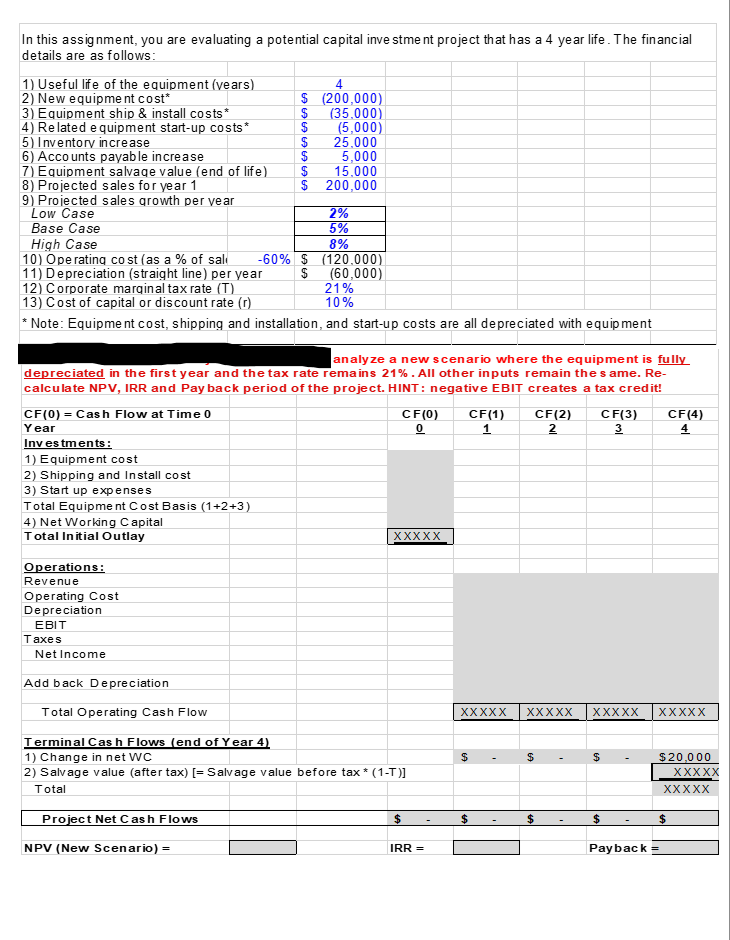

Question: 6 In this assignment, you are evaluating a potential capital investment project that has a 4 year life. The financial details are as follows: 1)

6 In this assignment, you are evaluating a potential capital investment project that has a 4 year life. The financial details are as follows: 1) Useful life of the equipment (vears) 4 2) New equipment cost* $ (200,000) 3) Equipment ship & install costs* $ (35.000) 4) Related equipment start-up costs* $ (5,000) 5) Inventory increase $ 25.000 6) Accounts payable increase $ 5,000 7) Equipment salvage value (end of life) $ 15.000 8) Projected sales for year 1 $ 200,000 9) Projected sales growth per year Low Case 2% Base Case 5% High Case 8% 10) Operating cost (as a % of sali -60% $ (120,000) 11) Depreciation (straight line) per year $ (60,000) 12) Corporate marginal tax rate (T) 21% 13) Cost of capital or discount rate (r) 10% * Note: Equipment cost, shipping and installation, and start-up costs are all depreciated with equipment analyze a new scenario where the equipment is fully depreciated in the first year and the tax rate remains 21%. All other inputs remain the same. Re- calculate NPV, IRR and Pay back period of the project. HINT: negative EBIT creates a tax credit! CF(0) = Cash Flow at Time 0 CF(0) CF(1) CF(2) CF(3) CF(4) Year 0 1 2 3 4 Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Equipment Cost Basis (1+2+3) 4) Net Working Capital Total Initial Outlay XXXXX Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income Add back Depreciation Total Operating Cash Flow XX XXX xxxxx xxxxx XXXXX $ $ $ Terminal Cash Flows (end of Year 4) 1) Change in net WC 2) Salvage value (after tax) [= Salvage value before tax*(1-T)] Total $ 20,000 XXXXX XXXXX Project Net Cash Flows $ $ $ $ $ NPV (New Scenario) = IRR = Payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts