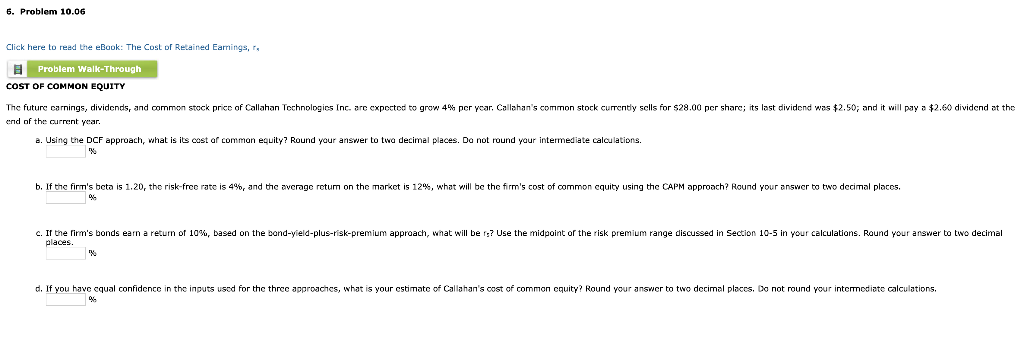

Question: 6. Problem 10.06 Click here to read the eBook: The Cost of Retained Earnings, Problem Walk-Through COST OF COMMON EQUITY The future carnings, dividends, and

6. Problem 10.06 Click here to read the eBook: The Cost of Retained Earnings, Problem Walk-Through COST OF COMMON EQUITY The future carnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 44 per year. Callahan's common stock currently sells for $28.00 per sharc; its last dividend was $2.50; and it will pay a $2.60 dividend at the end of the current year. 2. Using the DCF approach, what is its cost of common equity? Round your answer to twa decimal places. Do not round your intermediate calculations. b. If the firm's bota is 1.20, the risk-free rate is 4%, and the average retum on the market is 12%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places, C. If the firm's bonds earn a return of 10%, based on the bond-yield-plus-risk-premium approach, what will be ig? Use the midpoint of the risk premium range discussed in Section 10-5 in your calculations. Round your answer to two decimal places. X2 d. If you have cqual confidence in the inputs used for the three approaches, what is your cstimate of Callahan's cost of common cquity? Round your answer to two decimal places. Do not round your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts