Question: (6 points) On May 15,2000, you enter into a 1-year forward rate agreement (FRA) with a bank for the period from November 15, 2000 to

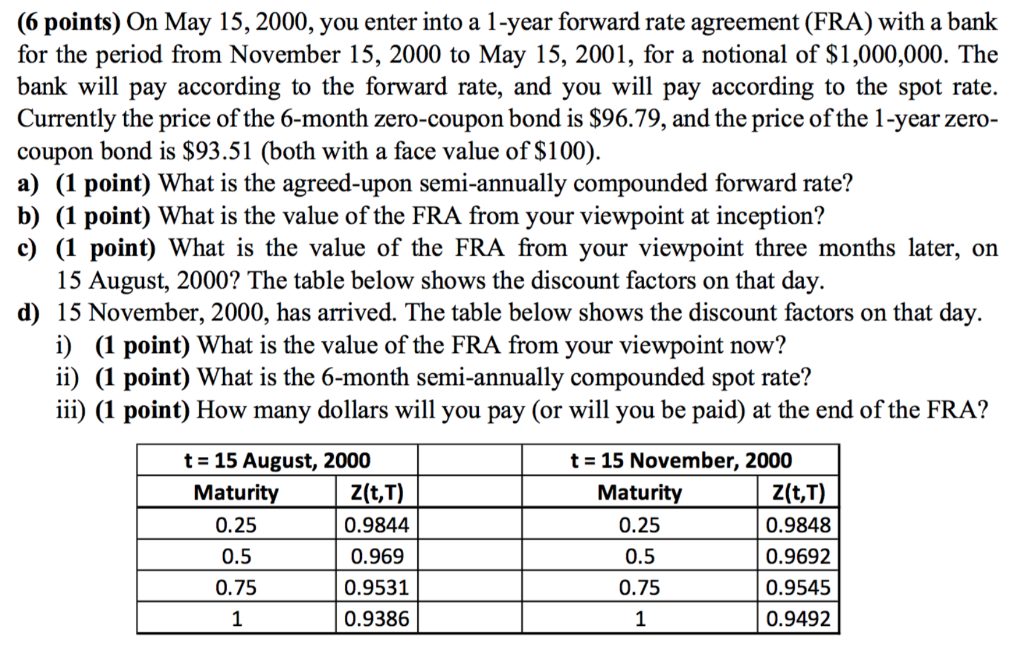

(6 points) On May 15,2000, you enter into a 1-year forward rate agreement (FRA) with a bank for the period from November 15, 2000 to May 15, 2001, for a notional of $1,000,000. The bank will pay according to the forward rate, and you will pay according to the spot rate. Currently the price of the 6-month zero-coupon bond is $96.79, and the price ofthe 1-year zero- coupon bond is $93.51 (both with a face value of $100) a) (1 point) What is the agreed-upon semi-annually compounded forward rate? b) (1 point) What is the value of the FRA from your viewpoint at inception? c) (1 point) What is the value of the FRA from your viewpoint three months later, on 15 August, 2000? The table below shows the discount factors on that day. d) 15 November, 2000, has arrived. The table below shows the discount factors on that day. i) (1 point) What is the value of the FRA from your viewpoint now? ii) (1 point) What is the 6-month semi-annually compounded spot rate? iii) (1 point) How many dollars will you pay (or will you be paid) at the end of the FRA? t 15 November, 2000 t 15 August, 2000 Z(t,T) 0.9848 0.9692 0.9545 0.9492 Z(t,T) 0.9844 0.969 0.9531 0.9386 Maturity 0.25 0.5 0.75 Maturity 0.25 0.5 0.75 1 (6 points) On May 15,2000, you enter into a 1-year forward rate agreement (FRA) with a bank for the period from November 15, 2000 to May 15, 2001, for a notional of $1,000,000. The bank will pay according to the forward rate, and you will pay according to the spot rate. Currently the price of the 6-month zero-coupon bond is $96.79, and the price ofthe 1-year zero- coupon bond is $93.51 (both with a face value of $100) a) (1 point) What is the agreed-upon semi-annually compounded forward rate? b) (1 point) What is the value of the FRA from your viewpoint at inception? c) (1 point) What is the value of the FRA from your viewpoint three months later, on 15 August, 2000? The table below shows the discount factors on that day. d) 15 November, 2000, has arrived. The table below shows the discount factors on that day. i) (1 point) What is the value of the FRA from your viewpoint now? ii) (1 point) What is the 6-month semi-annually compounded spot rate? iii) (1 point) How many dollars will you pay (or will you be paid) at the end of the FRA? t 15 November, 2000 t 15 August, 2000 Z(t,T) 0.9848 0.9692 0.9545 0.9492 Z(t,T) 0.9844 0.969 0.9531 0.9386 Maturity 0.25 0.5 0.75 Maturity 0.25 0.5 0.75 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts