defined as a. the bid/ask spread on currency exchange rate transactions. b. the degree to which the prices of imported and exported goods change as a result of exchange rate changes. c. the PPP of lesser-developed countries. d. the practice by Great Britain of maintaining the relative strength of the currencies of the Commonwealth countries under the current floating exchange rate regime. 7. Which of the following is NOT an example of a cash flow statement? a. Dividend paid b. Interest paid c. Rent and lease payments d. Principal payments 8. The after - tax cost of debt is calculated by: a. Dividing the before tax cost of debt by (1 - tax rate) b. Subtracting (1 - tax rate) from the before tax cost of debt c. Multiplying the before tax cost of debt by (1 tax rate) d. Subtracting the tax rate from the before tax cost of debt 9. Which of the following is not a key variable in the weighted average cost of capital (WACC) equation? a. Market value of equity b. Market value of debt c. Marginal tax rate d. The risk free rate of return 10. is the active buying and selling of the domestic currency against foreign currencies. a. Indirect Intervention b. Direct Intervention c. Foreign Direct Investment a. Federal Funding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts