Question: Given that home expected inflation rate exceeds foreign expected inflation rates, Power Parity implies: interest rates in both countries will be the same home currency

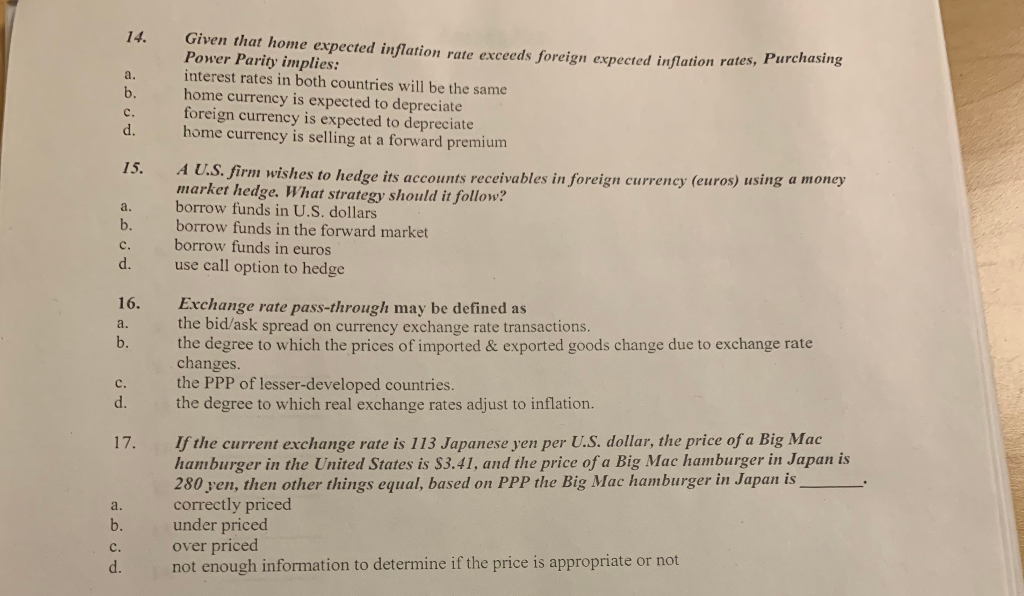

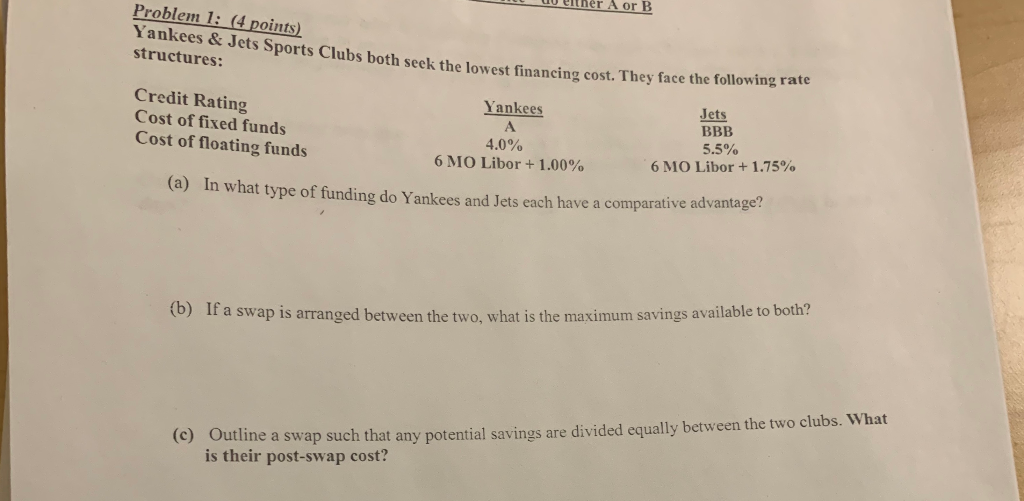

Given that home expected inflation rate exceeds foreign expected inflation rates, Power Parity implies: interest rates in both countries will be the same home currency is expected to depreciate foreign currency is expected to depreciate home currency is selling at a forward premium A U.S. firm wishes to hedge its accounts receivables in foreign currency (euros) using a money market hedge. What strategy should it follow? borrow funds in U.S. dollars borrow funds in the forward market borrow funds in euros use call option to hedge Exchange rate pass-through may be defined as the bid/ask spread on currency exchange rate transactions. the degree to which the prices of imported & exported goods change due to exchange rate changes. the PPP of lesser-developed countries. the degree to which real exchange rates adjust to inflation. If the current exchange rate is 113 Japanese yen per U.S. dollar, the price of a Big Mac hamburger in the United States is $3.41, and the price of a Big Mac hamburger in Japan is 280 ven, then other things equal, based on PPP the Big Mac hamburger in Japan is correctly priced under priced over priced not enough information to determine if the price is appropriate or not lu entner A or B Problem 1: (4 points) Yankees & Jets Sports Clubs both seek the lowest financing cost. They structures: Yankees Credit Rating Cost of fixed funds Cost of floating funds West financing cost. They face the following rate 4.0% 6 MO Libor + 1.00% Jets BBB 5.5% 6 MO Libor + 1.75% (a) In what type of funding do Yankees and Jets each have a comparative advanta (b) If a swap is arranged between the two, what is the p is arranged between the two, what is the maximum savings available to both? (c) Outline a swap such that any potential savings are divided equally between the two clubs. What is their post-swap cost? Given that home expected inflation rate exceeds foreign expected inflation rates, Power Parity implies: interest rates in both countries will be the same home currency is expected to depreciate foreign currency is expected to depreciate home currency is selling at a forward premium A U.S. firm wishes to hedge its accounts receivables in foreign currency (euros) using a money market hedge. What strategy should it follow? borrow funds in U.S. dollars borrow funds in the forward market borrow funds in euros use call option to hedge Exchange rate pass-through may be defined as the bid/ask spread on currency exchange rate transactions. the degree to which the prices of imported & exported goods change due to exchange rate changes. the PPP of lesser-developed countries. the degree to which real exchange rates adjust to inflation. If the current exchange rate is 113 Japanese yen per U.S. dollar, the price of a Big Mac hamburger in the United States is $3.41, and the price of a Big Mac hamburger in Japan is 280 ven, then other things equal, based on PPP the Big Mac hamburger in Japan is correctly priced under priced over priced not enough information to determine if the price is appropriate or not lu entner A or B Problem 1: (4 points) Yankees & Jets Sports Clubs both seek the lowest financing cost. They structures: Yankees Credit Rating Cost of fixed funds Cost of floating funds West financing cost. They face the following rate 4.0% 6 MO Libor + 1.00% Jets BBB 5.5% 6 MO Libor + 1.75% (a) In what type of funding do Yankees and Jets each have a comparative advanta (b) If a swap is arranged between the two, what is the p is arranged between the two, what is the maximum savings available to both? (c) Outline a swap such that any potential savings are divided equally between the two clubs. What is their post-swap cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts