Question: 6. Problem 12.11 (Replacement Analysis) eBook St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will

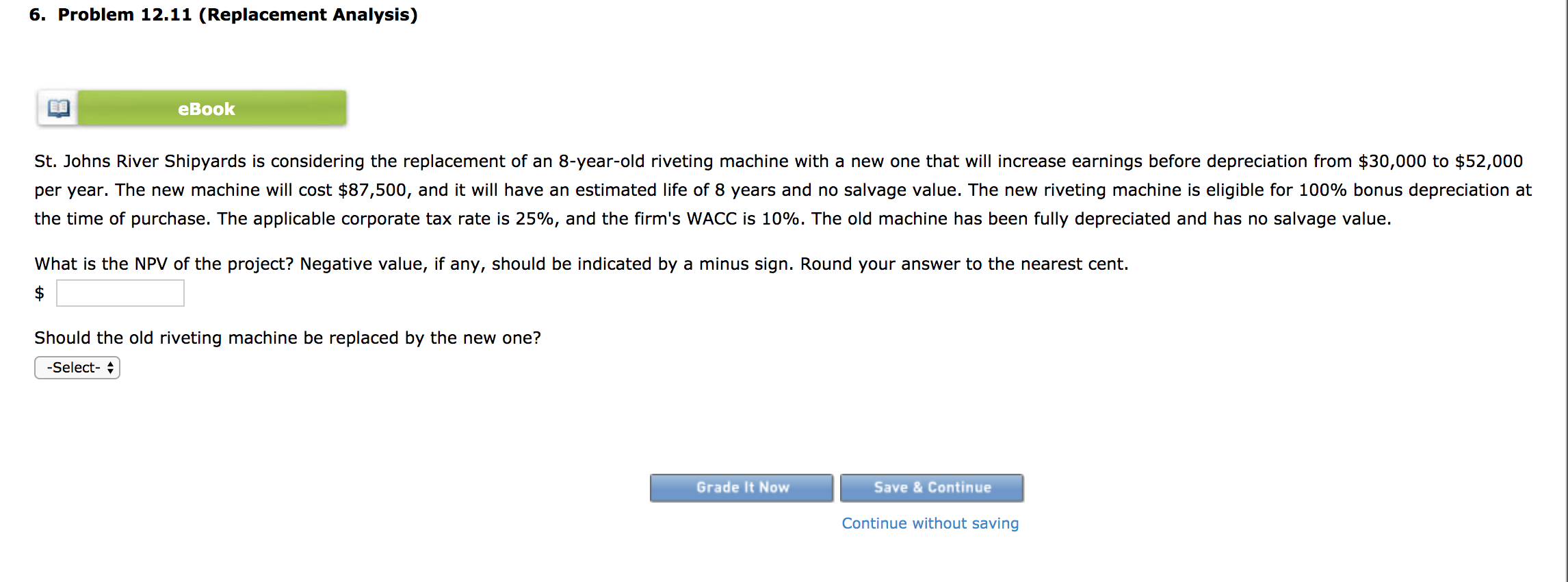

6. Problem 12.11 (Replacement Analysis) eBook St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will increase earnings before depreciation from $30,000 to $52,000 per year. The new machine will cost $87,500, and it will have an estimated life of 8 years and no salvage value. The new riveting machine is eligible for 100% bonus depreciation at the time of purchase. The applicable corporate tax rate is 25%, and the firm's WACC is 10%. The old machine has been fully depreciated and has no salvage value. What is the NPV of the project? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent. Should the old riveting machine be replaced by the new one? -Select- - Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts