Question: 6) In order to answer the next question, you need to fill in future values in the following table. Your company has sold some parts

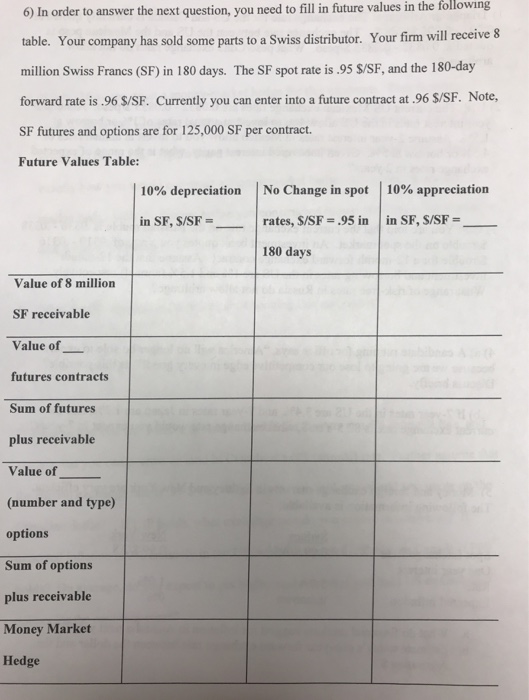

6) In order to answer the next question, you need to fill in future values in the following table. Your company has sold some parts to a Swiss distributor. Your firm will receive 8 million Swiss Francs (SF) in 180 days. The SF spot rate is .95 S/SF, and the 180-day forward rate is.96 S/SF. Currently you can enter into a future contract at .96 S/SF. Note, SF futures and options are for 125,000 SF per contract. Future Values Table: | No Change in spot | 10% appreciation | in SF, S/SF = 10% depreciation in SF, S/SF rates, SSF-.95 in 180 days Value of 8 million SF receivable Value of - futures contracts Sum of futures plus receivable Value of (number and type) options Sum of options plus receivable Money Market Hedge 6) In order to answer the next question, you need to fill in future values in the following table. Your company has sold some parts to a Swiss distributor. Your firm will receive 8 million Swiss Francs (SF) in 180 days. The SF spot rate is .95 S/SF, and the 180-day forward rate is.96 S/SF. Currently you can enter into a future contract at .96 S/SF. Note, SF futures and options are for 125,000 SF per contract. Future Values Table: | No Change in spot | 10% appreciation | in SF, S/SF = 10% depreciation in SF, S/SF rates, SSF-.95 in 180 days Value of 8 million SF receivable Value of - futures contracts Sum of futures plus receivable Value of (number and type) options Sum of options plus receivable Money Market Hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts