Question: 6. Lecture Note 2) The accounting department is preparing the firm's quarterly financial statements. As part of that process, they would like you to value

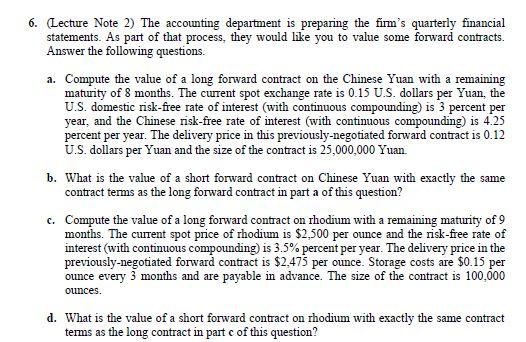

6. Lecture Note 2) The accounting department is preparing the firm's quarterly financial statements. As part of that process, they would like you to value some forward contracts. Answer the following questions. a. Compute the value of a long forward contract on the Chinese Yuan with a remaining maturity of 8 months. The current spot exchange rate is 0.15 U.S. dollars per Yuan, the U.S. domestic risk-free rate of interest (with continuous compounding) is 3 percent per year, and the Chinese risk-free rate of interest (with continuous compounding) is 4.25 percent per year. The delivery price in this previously-negotiated forward contract is 0.12 U.S. dollars per Yuan and the size of the contract is 25,000,000 Yuan b. What is the value of a short forward contract on Chinese Yuan with exactly the same contract terms as the long forward contract in part a of this question? c. Compute the value of a long forward contract on rhodium with a remaining maturity of 9 months. The current spot price of rhodium is $2,500 per ounce and the risk-free rate of interest (with continuous compounding) is 3.5% percent per year. The delivery price in the previously-negotiated forward contract is $2,475 per ounce Storage costs are $0.15 per ounce every 3 months and are payable in advance. The size of the contract is 100,000 ounces. d. What is the value of a short forward contract on rhodium with exactly the same contract terms as the long contract in part c of this question? 6. Lecture Note 2) The accounting department is preparing the firm's quarterly financial statements. As part of that process, they would like you to value some forward contracts. Answer the following questions. a. Compute the value of a long forward contract on the Chinese Yuan with a remaining maturity of 8 months. The current spot exchange rate is 0.15 U.S. dollars per Yuan, the U.S. domestic risk-free rate of interest (with continuous compounding) is 3 percent per year, and the Chinese risk-free rate of interest (with continuous compounding) is 4.25 percent per year. The delivery price in this previously-negotiated forward contract is 0.12 U.S. dollars per Yuan and the size of the contract is 25,000,000 Yuan b. What is the value of a short forward contract on Chinese Yuan with exactly the same contract terms as the long forward contract in part a of this question? c. Compute the value of a long forward contract on rhodium with a remaining maturity of 9 months. The current spot price of rhodium is $2,500 per ounce and the risk-free rate of interest (with continuous compounding) is 3.5% percent per year. The delivery price in the previously-negotiated forward contract is $2,475 per ounce Storage costs are $0.15 per ounce every 3 months and are payable in advance. The size of the contract is 100,000 ounces. d. What is the value of a short forward contract on rhodium with exactly the same contract terms as the long contract in part c of this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts