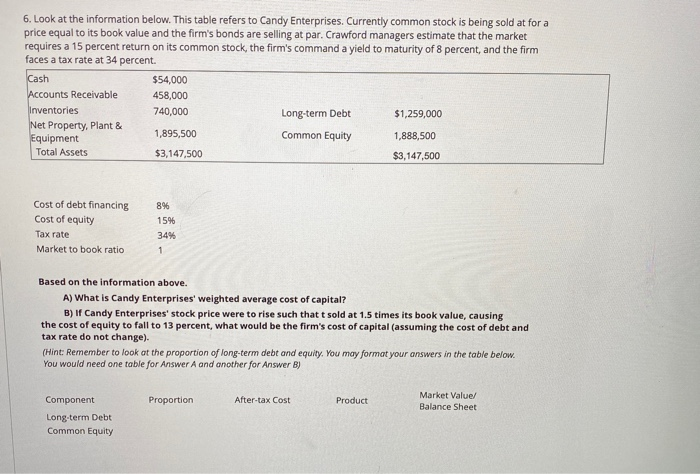

Question: 6. Look at the information below. This table refers to Candy Enterprises. Currently common stock is being sold at for a price equal to its

6. Look at the information below. This table refers to Candy Enterprises. Currently common stock is being sold at for a price equal to its book value and the firm's bonds are selling at par. Crawford managers estimate that the market requires a 15 percent return on its common stock, the firm's command a yield to maturity of 8 percent, and the firm faces a tax rate at 34 percent. Cash Accounts Receivable $54,000 458,000 Inventories Net Property, Plant & Equipment Total Assets 740,000 Long-term Debt $1,259,000 1,895,500 Common Equity 1,888,500 $3,147,500 $3,147,500 Cost of debt financing 8% Cost of equity 15% ate 34% Market to book ratio 1 Based on the information above. A) What is Candy Enterprises' weighted average cost of capital? B) If Candy Enterprises' stock price were to rise such that t sold at 1.5 times its book value, causing the cost of equity to fall to 13 percent, what would be the firm's cost of capital (assuming the cost of debt and tax rate do not change). (Hint: Remember to look at the proportion of long-term debt and equity. You may format your answers in the table below You would need one table for Answer A and another for Answer B) Market Value/ After-tax Cost Component Product Proportion Balance Sheet Long-term Debt Common Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts