Question: Please solve using Excel and show/explain how you solved the questions through Excel. Thank you 4. On May 15, 2000 you enter into a 1-year

Please solve using Excel and show/explain how you solved the questions through Excel. Thank you

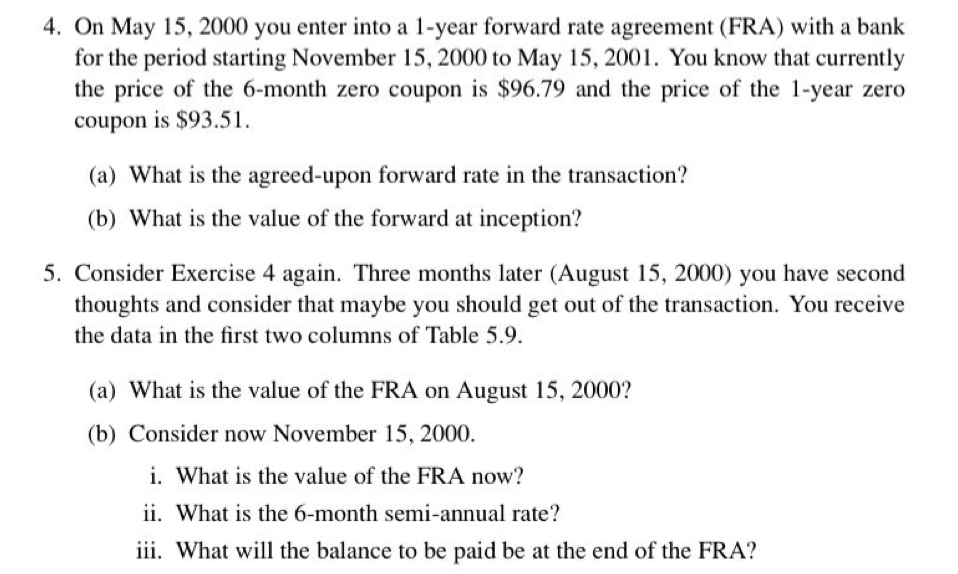

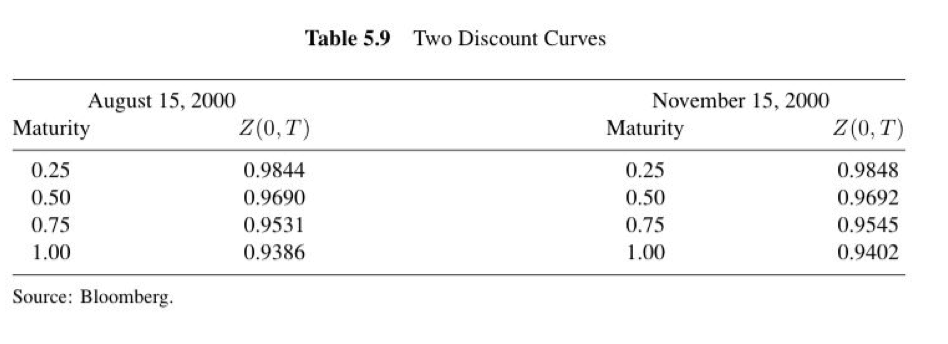

4. On May 15, 2000 you enter into a 1-year forward rate agreement (FRA) with a bank for the period starting November 15, 2000 to May 15, 2001. You know that currently the price of the 6-month zero coupon is $96.79 and the price of the 1-year zero coupon is $93.51. (a) What is the agreed-upon forward rate in the transaction? (b) What is the value of the forward at inception? 5. Consider Exercise 4 again. Three months later (August 15, 2000) you have second thoughts and consider that maybe you should get out of the transaction. You receive the data in the first two columns of Table 5.9. (a) What is the value of the FRA on August 15, 2000? (b) Consider now November 15, 2000. i. What is the value of the FRA now? ii. What is the 6-month semi-annual rate? iii. What will the balance to be paid be at the end of the FRA? Table 5.9 Two Discount Curves August 15, 2000 Maturity Z(0,T) 0.25 0.50 0.75 1.00 0.9844 0.9690 0.9531 0.9386 November 15, 2000 Maturity Z(0,T) 0.25 0.9848 0.50 0.9692 0.75 0.9545 1.00 0.9402 Source: Bloomberg 4. On May 15, 2000 you enter into a 1-year forward rate agreement (FRA) with a bank for the period starting November 15, 2000 to May 15, 2001. You know that currently the price of the 6-month zero coupon is $96.79 and the price of the 1-year zero coupon is $93.51. (a) What is the agreed-upon forward rate in the transaction? (b) What is the value of the forward at inception? 5. Consider Exercise 4 again. Three months later (August 15, 2000) you have second thoughts and consider that maybe you should get out of the transaction. You receive the data in the first two columns of Table 5.9. (a) What is the value of the FRA on August 15, 2000? (b) Consider now November 15, 2000. i. What is the value of the FRA now? ii. What is the 6-month semi-annual rate? iii. What will the balance to be paid be at the end of the FRA? Table 5.9 Two Discount Curves August 15, 2000 Maturity Z(0,T) 0.25 0.50 0.75 1.00 0.9844 0.9690 0.9531 0.9386 November 15, 2000 Maturity Z(0,T) 0.25 0.9848 0.50 0.9692 0.75 0.9545 1.00 0.9402 Source: Bloomberg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts