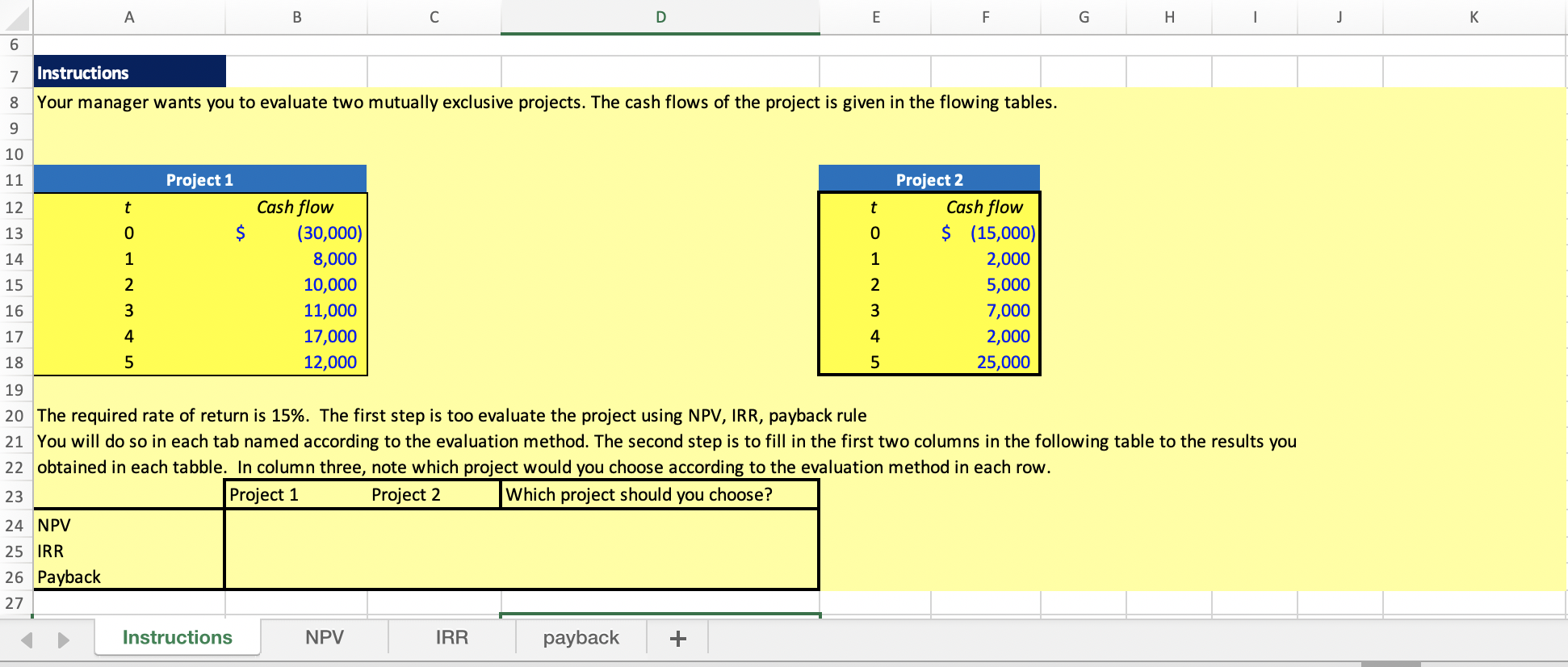

Question: 6 Instructions Your manager wants you to evaluate two mutually exclusive projects. The cash flows of the project is given in the flowing tables. 8

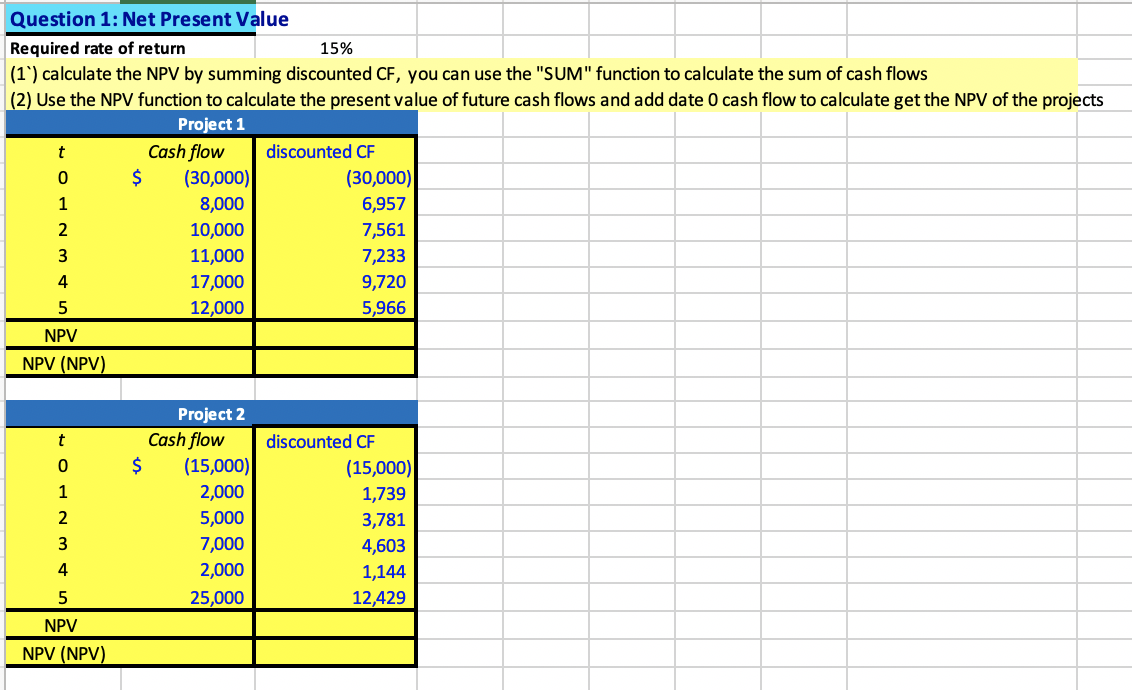

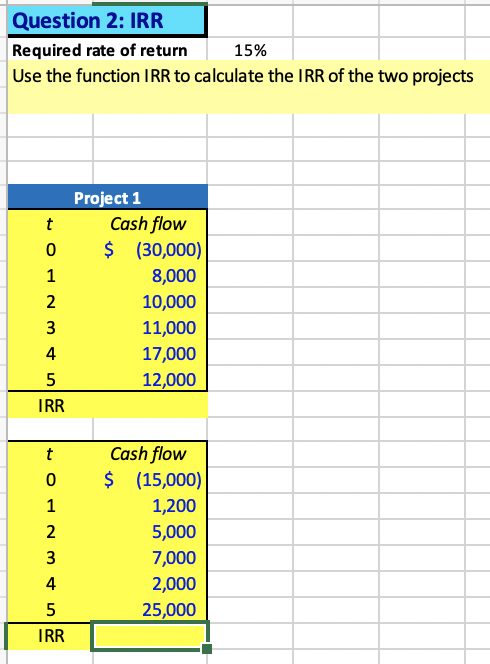

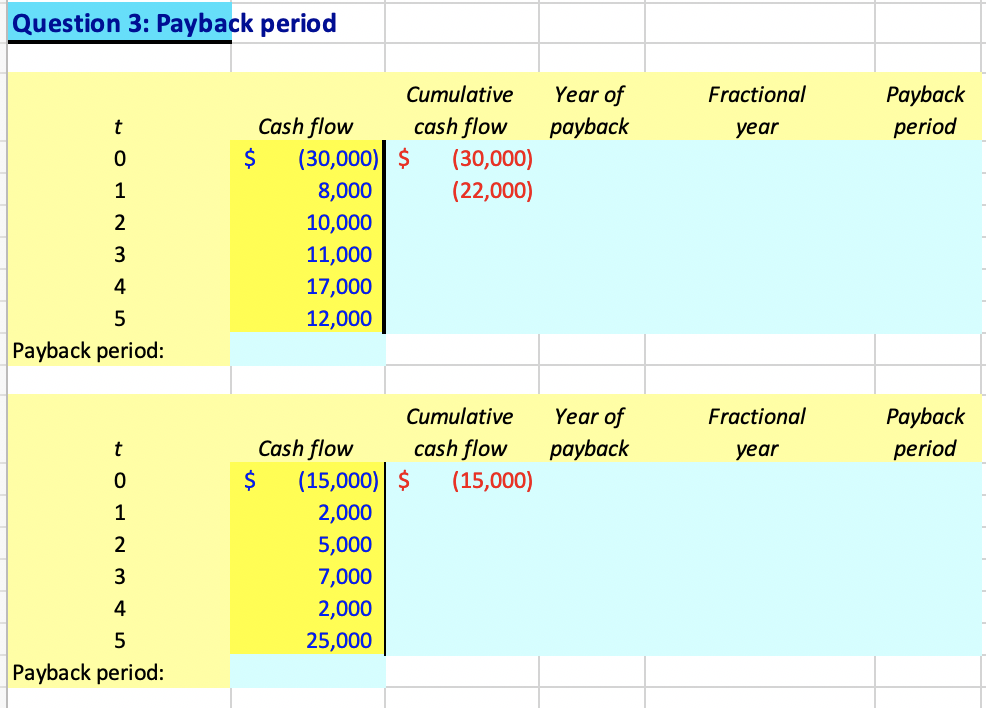

6 Instructions Your manager wants you to evaluate two mutually exclusive projects. The cash flows of the project is given in the flowing tables. 8 Project 1 $ uomi Cash flow (30,000) 8,000 10,000 11,000 17,000 12,000 + Onm Project 2 Cash flow $ (15,000) 2,000 5,000 7,000 2,000 25,000 20 The required rate of return is 15%. The first step is too evaluate the project using NPV, IRR, payback rule 21 You will do so in each tab named according to the evaluation method. The second step is to fill in the first two columns in the following table to the results you 22 obtained in each tabble. In column three, note which project would you choose according to the evaluation method in each row. Project 1 Project 2 Which project should you choose? NPV 24 IRR 26 Payback 27 Instructions NPV IRR payback Question 1: Net Present Value Required rate of return 15% (1) calculate the NPV by summing discounted CF, you can use the "SUM" function to calculate the sum of cash flows (2) Use the NPV function to calculate the present value of future cash flows and add date 0 cash flow to calculate get the NPV of the projects Project 1 Cash flow discounted CF (30,000) (30,000) 8,000 6,957 10,000 7,561 11,000 7,233 17,000 9,720 12,000 5,966 NPV NPV (NPV) $ + OHNM + in Project 2 Cash flow (15,000) 2,000 5,000 7,000 2,000 25,000 discounted CF (15,000) 1,739 3,781 4,603 1,144 12,429 NPV NPV (NPV) Question 2: IRR Required rate of return 15% Use the function IRR to calculate the IRR of the two projects Project 1 Cash flow $ (30,000) 8,000 10,000 11,000 17,000 12,000 IRR Awn Cash flow (15,000) 1,200 5,000 7,000 2,000 25,000 Question 3: Payback period Year of payback Fractional year Payback period JIOW tom7 Cumulative Cash flow cash flow (30,000) $ (30,000) 8,000 (22,000) 10,000 11,000 17,000 12,000 Payback period: Fractional Year of payback Payback period year + ON M7 D Cumulative Cash flow cash flow $ (15,000) $ (15,000) 2,000 5,000 7,000 2,000 25,000 Payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts