Question: Please provide step by step how you get the number! 1) Suppose you invest $1 at the beginning of 1927 in the short term treasuries.

Please provide step by step how you get the number!

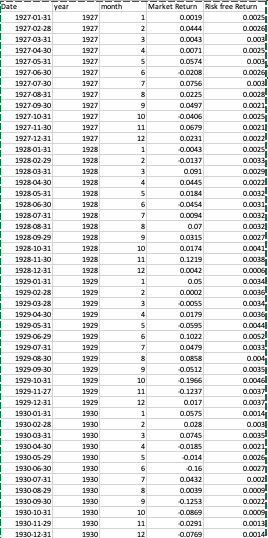

1) Suppose you invest $1 at the beginning of 1927 in the short term treasuries. What would be the value of the $1 invested at the end of 1930? What would be the value of a $1 invested in the stock market at the end of 1930? Now, suppose you have perfect foresight, and at the beginning of each month you can tell which market was going to have a higher return that month. If the short-term treasury bills have a higher return than the stock market in that month, then you invest all your money in the treasury bills. If not, you invest all your money in the stock market. If you could do this, how much would a $1 invested in January 1927 grow to at the end of 1930? What do these results tell you about the feasibility of market timing?

2) What would be the value of a $1 invested in the stock market if you exclude the worst 12 months of returns (that is set those returns equal to zero)? What would be the value of a $1 invested in the stock market if you exclude the best 12 months of returns?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts