Question: 6. Market value ratios Ratios are mostiy calculated using dota drawn from the financial statements of a firm, Hewever, another aroup of rates, called market

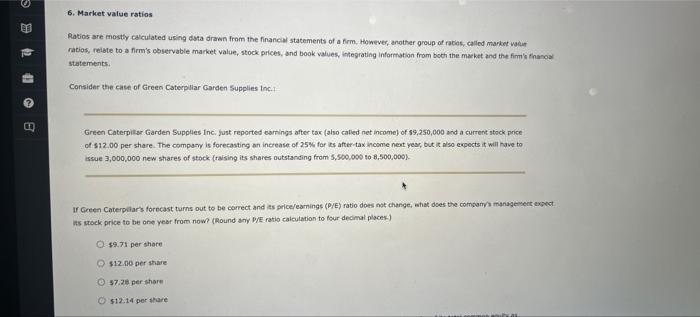

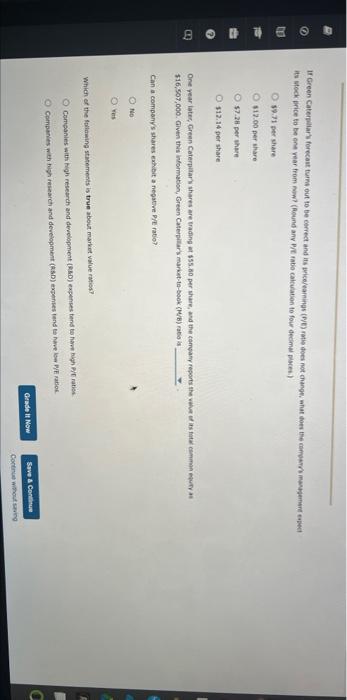

6. Market value ratios Ratios are mostiy calculated using dota drawn from the financial statements of a firm, Hewever, another aroup of rates, called market watir rabios, felate to a firm's observable market value, stock prices, and book values, integrating information from both the macket and the fimi's finanoal statements. Consider the case of Green Caterpllar Garden supplies inc.t Green Caterpilise Garden Supplies Inc. Just reported earnings after tax (also called net income) of $9,250,000 acd a current stock price of $12.00 per share. The compary is forecasting an increase of 25% for its after-tax inoome neat year, but it also eqpects it wil have to issue 3,000,000 new shares of stock fraising its shares outstanding from 5,500,000808,500,000K If Gireen Caterpilar's forecast turns out to be correct and as price/eamings (P/E) ratio does not change; what does the compariy) manageisert expect is sreck price to be ond year from now? (Round any P/E ratio calcutation to four decimal places.) 49.71 per share 412 no per share 37.28 per share 512.14 per stare its mock erice to be ont vear from Aew? (Round any Prt rabo caiculation to four decima posen.) 59.71 per share 412.00 per share \$7.2H per there 112.14 per share One year iates, Grean Caterpalar's shares are trading of 855.60 per ahare, and the tampany ressits the wilve of its hate canman equry at 516,907,000. Given thii information, Green Catepiltars markt-ta-book sMib) ratio in Can a companys shares eahibit a negative Pre ratio? Which of the folianing statements is true about market value ratios? Companies with high research and development (280) expenies tens bo harn high Pf ratist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts