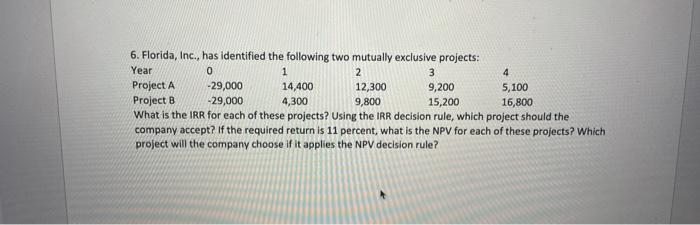

Question: 6. Florida, Inc., has identified the following two mutually exclusive projects: Year 0 1 2 3 4 Project A -29,000 14,400 12,300 9,200 5,100 Project

6. Florida, Inc., has identified the following two mutually exclusive projects: Year 0 1 2 3 4 Project A -29,000 14,400 12,300 9,200 5,100 Project B -29,000 4,300 9,800 15,200 16,800 What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts