Question: 6. Future value calculations Future Value Calculations Akiko and Shiloh are still sitting together, with their notebooks and textbooks open, in a booth at a

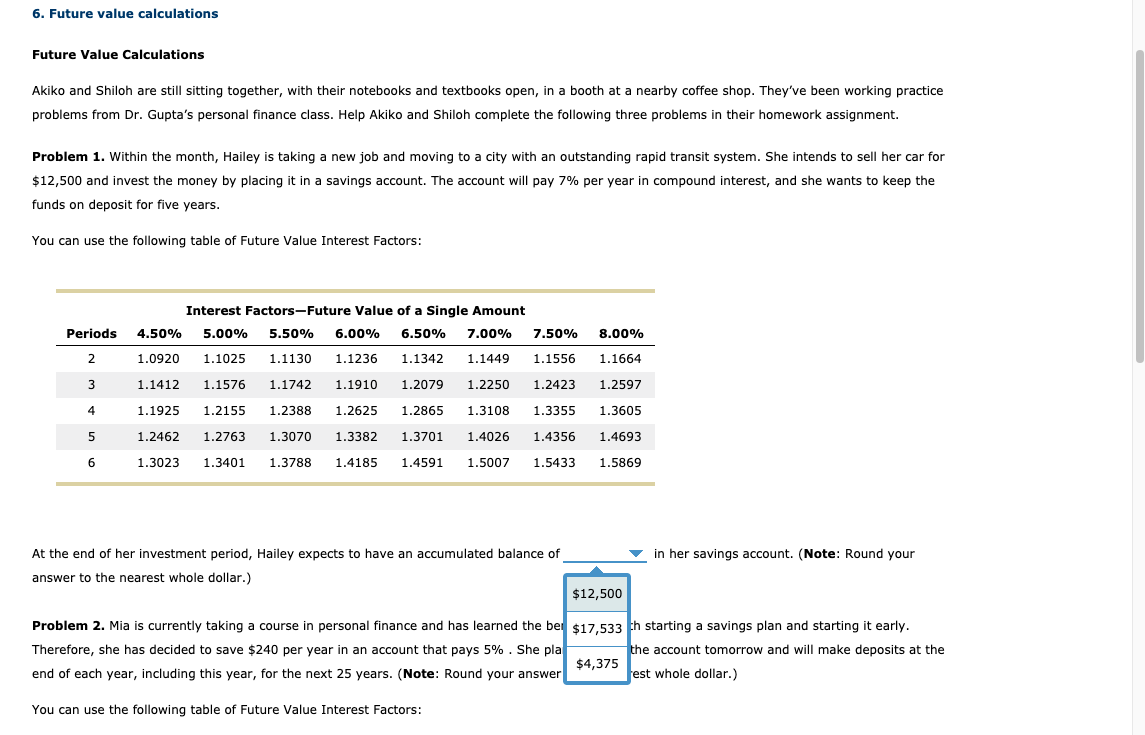

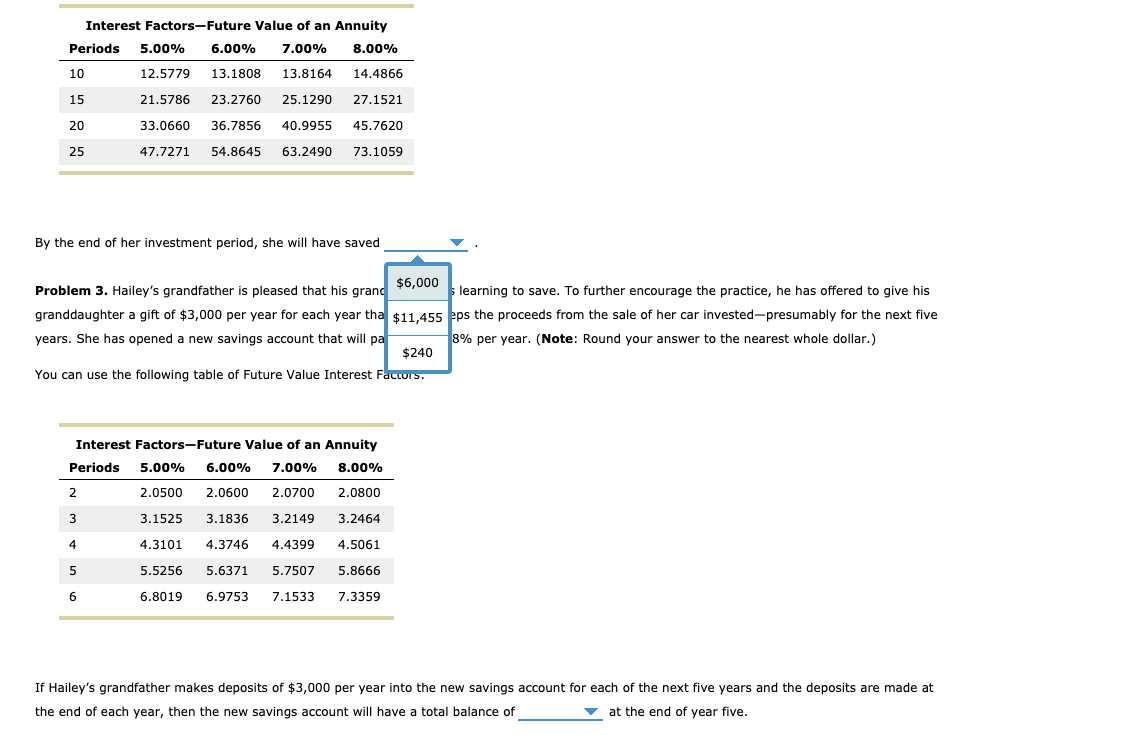

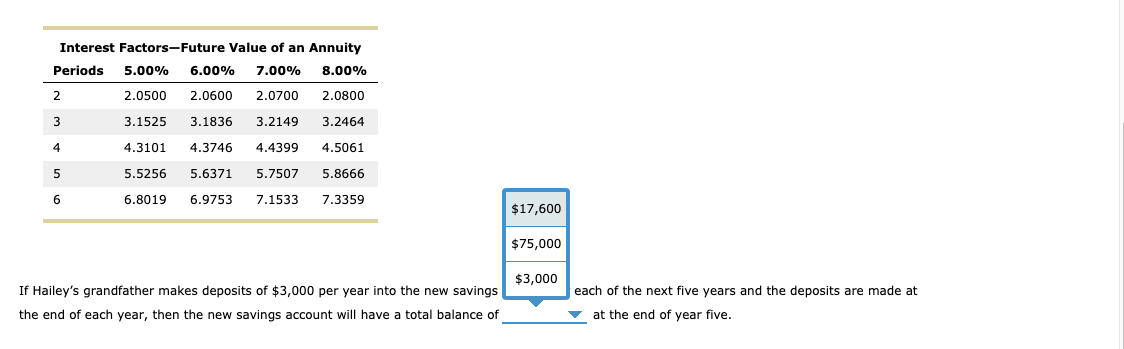

6. Future value calculations Future Value Calculations Akiko and Shiloh are still sitting together, with their notebooks and textbooks open, in a booth at a nearby coffee shop. They've been working practice problems from Dr. Gupta's personal finance class. Help Akiko and Shiloh complete the following three problems in their homework assignment. Problem 1. Within the month, Hailey is taking a new job and moving to a city with an outstanding rapid transit system. She intends to sell her car for $12,500 and invest the money by placing it in a savings account. The account will pay 7% per year in compound interest, and she wants to keep the funds on deposit for five years. You can use the following table of Future Value Interest Factors: Interest Factors-Future Value of a Single Amount 4.50% 5.00% 5.50% % 6.00% 6.50% 7.00% 7.50% 8.00% Periods 2 1.0920 1.1025 1.1130 1.1236 1.1342 1.1449 1.1556 1.1664 3 1.1412 1.1576 1.1742 1.1910 1.2079 1.2250 1.2423 1.2597 4 1.1925 1.2155 1.2388 1.2625 1.2865 1.3108 1.3355 1.3605 5 1.2462 1.2763 1.3070 1.3382 1.3701 1.4026 1.4356 1.4693 6 1.3023 1.3401 1.3788 1.4185 1.4591 1.5007 1.5433 1.5869 in her savings account. (Note: Round your At the end of her investment period, Hailey expects to have an accumulated balance of answer to the nearest whole dollar.) $12,500 Problem 2. Mia is currently taking a course in personal finance and has learned the bel $17,533 h starting a savings plan and starting it early. Therefore, she has decided to save $240 per year in an account that pays 5%. She pla the account tomorrow and will make deposits at the $4,375 end of each year, including this year, for the next 25 years. (Note: Round your answer est whole dollar.) You can use the following table of Future Value Interest Factors: Interest Factors-Future Value of an Annuity Periods 5.00% 6.00% 7.00% 8.00% 10 12.5779 13.1808 13.8164 14.4866 15 21.5786 23.2760 25.1290 27.1521 20 33.0660 36.7856 40.9955 45.7620 25 47.7271 54.8645 63.2490 73.1059 By the end of her investment period, she will have saved Problem 3. Hailey's grandfather is pleased that his grand $6,000 learning to save. To further encourage the practice, he has offered to give his granddaughter a gift of $3,000 per year for each year tha $11,455 eps the proceeds from the sale of her car invested-presumably for the next five years. She has opened a new savings account that will pat 8% per year. (Note: Round your answer to the nearest whole dollar.) $240 You can use the following table of Future Value Interest Factors. Interest Factors-Future Value of an Annuity Periods 5.00% 6.00% 7.00% 8.00% 2 2.0500 2.0600 2.0700 2.0800 3 3.1525 3.1836 3.2149 3.2464 4 4.3101 4.3746 4.4399 4.5061 5 5.5256 5.6371 5.7507 5.8666 6 6 6.8019 6.9753 7.1533 7.3359 If Hailey's grandfather makes deposits of $3,000 per year into the new savings account for each of the next five years and the deposits are made at the end of each year, then the new savings account will have a total balance of at the end of year five. Interest Factors-Future Value of an Annuity Periods 5.00% 6.00% 7.00% 8.00% 2 2.0500 2.0600 2.0700 2.0800 3 3.1525 3.1836 3.2149 3.2464 4 4.3101 4.3746 4.4399 4.5061 5 5.5256 5.6371 5.7507 5.8666 6 6.8019 6.9753 7.1533 7.3359 $17,600 $75,000 $3,000 If Hailey's grandfather makes deposits of $3,000 per year into the new savings the end of each year, then the new savings account will have a total balance of each of the next five years and the deposits are made at at the end of year five

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts