Question: #6 Intro You bought 1 call option with an exercise price of $50 for $16.63, sold (wrote) 2 call options on the same stock with

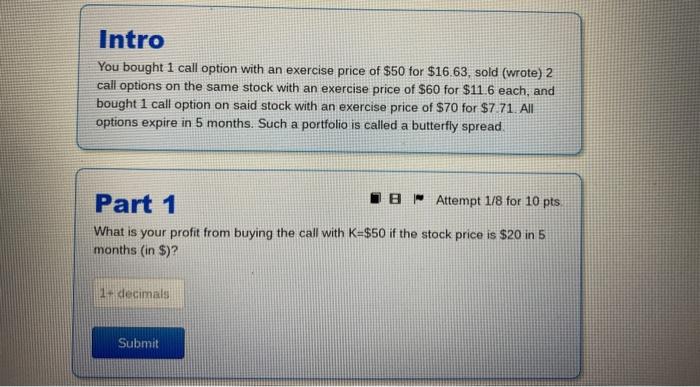

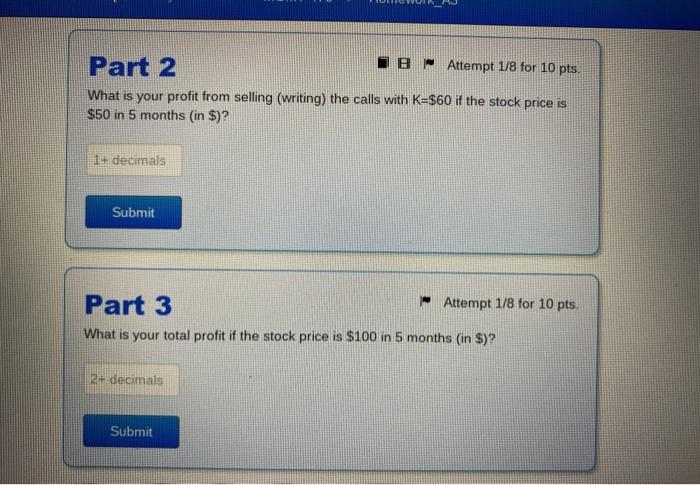

Intro You bought 1 call option with an exercise price of $50 for $16.63, sold (wrote) 2 call options on the same stock with an exercise price of $60 for $11.6 each, and bought 1 call option on said stock with an exercise price of $70 for $7 71. All options expire in 5 months. Such a portfolio is called a butterfly spread IB Attempt 1/8 for 10 pts Part 1 What is your profit from buying the call with K=$50 if the stock price is $20 in 5 months (in $)? 1 decimals Submit IB Attempt 1/8 for 10 pts. Part 2 What is your profit from selling (writing) the calls with K=$60 if the stock price is $50 in 5 months (in $)? 1. decimals Submit Part 3 Attempt 1/8 for 10 pts. What is your total profit if the stock price is $100 in 5 months (in $)? 2+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts