Question: Problem 2 A father is planning a savings program for his daughter to pay for college. She is 14, she plans to enroll at the

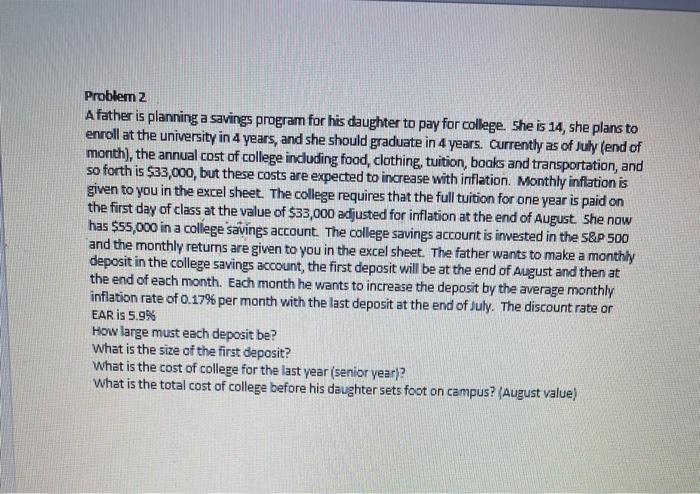

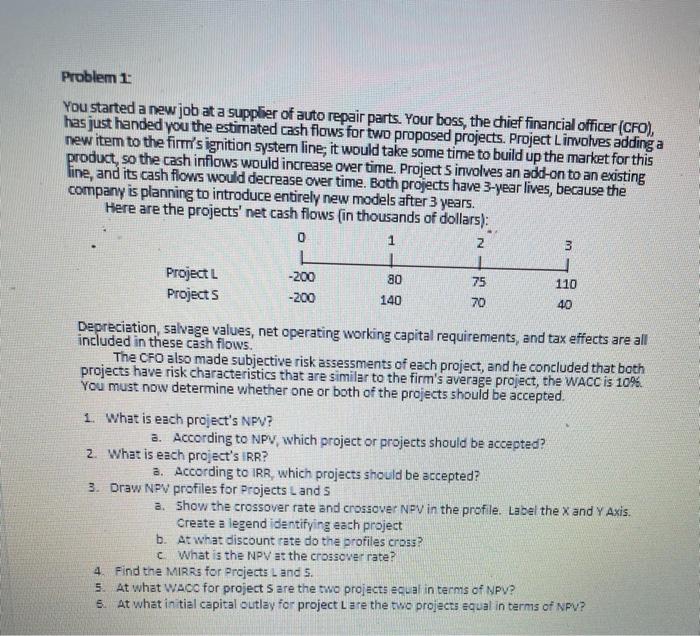

Problem 2 A father is planning a savings program for his daughter to pay for college. She is 14, she plans to enroll at the university in 4 years, and she should graduate in 4 years. Currently as of July (end of month), the annual cost of college including food, clothing, tuition, books and transportation, and so forth is $33,000, but these costs are expected to increase with inflation. Monthly inflation is given to you in the excel sheet. The college requires that the full tuition for one year is paid on the first day of class at the value of $33,000 adjusted for inflation at the end of August. She now has $55,000 in a college savings account. The college savings account is invested in the S&P 500 and the monthly returns are given to you in the excel sheet. The father wants to make a monthly deposit in the college savings account, the first deposit will be at the end of August and then at the end of each month. Each month he wants to increase the deposit by the average monthly inflation rate of 0.17% per month with the last deposit at the end of July. The discount rate or EAR is 5.9% How large must each deposit be? What is the size of the first deposit? What is the cost of college for the last year (senior year)? What is the total cost of college before his daughter sets foot on campus? (August value) Problem 1 You started a new job at a supplier of auto repair parts. Your boss, the chief financial officer (CFO), has just handed you the estimated cash flows for two proposed projects. Project Linvolves adding a new item to the firm'signition system line, it would take some time to build up the market for this product, so the cash inflows would increase over time. Projects involves an add-on to an existing fine, and its cash flows would decrease over time. Both projects have 3-year lives, because the company is planning to introduce entirely new models after 3 years. Here are the projects' net cash flows (in thousands of dollars); 0 1 Z 1 Project -200 75 Projects -200 140 70 40 3 80 110 Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. The CFO also made subjective risk assessments of each project, and he concluded that both projects have risk characteristics that are similar to the firm's average project, the WACC is 10% You must now determine whether one or both of the projects should be accepted. 1. What is each project's NPV? a. According to NPV, which project or projects should be accepted? 2. What is each project's IRR? a. According to IRR, which projects should be accepted? 3. Draw NPV profiles for Projects Lands a. show the crossover rate and crossover NPV in the profile. Label the X and Y Axis. Create a legend identifying each project b. At what discount rate do the profiles cross? What is the NPV at the crossover rate? 4. Find the MIRRs for Projects Land 5. 5. At what WACC for project 5 are the two projects equal in terms of NPV? 6. At what initial capital outlay for project Lare the two projects equal in terms of NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts