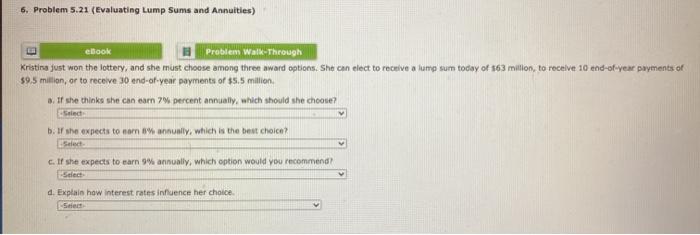

Question: 6. Problem 5.21 (Evaluating Lump Sums and Annuities) ebook Problem Walk-Through Kristina just won the lottery, and she must choose among the award options. She

6. Problem 5.21 (Evaluating Lump Sums and Annuities) ebook Problem Walk-Through Kristina just won the lottery, and she must choose among the award options. She can elect to receive a lump sum today of 563 million to receive 10 end-of-year payments of 89,5 million, or to receive 30 end-of-year payments of $5.5 million If she thinks she can earn 7% percent annually, which should she choose? Select b. 1 she expects to come annunty, which is the best choice? c. If she expects to earn 9% annually, which option would you recommend d. Explain how interest rates influence her choice Set

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts