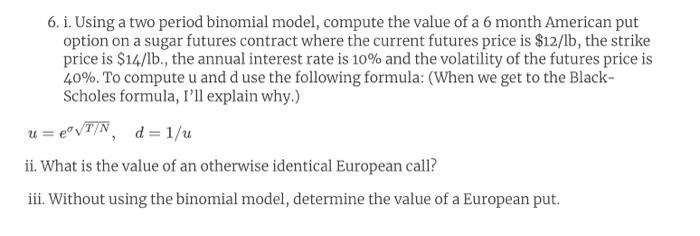

Question: 6. i. Using a two period binomial model, compute the value of a 6 month American put option on a sugar futures contract where the

6. i. Using a two period binomial model, compute the value of a 6 month American put option on a sugar futures contract where the current futures price is $12/1b, the strike price is $14/1b., the annual interest rate is 10% and the volatility of the futures price is 40%. To compute u and d use the following formula: (When we get to the Black- Scholes formula, I'll explain why.) u = evT/N, d=1/u ii. What is the value of an otherwise identical European call? iii. Without using the binomial model, determine the value of a European put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts